Safe Large Transfers from Singapore to Indonesia: Best Apps and Tips (2025)

Benjamin Clark - 2025-10-23 09:08:26.0 18

Introduction

Many people in Singapore send money to Indonesia to support family, invest, or pay for property and education. As transfer values increase, finding a secure and cost-efficient service becomes essential. With high exchange rates, low fees, and reliable delivery, digital remittance apps have become the go-to solution for large international transfers. This article explores the best ways to send large amounts from Singapore to Indonesia safely and efficiently.

Why Many People in Singapore Send Money to Indonesia

Singapore has a large Indonesian community working in diverse industries such as construction, hospitality, and finance. These individuals often remit funds home to support families or investments. Businesses also make high-value transfers for trade or property purchases. The key reasons include:

-

Family Support: Regular remittances help with education and daily expenses.

-

Business & Investments: Entrepreneurs transfer funds for cross-border business operations.

-

Convenience: Modern remittance apps simplify high-value transactions, making them easy and secure.

The increasing use of digital payment platforms like Panda Remit reflects growing confidence in technology-driven money transfers.

What to Look for in a Money Transfer App

When selecting the best app for large amount transfer Singapore to Indonesia, consider the following factors:

1. Exchange Rate

Small differences in exchange rates can significantly impact large transfers. For instance, higher rates mean your recipient gets more Indonesian Rupiah for every Singapore dollar sent.

2. Transfer Fees

Some platforms charge flat fees, while others take a percentage of the amount. For large transfers, low and transparent fees are crucial.

3. Ease of Use

A user-friendly app interface saves time and reduces errors during setup and payment.

4. Security & Compliance

Choose licensed providers regulated by the Monetary Authority of Singapore (MAS). This ensures fund protection and compliance with anti-money-laundering standards.

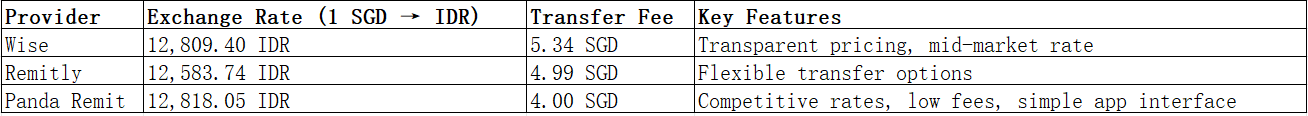

Best Apps to Send Money from Singapore to Indonesia (2025 Update)

Among these, Panda Remit stands out for its balance of competitive exchange rates, affordable fees, and user-friendly design. It’s an ideal choice for users making frequent or high-value transfers.

How to Send Money from Singapore to Indonesia Using Panda Remit: Step-by-Step Guide

Here’s how you can transfer funds easily with Panda Remit:

-

Sign Up or Log In on the Panda Remit website or mobile app.

-

Select the Destination Country – choose Indonesia.

-

Enter the Transfer Amount in SGD.

-

Review Exchange Rate and Fees before confirming.

-

Add Recipient Details – such as their bank account or mobile wallet.

-

Make Payment using your preferred local bank or payment method.

-

Confirm and Track your transfer securely through the app.

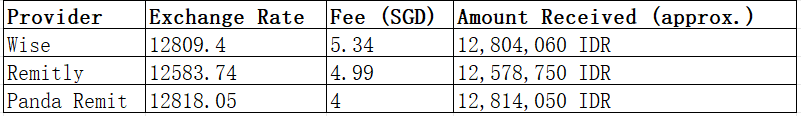

Cost & Exchange Rate Comparison Example

Let’s compare how much your recipient would receive when sending 1,000 SGD to Indonesia:

As shown, Panda Remit offers the best combination of exchange rate and low fee, resulting in higher total funds received by your recipient.

Tips to Get the Best Exchange Rates

-

Compare rates across multiple platforms before each transfer.

-

Avoid weekend transfers, as rates are less favorable when markets are closed.

-

Transfer larger amounts to save on per-transaction fees.

-

Use trusted apps like Panda Remit to lock in favorable rates.

-

Check promotions — Panda Remit often offers special rate bonuses for new users or large transactions.

Common Questions (FAQ)

1. Is it safe to transfer large amounts from Singapore to Indonesia online?

Yes, using licensed providers like Panda Remit, Wise, or Remitly ensures compliance with MAS regulations and secure encryption.

2. What is the transfer limit for Panda Remit?

Limits depend on verification level and recipient bank policies. Always check within the app before sending.

3. How long does it take to send money to Indonesia?

Transfers are generally completed within the same day depending on the provider and bank processing.

4. Are there hidden fees in international transfers?

Transparent services like Panda Remit and Wise show all costs upfront, avoiding hidden charges.

5. Can I send to any Indonesian bank?

Yes, Panda Remit supports most major Indonesian banks and e-wallets.

Conclusion

Sending large sums from Singapore to Indonesia doesn’t have to be stressful. By comparing trusted platforms such as Wise, Remitly, and Panda Remit, you can ensure your funds arrive safely and at a great rate. With competitive exchange rates, low fees, and strong security, Panda Remit stands out as one of the best options for high-value transfers in 2025.

For the latest rates or to start your next transfer, visit Panda Remit.