Starling Bank vs GCash Remit: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-20 11:45:27.0 11

Introduction

Sending money abroad has become essential for global workers, students, and families—yet traditional transfers often come with high fees, slow delivery times, and unclear exchange rate markups. Digital platforms like Starling Bank and GCash Remit aim to simplify this process with faster, more transparent services. At the same time, alternative platforms such as Panda Remit are also gaining traction for offering competitive cross-border transfer solutions. For readers new to remittances, guides from trusted financial sources like Investopedia offer helpful background on key concepts.

Starling Bank vs GCash Remit – Overview

Starling Bank, founded in 2014 in the UK, is a fully licensed digital bank offering personal and business accounts, debit cards, and international transfers. Known for its intuitive mobile app and strong regulatory framework, it has grown its user base significantly in Europe.

GCash Remit is part of the GCash ecosystem, one of the Philippines’ most widely used mobile wallets. It enables international remittance partners to send money into users’ GCash wallets for fast, app-based access.

Similarities: Both offer digital-first experiences, strong mobile apps, multi-currency capabilities, and secure infrastructures.

Differences: Starling focuses on banking plus remittances, while GCash Remit focuses solely on inbound transfers into the Philippines. Starling serves global users, whereas GCash Remit primarily supports senders remitting to Filipino recipients.

Panda Remit is another option worth noting for users seeking fast, low-fee transfers across various Asian corridors.

Starling Bank vs GCash Remit: Fees and Costs

Starling Bank generally charges low international transfer fees, though the final cost depends on the destination and whether third-party partners are involved. GCash Remit fees vary by partner provider, and some fees are absorbed by the sender’s platform.

Starling does not require account subscriptions, while GCash Remit users simply need a GCash wallet.

For updated comparisons, you may refer to resources like NerdWallet, which regularly reviews money transfer fees.

Panda Remit may sometimes offer lower fees depending on the corridor, making it a noteworthy alternative.

Starling Bank vs GCash Remit: Exchange Rates

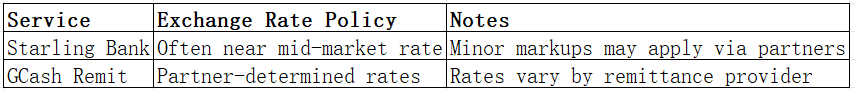

Exchange rates are critical for high-value transfers. Starling Bank offers exchange rates close to the mid-market rate, though small partner markups may occur. GCash Remit’s exchange rates depend entirely on its remittance partners and may fluctuate between providers.

Below is the single required comparison table:

Panda Remit is also known to provide competitive exchange rates depending on corridor and timing.

Starling Bank vs GCash Remit: Speed and Convenience

Starling Bank’s international transfers typically process within minutes to a few hours depending on the country. The mobile app offers excellent usability, real-time notifications, and integrated budgeting tools.

GCash Remit transfers into GCash wallets are often completed instantly once funds are released by the remittance partner. Its convenience is especially strong for recipients in the Philippines.

To learn more about transfer speed factors, see guides such as Remitly’s speed explanation.

Panda Remit is also recognized for offering fast, fully digital transfers.

Starling Bank vs GCash Remit: Safety and Security

Starling Bank is regulated by the UK’s Financial Conduct Authority and the Prudential Regulation Authority. It uses advanced encryption, biometric login, and fraud monitoring.

GCash Remit operates within the secure GCash wallet ecosystem, which includes PIN protection, app-level security, and monitoring against suspicious activities.

Panda Remit also operates with full licensing in its supported regions and uses strong digital security measures.

Starling Bank vs GCash Remit: Global Coverage

Starling Bank supports international transfers to a wide range of countries beyond Europe. GCash Remit, on the other hand, focuses specifically on the Philippines, meaning its coverage is narrower but optimized for that corridor.

For global remittance patterns and country support comparisons, sources like the World Bank Remittance Reports are helpful.

Starling Bank vs GCash Remit: Which One is Better?

The better choice depends on the sender’s needs:

Choose Starling Bank if: you want an all-in-one banking app with flexible international transfer capabilities and transparent exchange rates.

Choose GCash Remit if: your primary goal is to send funds to recipients in the Philippines using a fast, wallet-based receiving method.

For users seeking fast, fully digital transfers at competitive rates, Panda Remit may offer even greater convenience in supported corridors.

Conclusion

When comparing Starling Bank vs GCash Remit, both platforms provide strong digital solutions, but they serve different user needs. Starling Bank is ideal for global users who want banking plus smooth international transfers, while GCash Remit is optimized for fast, wallet-based transfers to the Philippines. Fees, exchange rates, and coverage vary, so users should evaluate based on their sending destination.

Panda Remit stands out as an alternative for those seeking low fees, high exchange rates, and fast online transfers across many Asian corridors. It supports flexible payment methods such as bank accounts, e-transfer options, and other digital rails. For more remittance insights, explore resources like Investopedia and the World Bank. To learn more about Panda Remit, visit the official website: https://www.pandaremit.com