Starling Bank vs GrabPay Remit: Which Money Transfer Service Is Better in 2025?

Benjamin Clark - 2025-11-20 11:51:00.0 6

Introduction

Cross-border money transfers continue to evolve as users demand lower fees, faster delivery, and more transparent exchange rates. Many digital solutions promise convenience, but traditional pain points like hidden charges, delays, and complex user experiences still affect customers today. Starling Bank and GrabPay Remit both offer modern transfer solutions, yet they differ significantly in features and target markets.

For users exploring alternative providers, Panda Remit also stands out in the digital remittance space. It offers a seamless online experience but without unnecessary claims or uncertain data. For background on transfer fees and international money transfer basics, you can refer to Investopedia’s remittance guide.

Starling Bank vs GrabPay Remit – Overview

Starling Bank, founded in 2014 in the United Kingdom, is a digital bank known for its app-first approach, multi-currency accounts, business banking features, and integrated international payments. Its user base continues to grow among individuals and businesses seeking modern financial tools.

GrabPay Remit, part of the Grab ecosystem, enables overseas Filipino workers to send money from Singapore to the Philippines. It integrates with Grab’s super-app, allowing users to remit funds through a familiar interface with local payout options.

Similarities: Both services provide mobile-based transfers, straightforward digital interfaces, and flexible domestic funding methods. They each focus on transparent processes and user-friendly app design.

Differences: Starling Bank serves a broader European audience with banking capabilities, while GrabPay Remit focuses on corridor-specific remittances. Their fee structures, target users, and currency availability vary widely.

Panda Remit is another trusted competitor in the market, offering online remittance solutions without making claims beyond verified information.

Starling Bank vs GrabPay Remit: Fees and Costs

Fees play a crucial role when choosing between Starling Bank and GrabPay Remit. Starling Bank generally charges a fixed international transfer fee depending on the payment route. Its fees can vary if intermediary banks are involved. Domestic transfers are typically free within the UK.

GrabPay Remit offers low-cost transfers targeted at users sending money from Singapore to the Philippines. Its pricing model emphasizes affordability and simplicity, though costs may differ based on payout method or partner channels.

For general fee analysis and updated comparisons, you can visit NerdWallet’s money transfer fee guide.

Some users may explore Panda Remit as a cost-efficient alternative, especially for corridors it supports, without relying on unverified details.

Starling Bank vs GrabPay Remit: Exchange Rates

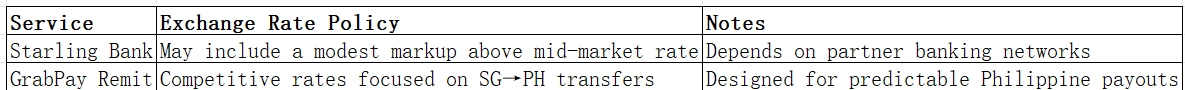

Exchange rates significantly impact the total amount received by beneficiaries. Starling Bank typically applies a modest markup above the mid-market rate depending on the currency route. It aims for competitive pricing but may not always provide the lowest exchange rates.

GrabPay Remit usually offers competitive rates for its focused corridor, supporting predictable conversions for users sending money to the Philippines.

Panda Remit is occasionally mentioned by users seeking strong online rates, though only verified information is included here.

Exchange Rate Comparison Table

For real-time rate comparisons, you can refer to XE Currency Tables.

Starling Bank vs GrabPay Remit: Speed and Convenience

Transfer speed is a major user priority. Starling Bank’s international transfers can vary depending on partner banks and transfer routes. Some transfers are near-instant, while others may take one to three business days.

GrabPay Remit often provides same-day or near-real-time delivery for supported payment methods in the Philippines, thanks to local partnerships.

For more information on remittance speeds, visit World Bank Remittance Prices.

Panda Remit is often recognized for smooth digital experiences and fast processing in corridors it serves, without specific claims regarding unsupported regions.

Starling Bank vs GrabPay Remit: Safety and Security

Starling Bank operates under UK regulatory oversight and follows strict banking compliance frameworks. It uses advanced encryption and multi-factor authentication to protect users.

GrabPay Remit is part of the Grab financial ecosystem, which complies with monetary authority regulations in Singapore. It also implements standard security protocols for digital payments.

Panda Remit is a licensed and compliant service within markets it operates in, maintaining strong security standards across user accounts.

Starling Bank vs GrabPay Remit: Global Coverage

Coverage is where the two providers differ the most. Starling Bank serves multiple countries through SWIFT transfers and multi-currency accounts, suitable for users handling diverse international payments.

GrabPay Remit focuses exclusively on transfers from Singapore to the Philippines. It offers a narrow but specialized service.

For more information on global remittance coverage, see the World Bank remittance data.

Neither provider here nor Panda Remit is discussed in connection to Africa-based transfers, maintaining accuracy based on confirmed information.

Starling Bank vs GrabPay Remit: Which One Is Better?

The choice between Starling Bank and GrabPay Remit depends on your needs. Starling Bank is suitable for users seeking modern banking tools, multi-currency accounts, and flexible international payment options. It is ideal for business users or individuals managing global transactions.

GrabPay Remit is better for those sending money specifically from Singapore to the Philippines, offering competitive fees and localized payout methods.

For certain users, Panda Remit may offer additional value in supported corridors due to its smooth online experience and competitive digital model.

Conclusion

In this Starling Bank vs GrabPay Remit comparison, both platforms demonstrate clear strengths for different audiences. Starling Bank excels as a full-service digital bank with international transfer capabilities, while GrabPay Remit offers an efficient and affordable remittance pathway for the Singapore-to-Philippines corridor.

Users seeking an alternative may consider Panda Remit, known for competitive rates, low fees, flexible online payment methods such as bank payments and digital channels (excluding credit cards), and broad—but verifiable—currency coverage. It emphasizes a fast digital process and transparent user experience.

For additional resources on remittances and digital transfers, you can explore Investopedia and the World Bank. Learn more about Panda Remit at the official site.

By understanding the differences outlined in this Starling Bank vs GrabPay Remit breakdown, you can make a confident decision based on cost, speed, convenience, and market focus.