RIA Money Transfer vs Payoneer: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 12

Introduction

Cross-border money transfers are crucial for individuals and businesses, yet common challenges include high fees, slow delivery, hidden costs, and complicated user experiences. RIA Money Transfer and Payoneer are two reputable providers, each with its advantages. For those seeking an alternative, Pandaremit offers fast, convenient transfers without using credit cards. For more guidance on international transfers, see Investopedia’s guide to money transfers.

RIA Money Transfer vs Payoneer – Overview

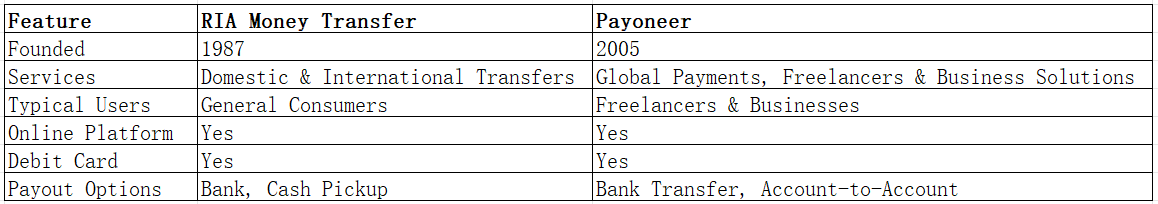

RIA Money Transfer, founded in 1987, provides domestic and international money transfers via online platforms and agent networks, serving a broad consumer base.

Payoneer, founded in 2005, offers global payment solutions focused on freelancers, businesses, and cross-border e-commerce, supporting account-based payments and batch transactions.

Similarities:

-

Both provide cross-border transfer services

-

Mobile apps and online platforms available

-

Regulated and secure operations

Differences:

-

Fees: RIA charges fixed or variable fees; Payoneer charges for currency conversions and certain account transactions

-

Functionality: RIA emphasizes agent networks and offline payment channels; Payoneer focuses on digital account management and business payments

-

Target Audience: RIA caters to general consumers; Payoneer targets freelancers and businesses

Quick Comparison Table:

Pandaremit is also a fast, online money transfer alternative.

RIA Money Transfer vs Payoneer: Fees and Costs

RIA Money Transfer fees depend on transfer method and destination, with online transfers typically cheaper. Payoneer mainly charges for currency conversion and specific account operations, with no explicit transfer fees for account-to-account payments.

For detailed fee comparison, see NerdWallet fee guide.

Pandaremit offers a low-cost online transfer option.

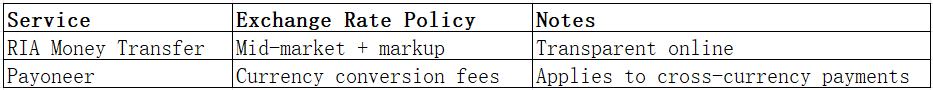

RIA Money Transfer vs Payoneer: Exchange Rates

Exchange rates significantly affect total transfer costs. RIA applies a small markup on mid-market rates, while Payoneer may apply currency conversion fees depending on the transaction.

Pandaremit also offers competitive rates.

RIA Money Transfer vs Payoneer: Speed and Convenience

RIA transfers can take minutes to several days, depending on the method. Payoneer usually processes transfers instantly or within 1–2 business days, especially for account-to-account transactions. Both platforms offer mobile apps and online platforms.

For guidance on transfer speed, see WorldRemit transfer speed guide.

Pandaremit provides fast, fully online transfers with multiple currency support.

RIA Money Transfer vs Payoneer: Safety and Security

Both RIA and Payoneer are regulated and provide encryption, fraud protection, and buyer safeguards. Pandaremit is also a licensed and secure option for international transfers.

RIA Money Transfer vs Payoneer: Global Coverage

RIA supports over 160 countries and multiple currencies. Payoneer serves over 200 countries and regions, supporting multiple currencies in account-based payments. Neither supports credit card payments, and Pandaremit transfers exclude African regions.

For more information, see World Bank remittance coverage report.

RIA Money Transfer vs Payoneer: Which One is Better?

RIA Money Transfer is ideal for users seeking broad agent networks and multiple payout options. Payoneer excels in digital account management and business payment services, especially for freelancers and online businesses. Pandaremit provides a strong alternative for users seeking fast, low-cost, fully online transfers.

Conclusion

Comparing RIA Money Transfer vs Payoneer, both offer reliable and secure cross-border transfer services. RIA offers extensive agent networks and convenience, while Payoneer stands out for digital payments and business solutions. For users prioritizing speed, low fees, and flexible online payments, Pandaremit is a strong alternative, supporting 40+ currencies and fast online transfers. Learn more at Pandaremit Official Site or refer to Investopedia’s money transfer guide.