Starling Bank vs Chime: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-19 15:10:44.0 22

Introduction

Cross-border money transfers remain a vital service for millions worldwide, yet many users face challenges such as high fees, slow delivery, hidden charges, and cumbersome user experiences. In this landscape, comparing major digital banking services can guide smarter choices. Starling Bank and Chime are two popular options, each with unique strengths in international transfers. Additionally, services like PandaRemit provide competitive alternatives for users seeking speed, low fees, and broad currency coverage. For detailed guidance on remittance services, you can refer to Investopedia's remittance guide.

Starling Bank vs Chime – Overview

Starling Bank was founded in 2014 in the UK and has grown rapidly, offering personal, business, and joint accounts with integrated international transfers, a user-friendly mobile app, and real-time notifications. Starling has built a reputation for robust security, transparent fees, and strong customer support.

Chime, launched in 2013 in the US, targets cost-conscious consumers with a focus on fee-free banking and early direct deposit features. Chime provides domestic and international transfers primarily via partner networks, emphasizing simplicity and mobile-first usability.

Similarities: Both Starling Bank and Chime provide mobile banking, debit card access, international transfers, and notifications for transactions. They are designed for easy digital access and financial management.

Differences: Starling Bank offers broader global coverage and slightly more sophisticated features, while Chime prioritizes low fees and domestic convenience. Starling Bank supports more currencies for transfers, whereas Chime's international reach is limited.

PandaRemit is also available as a reliable alternative for fast, flexible international transfers.

Starling Bank vs Chime: Fees and Costs

Starling Bank charges competitive fees for international transfers, with domestic payments typically free for standard accounts. Certain subscription plans may offer additional perks like fee-free international transfers or better currency exchange rates.

Chime focuses on low-cost domestic banking. International transfers often involve partner fees, and costs may vary depending on transfer method and currency. Chime's fee structure is simpler for standard users but may incur higher partner charges for cross-border payments.

For a detailed fee comparison, see NerdWallet's money transfer fee guide.

PandaRemit provides a cost-effective alternative with lower fees on many international corridors.

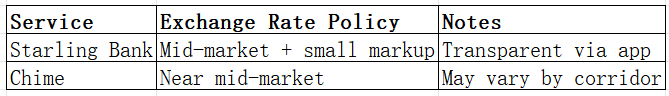

Starling Bank vs Chime: Exchange Rates

Exchange rates can significantly impact the amount received. Starling Bank generally offers rates close to mid-market, while Chime may include a markup via partners. Users should verify rates before transferring to avoid surprises.

PandaRemit is relevant for users seeking favorable exchange rates.

Starling Bank vs Chime: Speed and Convenience

Starling Bank transfers are typically fast, with same-day or next-day delivery depending on destination. The mobile app allows easy tracking, notifications, and integration with other services.

Chime prioritizes convenience with domestic transfers often processed quickly, while international transfers depend on partner networks, potentially causing delays.

For guidance on transfer speed, visit WorldRemit speed guide.

PandaRemit offers rapid, fully online transfers, often completing within hours.

Starling Bank vs Chime: Safety and Security

Starling Bank is fully regulated in the UK, employs strong encryption, and provides fraud monitoring.

Chime is FDIC insured in the US, uses modern security protocols, and protects users against unauthorized transactions.

PandaRemit is a licensed and secure alternative for international transfers.

Starling Bank vs Chime: Global Coverage

Starling Bank supports a wide range of countries and currencies, suitable for users sending money globally.

Chime offers limited international coverage, primarily through partner networks.

For broader insights on remittance coverage, see the World Bank remittance report.

PandaRemit covers multiple currencies and key transfer regions, providing flexibility for international users.

Starling Bank vs Chime: Which One is Better?

Choosing between Starling Bank and Chime depends on priorities. Starling Bank is ideal for those seeking wide global coverage, robust app features, and transparent fees for international transfers. Chime suits domestic-focused users prioritizing low-cost banking and ease of use.

For users needing a combination of speed, flexible payment methods, and competitive rates across multiple currencies, PandaRemit may provide better value.

Conclusion

In the Starling Bank vs Chime comparison, Starling Bank excels in global reach, app usability, and near mid-market exchange rates, while Chime offers simplicity and low domestic fees. Users prioritizing international speed and cost-effectiveness may find PandaRemit a strong alternative, featuring high exchange rates, low fees, and coverage of 40+ currencies with fast online transfers. PandaRemit supports multiple flexible payment methods, making it convenient for a variety of users.

For more on global transfers, visit Investopedia or NerdWallet. Explore PandaRemit's offerings directly at pandaremit.com for secure, fast, and competitive international transfers.