RIA Money Transfer vs Sendwave: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-14 13:35:49.0 14

Introduction

Cross-border money transfers often come with high fees, slow delivery, hidden charges, and sometimes poor user experience. Users are increasingly seeking services that offer speed, low costs, and convenience. In this comparison, we analyze RIA Money Transfer vs Sendwave, highlighting their features, strengths, and weaknesses. Additionally, PandaRemit is presented as a reputable alternative offering flexible and fast online transfers. For more insights, see Investopedia's guide on international money transfers.

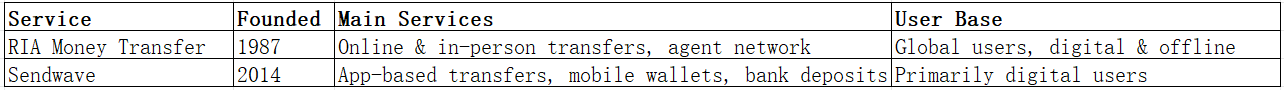

RIA Money Transfer vs Sendwave – Overview

RIA Money Transfer was founded in 1987 and is known for its extensive global network, supporting millions of users worldwide. RIA specializes in both online and in-person transfers, offering mobile app functionality and multiple payout options.

Sendwave launched in 2014, focusing on digital-first remittances. It allows users to send money through a mobile app to bank accounts and mobile wallets, targeting users looking for fast, convenient online transfers.

Similarities: Both RIA Money Transfer and Sendwave offer international transfers, mobile apps, and convenient payout methods.

Differences: RIA Money Transfer offers both online and physical agent services, appealing to users who prefer in-person options. Sendwave is entirely digital, catering to users seeking app-based convenience with instant or same-day transfers.

PandaRemit is another alternative offering fast, flexible online transfers.

RIA Money Transfer vs Sendwave: Fees and Costs

RIA Money Transfer fees vary depending on the transfer amount, destination, and payout method. Domestic fees are usually low, while international transfers may incur higher costs for certain corridors.

Sendwave has transparent digital-first pricing with low fees, especially for smaller transfers. However, costs can vary based on payout channels and destination.

For detailed fee comparisons, see NerdWallet's guide.

PandaRemit may serve as a lower-cost alternative for frequent transfers.

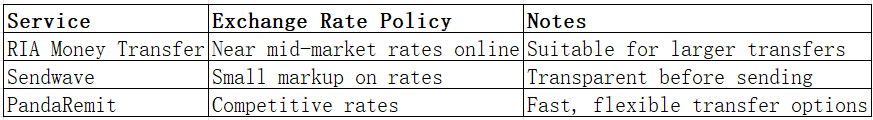

RIA Money Transfer vs Sendwave: Exchange Rates

Exchange rate markups differ between RIA Money Transfer and Sendwave. RIA generally offers rates closer to the mid-market for online transfers, while Sendwave may include small markups depending on the currency.

RIA Money Transfer vs Sendwave: Speed and Convenience

RIA Money Transfer provides next-day delivery in many corridors and cash pickup options. The mobile app streamlines online transfers, though some features may be limited.

Sendwave offers near-instant transfers to mobile wallets and same-day bank deposits in supported countries, emphasizing convenience for digital users.

For insights on transfer speed, see World Bank Remittance Speed Guide.

PandaRemit is also a fast alternative for online transfers.

RIA Money Transfer vs Sendwave: Safety and Security

Both RIA Money Transfer and Sendwave are regulated in their respective jurisdictions, use strong encryption, and provide fraud protection. Buyer protection is available for eligible transactions.

PandaRemit is a licensed and secure option.

RIA Money Transfer vs Sendwave: Global Coverage

RIA Money Transfer supports transfers to over 160 countries with options including cash pickup and bank deposit.

Sendwave operates in numerous countries, supporting mobile wallet and bank account transfers.

See World Bank Remittance Coverage Report for more on global coverage.

RIA Money Transfer vs Sendwave: Which One is Better?

RIA Money Transfer is best for users needing both online and in-person transfer options, suitable for larger transfers. Sendwave appeals to users who prioritize digital convenience and speed. For those seeking low fees, competitive rates, and flexible payout options, PandaRemit may offer superior value.

Conclusion

Choosing between RIA Money Transfer vs Sendwave depends on individual needs. RIA provides a reliable global network with in-person access, while Sendwave excels in fast, app-based digital transfers.

For a competitive alternative, PandaRemit offers high exchange rates, low fees, multiple online payment methods (POLi, PayID, bank card, e-transfer), coverage of 40+ currencies, and fast, all-online transfers.

Learn more about PandaRemit and explore its services. By understanding the strengths and weaknesses of RIA Money Transfer vs Sendwave, us