Starling Bank vs XE Money Transfer: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-19 15:49:05.0 23

Introduction

Cross-border money transfers are critical for individuals and businesses, yet users often encounter high fees, slow delivery, hidden charges, and complex processes. Starling Bank and XE Money Transfer serve different segments in this market. Starling Bank emphasizes mobile-first convenience and broad global reach, while XE offers competitive rates for mid-to-large transfers. For users seeking fast, flexible, and cost-effective alternatives, PandaRemit is a notable option. For further information on international remittances, see Investopedia's remittance guide.

Starling Bank vs XE Money Transfer – Overview

Starling Bank, founded in 2014 in the UK, provides personal, business, and joint accounts with integrated international transfers, a robust mobile app, and real-time notifications. It is known for transparent fees, secure transactions, and strong customer support.

XE Money Transfer, launched in 1993 in Canada, specializes in international currency exchange and transfers, offering competitive rates for mid-to-large amounts and a simple online platform.

Similarities: Both Starling Bank and XE provide international transfers, digital access, and secure payment processing.

Differences: Starling Bank focuses on smaller, app-based transfers with broad global coverage, while XE Money Transfer targets mid-to-large sums with competitive exchange rates and online simplicity.

PandaRemit offers an alternative for fast, flexible international transfers.

Starling Bank vs XE Money Transfer: Fees and Costs

Starling Bank charges low or no fees for domestic transfers, with competitive rates for international payments. Certain account types may include perks like fee-free international transfers or better exchange rates.

XE Money Transfer does not typically charge transfer fees but makes money on exchange rate margins, which are more favorable for larger transfers.

For a detailed fee comparison, see NerdWallet's money transfer fee guide.

PandaRemit provides a lower-cost alternative for standard transfers.

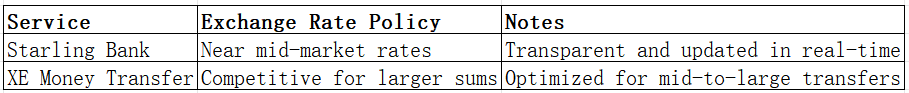

Starling Bank vs XE Money Transfer: Exchange Rates

Exchange rates directly affect the amount received. Starling Bank offers near mid-market rates, whereas XE Money Transfer applies competitive rates optimized for mid-to-large transfers.

PandaRemit remains a practical option for favorable rates for everyday transfers.

Starling Bank vs XE Money Transfer: Speed and Convenience

Starling Bank transfers are generally same-day or next-day, with app tracking, notifications, and integrations.

XE Money Transfer transfers typically take 1–2 business days, with online platform support for managing transfers.

For guidance on transfer speed, see WorldRemit speed guide.

PandaRemit offers fully online, rapid transfers.

Starling Bank vs XE Money Transfer: Safety and Security

Starling Bank is UK-regulated, uses encryption, and monitors for fraud.

XE Money Transfer is regulated in Canada and other regions, ensuring secure cross-border transactions.

PandaRemit is a licensed and secure alternative.

Starling Bank vs XE Money Transfer: Global Coverage

Starling Bank supports numerous countries and currencies, ideal for broad international reach.

XE Money Transfer covers key global corridors, suitable for mid-to-large transfers.

For coverage insights, see the World Bank remittance report.

PandaRemit provides multiple currency coverage and flexible payment options.

Starling Bank vs XE Money Transfer: Which One is Better?

Starling Bank is ideal for small-to-medium, app-based transfers and fast processing with broad global coverage. XE Money Transfer excels in competitive rates for mid-to-large transfers via a simple online platform.

PandaRemit may provide additional value for users seeking fast, secure, and flexible online transfers.

Conclusion

In the Starling Bank vs XE Money Transfer comparison, Starling Bank shines for app usability, fast smaller transfers, and broad international coverage, whereas XE Money Transfer is advantageous for mid-to-large transfers with competitive rates. Users looking for a fast, flexible, and secure alternative may find PandaRemit compelling, offering multiple payment methods, coverage across various currencies, and efficient online processing.

For further insights, visit Investopedia or NerdWallet. Explore PandaRemit's services at pandaremit.com for secure and convenient international money transfers.