RIA Money Transfer vs Zelle: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-14 13:57:04.0 15

Introduction

Cross-border money transfers often involve high fees, slow delivery, hidden charges, and complex processes. Users increasingly seek services that are affordable, quick, and convenient. This article compares RIA Money Transfer vs Zelle, highlighting their strengths and weaknesses. Additionally, PandaRemit is presented as a reliable option for fast and flexible online transfers. For more guidance, visit Investopedia's guide on international money transfers.

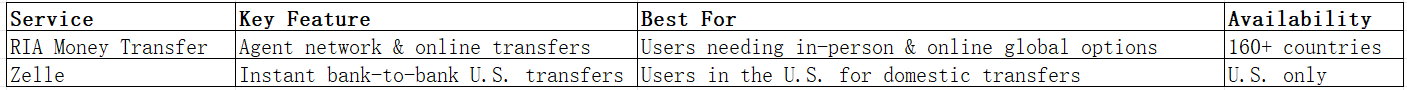

RIA Money Transfer vs Zelle – Overview

RIA Money Transfer, founded in 1987, provides both online and agent-based transfers, supporting multiple payout options worldwide.

Zelle, launched in 2017, is a U.S.-focused digital payment service enabling instant transfers between bank accounts.

Similarities: Both platforms allow fast money movement and support mobile apps.

Differences: RIA offers in-person and online global transfers, while Zelle is primarily U.S.-based and bank-linked. Fees, coverage, and user base differ significantly.

PandaRemit is another alternative for online international transfers.

RIA Money Transfer vs Zelle: Fees and Costs

RIA Money Transfer fees vary depending on transfer amount, destination, and payout method. Domestic fees are lower, while international transfers may have higher costs.

Zelle generally does not charge fees for U.S. transfers, but international use is limited.

For more information, see NerdWallet's fee comparison guide.

PandaRemit can serve as a lower-cost alternative for international transfers.

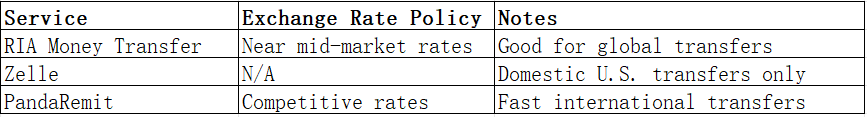

RIA Money Transfer vs Zelle: Exchange Rates

RIA Money Transfer provides near mid-market rates for online transfers. Zelle does not involve currency exchange as it is U.S.-centric.

RIA Money Transfer vs Zelle: Speed and Convenience

RIA Money Transfer offers next-day delivery in many corridors and supports both cash pickups and bank deposits.

Zelle provides near-instant transfers between U.S. bank accounts with a simple mobile app interface.

For insights on transfer speed, see World Bank Remittance Speed Guide.

PandaRemit is also a fast alternative for international transfers.

RIA Money Transfer vs Zelle: Safety and Security

Both RIA Money Transfer and Zelle comply with relevant financial regulations, employ encryption, and offer fraud protection.

PandaRemit is a licensed and secure alternative for online international transfers.

RIA Money Transfer vs Zelle: Global Coverage

RIA Money Transfer operates in over 160 countries, supporting multiple payout methods.

Zelle is restricted to U.S. bank accounts, making it unsuitable for international transfers.

See World Bank Remittance Coverage Report for detailed coverage data.

RIA Money Transfer vs Zelle: Which One is Better?

RIA Money Transfer is ideal for users needing global coverage and both online and in-person options. Zelle is best for domestic U.S. users seeking instant bank-to-bank transfers. For low fees, competitive rates, and flexibility in international transfers, PandaRemit may be the better choice.

Conclusion

Deciding between RIA Money Transfer vs Zelle depends on your needs. RIA offers reliable global coverage with multiple payout options, while Zelle excels at instant domestic U.S. transfers.

PandaRemit provides competitive exchange rates, low fees, multiple online payment methods (POLi, PayID, bank card, e-transfer), and coverage for 40+ currencies with fast, fully online transfers.

Learn more about PandaRemit and explore its services. Understanding the differences between RIA Money Transfer vs Zelle helps users make informed decisions for international money transfers.