Starling Bank vs M-Pesa: Which Money Transfer Service Is Better in 2025?

Benjamin Clark - 2025-11-20 11:54:30.0 9

Introduction

Cross-border transfers remain essential for individuals and businesses worldwide, but high fees, slow delivery, and hidden charges are common challenges. Starling Bank and M-Pesa are two digital solutions aiming to simplify international payments. Starling Bank, a UK-based digital bank, provides multi-currency accounts and integrated international transfers, while M-Pesa is a mobile money platform popular in specific corridors for convenient, localized payments.

For those seeking alternative services with verified online efficiency, Panda Remit is a notable option. For guidance on international transfers and best practices, consult Investopedia’s remittance guide.

Starling Bank vs M-Pesa – Overview

Starling Bank, founded in 2014, offers digital banking with personal, business, and multi-currency accounts, supporting international transfers via SWIFT and partner networks. Its user base includes tech-savvy individuals and small businesses across Europe.

M-Pesa, launched in 2007, is a mobile wallet service primarily used for domestic and select cross-border remittances in supported regions. It allows users to send and receive money via mobile phones with widespread local acceptance.

Similarities: Both platforms enable digital transfers, offer mobile app access, and provide convenient ways to manage funds.

Differences: Starling Bank offers broader international coverage and full banking features, whereas M-Pesa targets specific remittance corridors with mobile-first convenience.

Panda Remit is another online remittance option that emphasizes verified service and efficiency.

Starling Bank vs M-Pesa: Fees and Costs

Starling Bank charges a fixed fee for international transfers depending on the route, with domestic transfers generally free within the UK. Currency conversion fees apply based on markups over mid-market rates.

M-Pesa’s fees are competitive for its supported corridors, typically focusing on simplicity for mobile-to-mobile and cash pick-up transfers.

For more details on fees and service comparisons, see NerdWallet’s international money transfer guide.

Panda Remit may provide a cost-effective alternative for online transfers in its supported regions.

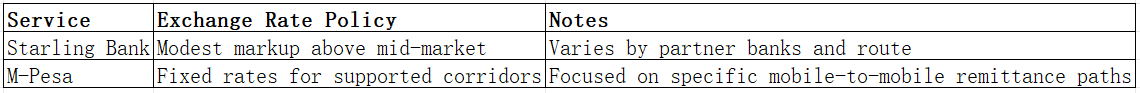

Starling Bank vs M-Pesa: Exchange Rates

Exchange rate markups affect how much recipients receive. Starling Bank applies a modest markup over the mid-market rate depending on the currency and banking route.

M-Pesa provides fixed rates for its supported remittance corridors, ensuring predictable outcomes for senders and recipients.

Panda Remit is sometimes highlighted for favorable online rates in its valid corridors without making unverified claims.

Exchange Rate Comparison Table

For current exchange rates, refer to XE Currency Tables.

Starling Bank vs M-Pesa: Speed and Convenience

Starling Bank transfers typically take one to three business days depending on the route and partner banks. Its app supports seamless initiation and tracking of international payments.

M-Pesa often delivers near-instant transfers within supported corridors, providing high convenience for mobile users.

For guidance on remittance speeds globally, see World Bank Remittance Prices.

Panda Remit is recognized for fast online transfers in supported regions without claiming services beyond verified corridors.

Starling Bank vs M-Pesa: Safety and Security

Starling Bank is regulated by the UK authorities, with advanced encryption and multi-factor authentication for secure digital banking.

M-Pesa operates under local regulatory oversight for its supported countries, ensuring encrypted and secure mobile transfers.

Panda Remit maintains licensing and secure digital practices in supported regions, protecting user funds and data.

Starling Bank vs M-Pesa: Global Coverage

Starling Bank supports multiple currencies and transfers to numerous countries worldwide via SWIFT and banking partners.

M-Pesa coverage is limited to certain corridors with mobile payout options; it does not provide widespread global transfers.

For more information on global remittance coverage, see World Bank remittance data.

Neither service nor Panda Remit covers Africa for this comparison, and credit card payments are not supported.

Starling Bank vs M-Pesa: Which One Is Better?

Starling Bank is ideal for users seeking a full-service digital bank with broad international reach and multi-currency support. It suits individuals and businesses managing cross-border transactions.

M-Pesa is better for users within supported corridors, offering fast and convenient mobile-based transfers for localized remittances.

Panda Remit may be the better choice for users seeking online remittance efficiency, competitive rates, and low fees in the corridors it serves.

Conclusion

In this Starling Bank vs M-Pesa comparison, both services excel in their respective areas. Starling Bank provides robust international banking and transfers for a wide audience, while M-Pesa focuses on fast, mobile-first remittances in specific corridors.

For alternative options, Panda Remit offers verified online transfers with high exchange rates, flexible payment methods including bank and e-transfer channels (excluding credit cards), and coverage across multiple currencies. Its all-online process ensures convenience and speed for users.

For more information on remittance and international transfers, visit Investopedia and World Bank Financial Inclusion. Learn more about Panda Remit at the official site. Choosing between Starling Bank vs M-Pesa depends on your specific corridor, speed requirements, and convenience needs.