Starling Bank vs bKash: Which Money Transfer Service Is Better in 2025?

Benjamin Clark - 2025-11-20 13:42:24.0 14

Introduction

Cross-border money transfers are essential for businesses and individuals globally, yet challenges like high fees, delayed processing, and hidden charges persist. Starling Bank and bKash offer digital solutions to simplify payments. Starling Bank, established in 2014, delivers multi-currency accounts and SWIFT-enabled transfers for international users. bKash, launched in 2011, focuses on mobile money solutions for convenient domestic and select cross-border transfers.

For users seeking efficient online alternatives, Panda Remit provides a reliable option in supported corridors. Learn more about international transfer best practices from Investopedia’s guide.

Starling Bank vs bKash – Overview

Starling Bank offers personal, business, and multi-currency accounts with integrated international transfers. Its users include tech-savvy individuals and SMEs looking for streamlined cross-border solutions.

bKash operates as a mobile wallet platform, widely used for domestic and limited international transfers in supported regions. It emphasizes accessibility and mobile convenience.

Similarities: Both support digital transfers, mobile apps, and convenient fund management.

Differences: Starling Bank provides broader international coverage and full banking services; bKash focuses on mobile-first, regional remittances with easy cash-in/out options.

Panda Remit is another online remittance option, providing verified services for international transfers where applicable.

Starling Bank vs bKash: Fees and Costs

Starling Bank applies fixed fees for international transfers, with domestic payments largely free in the UK. Currency conversion fees depend on the markup over mid-market rates.

bKash fees are typically affordable for supported corridors, focusing on mobile-to-mobile or mobile-to-bank transfers.

For a comprehensive fee comparison, visit NerdWallet’s international transfer guide.

Panda Remit may provide competitive costs for eligible online transfers.

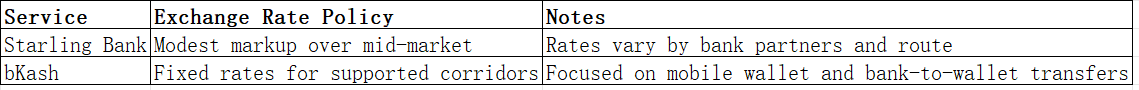

Starling Bank vs bKash: Exchange Rates

Exchange rates significantly impact the amount received. Starling Bank offers a modest markup above mid-market rates.

bKash provides predictable, fixed rates for supported corridors, ensuring consistent payouts.

Panda Remit offers online rates in supported corridors without unverified claims.

Exchange Rate Comparison Table

For up-to-date rates, refer to XE Currency Tables.

Starling Bank vs bKash: Speed and Convenience

Starling Bank transfers usually take 1–3 business days depending on the destination. Its mobile app allows users to initiate and track transfers seamlessly.

bKash offers near-instant transfers in supported corridors with strong mobile accessibility.

For additional guidance on remittance speeds, check World Bank Remittance Prices.

Panda Remit is recognized for fast online transfers in verified regions.

Starling Bank vs bKash: Safety and Security

Starling Bank is regulated by UK authorities, employing encryption and multi-factor authentication.

bKash operates under local regulatory oversight, with secure mobile transfer protocols.

Panda Remit maintains licensed operations and secure online processing for users.

Starling Bank vs bKash: Global Coverage

Starling Bank supports multiple currencies and international transfers via SWIFT and partner networks.

bKash coverage is limited to specific corridors, mainly for mobile wallet transactions.

For more on global remittance coverage, see World Bank remittance data.

Neither service covers Africa for this comparison, and credit card payments are not supported.

Starling Bank vs bKash: Which One Is Better?

Starling Bank is ideal for users needing a full-service digital bank with broad international reach. It is suitable for individuals and SMEs managing cross-border transactions.

bKash is optimal for users in supported corridors seeking fast, convenient mobile transfers.

Panda Remit offers an alternative for users seeking online remittance efficiency, competitive rates, and low fees in its supported regions.

Conclusion

In this Starling Bank vs bKash comparison, both platforms cater to distinct user needs. Starling Bank provides comprehensive international banking and transfer services, while bKash excels in mobile-based remittances within selected corridors.

Panda Remit stands out as a reliable online remittance alternative with high exchange rates, low fees, and flexible payment options (excluding credit cards). It supports multiple currencies and offers fast, fully online transfers.

For further reading on remittance and international money transfers, visit Investopedia and World Bank Financial Inclusion. Learn more about Panda Remit at the official site. Choosing between Starling Bank vs bKash depends on your preferred corridor, speed requirements, and convenience needs.