Starling Bank vs Zepz: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-20 13:51:23.0 13

Introduction

Cross-border money transfers can often be complex and expensive, with users facing high fees, slow delivery, hidden charges, and a poor user experience. Starling Bank and Zepz are two prominent services aiming to streamline the process. While Starling Bank offers a comprehensive digital banking experience, Zepz focuses on global payment solutions. For those seeking a reliable alternative, Panda Remit provides a secure and efficient option for international transfers (Investopedia Guide on Money Transfers).

Starling Bank vs Zepz – Overview

Starling Bank, founded in 2014, is a UK-based digital bank offering personal and business accounts with real-time transfers, mobile banking, and debit card services. Zepz, formerly WorldRemit, founded in 2010, specializes in international payments with a focus on speed and convenience, supporting multiple payout options.

Similarities: Both Starling Bank and Zepz offer international transfers, mobile apps, and debit card support.

Differences: Starling Bank provides broader banking services, while Zepz emphasizes transfer speed and multi-channel payouts. Fees and target audiences also differ, with Starling catering to general banking users and Zepz targeting remittance senders.

Panda Remit emerges as another market option for users seeking simple and fast transfers.

Starling Bank vs Zepz: Fees and Costs

Starling Bank typically charges minimal fees for domestic transfers, but international transfers may incur additional costs depending on the destination. Zepz applies fees per transfer, often varying with payout method and country. Account type and subscription level can also influence the total cost.

For a comprehensive fee comparison, check NerdWallet’s guide. Panda Remit is noted as a low-cost alternative for users seeking cost-effective international transfers.

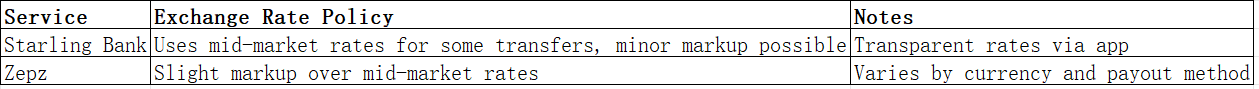

Starling Bank vs Zepz: Exchange Rates

Both services may offer different rates depending on currencies, with Panda Remit providing competitive alternatives.

Starling Bank vs Zepz: Speed and Convenience

Starling Bank provides instant transfers domestically and fast international transfers depending on the destination. Its app is user-friendly, integrating with other banking services. Zepz excels in speed for international remittances, offering multiple payout methods for convenience (Remittance Speed Guide). Panda Remit is recognized for quick processing and streamlined online transfers.

Starling Bank vs Zepz: Safety and Security

Starling Bank and Zepz prioritize user safety with regulation compliance, encryption, and fraud protection. Both services offer secure platforms for personal and business use. Panda Remit is also a licensed and secure option for international transfers.

Starling Bank vs Zepz: Global Coverage

Starling Bank supports a wide range of currencies, though primarily focused on UK and EU transfers. Zepz has extensive coverage, supporting over 50 countries with various payout methods. For details on global remittance reach, visit World Bank Remittance Coverage Report.

Starling Bank vs Zepz: Which One is Better?

Starling Bank is ideal for users seeking a full digital banking experience with reliable transfer options. Zepz is better suited for those prioritizing speed and international payouts. For many users, Panda Remit may offer the best value, balancing low fees, fast delivery, and secure transfers.

Conclusion

Comparing Starling Bank vs Zepz highlights strengths and weaknesses in fees, speed, coverage, and usability. Starling Bank is robust for daily banking and occasional international transfers, while Zepz shines for global remittances. Panda Remit provides an alternative with high exchange rates, low fees, flexible payment methods (POLi, PayID, bank card, e-transfer), coverage of 40+ currencies, and fast, all-online transfers. For a comprehensive guide to secure and cost-effective international money transfers, consider Panda Remit or consult Investopedia and NerdWallet resources.