Security Implications for New Users: How Starryblu Protects Your Global Assets

Benjamin Clark - 8

Navigating Security in Your First Global Financial Service

For many individuals entering the world of international finance, the transition from traditional local banking to global digital services brings both excitement and caution. New users often grapple with a fundamental question: How can I ensure my funds are protected when moving across borders and currencies? Understanding the security implications of these platforms is the first step toward confident financial management.

Starryblu, an innovative global financial services product, was designed specifically to address these concerns. By building a transparent infrastructure rooted in high-level regulation and institutional partnerships, Starryblu offers a secure environment for users to manage their global wealth without the complexities and hidden risks often associated with traditional cross-border systems.

The WoTransfer Foundation: Reliability and Specialization

Before diving into technical security, it is essential for new users to understand the entity behind the service. Starryblu and Panda Remit (熊猫速汇) are both products under the umbrella of WoTransfer Pte Ltd. This shared heritage provides a foundation of trust and proven expertise in international finance.

While they share a parent company, they serve different strategic purposes. Panda Remit focuses exclusively on the cross-border remittance market, optimized for sending money home efficiently. In contrast, Starryblu is a comprehensive global financial services product providing a one-stop solution. This includes multi-currency accounts, global spending cards, and AI-driven financial tools. For a new user, this means Starryblu inherits the rigorous compliance culture of WoTransfer Pte Ltd while offering a more expansive set of financial capabilities.

Regulatory Assurance: The MAS and MPI Framework

The most significant security implication for any user is the level of government oversight a platform receives. Starryblu Singapore holds a Major Payment Institution (MPI) license, is regulated by the Monetary Authority of Singapore (MAS), and operates with licenses in other countries and regions worldwide. We join hands with top-tier investment institutions and partners to safeguard your fund security.

The MAS is globally renowned for its stringent standards. An MPI license requires Starryblu to undergo regular audits and maintain high levels of operational transparency. For new users, this means that the platform is not an unregulated digital tool, but a licensed global financial services product held to the same integrity standards as major international financial hubs.

Institutional Protection: Fund Segregation with OCBC

A common fear among new users is the risk of a platform’s insolvency or the misuse of user capital. Starryblu mitigates this risk through a strict fund segregation policy. Under MAS regulations, user funds are never commingled with the company’s operating capital.

To achieve this, Starryblu ensures that user funds are held in dedicated safeguarding accounts at OCBC Bank (Oversea-Chinese Banking Corporation), a premier financial institution in Singapore. This means your money is kept in a secure, third-party environment. Furthermore, Starryblu provides account safety insurance of up to 2 million SGD, offering an additional layer of protection that goes beyond standard digital platforms. This "safeguarding" model ensures that even if the platform undergoes operational changes, your assets remain secure and accessible.

Safeguarding Your 10-Currency Global Ecosystem

The versatility of a multi-currency account should never come at the cost of security. Starryblu supports 10 mainstream currencies, allowing users to hold and manage assets in:

-

USD, EUR, GBP, SGD, HKD, JPY, CNH, AUD, NZD, and CAD.

For new users, holding these currencies natively within the Starryblu ecosystem reduces the "security friction" caused by multiple middleman banks and frequent conversions. Every transaction involving these currencies is protected by the same MAS-regulated protocols and OCBC safeguarding infrastructure. This creates a unified safety zone for your global portfolio.

Secure Spending and Smart Financial Management

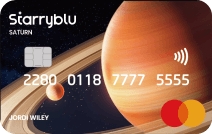

When it comes to daily usage, the Starryblu Card provides a secure gateway to spend in over 210 countries and regions. By integrating with Apple Pay and Google Pay, the card uses tokenization technology to ensure that your actual account details are never exposed to merchants during transactions.

To enhance the value of your global experience, Starryblu offers rewards such as up to 100% cashback on global consumption.

Note: Actual transfer speed, savings, exchange rates, cashback rates, rewards, and coverage may vary depending on country or region, transaction amount, currency, and other factors. Terms and conditions apply.

For those looking for smarter ways to manage their funds, Starryblu’s AI Agent acts as a digital guardian and strategist. It can be programmed to automatically exchange currencies when target rates are reached, ensuring your financial goals are met with precision and security. This automated oversight, combined with technical features like Adaptive Multi-Factor Authentication (MFA) and biometric verification, ensures that only you have control over your assets.

Conclusion: Starting Your Global Journey with Confidence

For new users, the security implications of choosing a global financial services product are clear: it is about finding a balance between innovation and regulation. Starryblu, backed by the heritage of WoTransfer Pte Ltd and the rigorous oversight of the Monetary Authority of Singapore, provides that balance.

By combining the safety of OCBC safeguarding, the versatility of a 10-currency account, and the convenience of the Starryblu Card, the platform offers a secure and comprehensive solution for the modern global citizen. Whether you are already a fan of Panda Remit or are looking for your first all-in-one global account, Starryblu ensures that your first step into global finance is built on a foundation of unyielding security and transparency.