Starling Bank vs iPayLinks: Which is Better for International Money Transfers?

Benjamin Clark - 2025-11-20 11:41:49.0 10

Introduction

Cross-border money transfers remain essential for freelancers, global businesses, and individuals sending funds abroad. Yet common challenges persist: high fees, slow delivery times, hidden costs, and unclear exchange rate margins. In this context, users increasingly compare Starling Bank vs iPayLinks to determine which service better meets their transfer needs in 2025.

Panda Remit also appears as a reputable alternative for fast and low-cost international transfers, especially for users seeking fully digital solutions. For background on how international transfers work, you can refer to guides from trusted finance sources such as Investopedia.

Starling Bank vs iPayLinks – Overview

Starling Bank is a UK-based digital bank founded in 2014, offering personal and business accounts, international transfers, and a highly rated mobile app. Its user base includes individuals and small businesses looking for transparent fees and modern banking features.

iPayLinks, founded in 2015, is a global payment service provider focused on cross-border merchant settlements, virtual accounts, and payment processing solutions for international e-commerce and digital businesses.

Similarities: both provide global payment capabilities, digital onboarding, and APIs or app-based management tools.

Differences: Starling targets individual users and SMEs through banking services, while iPayLinks focuses on cross-border business payments and settlements.

Panda Remit also serves as another digital option for users prioritizing fast online remittances.

Starling Bank vs iPayLinks: Fees and Costs

Starling Bank generally charges low, transparent fees for international transfers, although costs can vary by country and receiving method. iPayLinks operates on a B2B model where fees depend on volume, integration requirements, and merchant needs.

Businesses using iPayLinks may encounter settlement fees, withdrawal fees, or FX conversion charges depending on their specific payment flows.

For broader context, external fee comparison references such as NerdWallet can offer general guidance. Panda Remit is known for offering competitive fees for personal transfers and can be an economical alternative for some users.

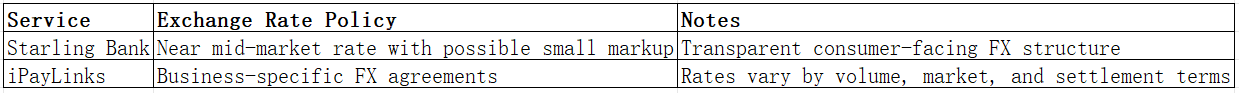

Starling Bank vs iPayLinks: Exchange Rates

Exchange rate transparency is crucial when evaluating money transfer services. Starling Bank typically uses competitive rates close to the mid-market rate, though a small markup may apply depending on the corridor.

iPayLinks applies FX conversion rates based on business agreements, transaction size, and settlement currency. Their rates may vary significantly based on B2B arrangements rather than offering a standard consumer-visible markup.

Below is the required comparison table:

Panda Remit can sometimes provide competitive exchange rates depending on corridor, without referencing unavailable specifics.

Starling Bank vs iPayLinks: Speed and Convenience

Starling Bank offers same-day domestic transfers and international transfers that typically arrive within 1–2 business days depending on corridor and partner banks.

iPayLinks emphasizes fast merchant settlements, batch processing, and multi-currency payouts, which can be beneficial for international e-commerce sellers.

For a deeper understanding of transfer speed factors, refer to external guides such as this overview on international remittance delivery times from Wise.

Panda Remit serves as a fast alternative for personal remittances with fully online processes.

Starling Bank vs iPayLinks: Safety and Security

Starling Bank is regulated by the UK’s Financial Conduct Authority (FCA) and uses strong encryption and fraud monitoring tools to secure customer funds.

iPayLinks complies with regional financial regulations depending on where it operates, offering risk management tools for merchants handling global transactions.

Panda Remit is also licensed and compliant in the regions it serves, offering secure digital remittance infrastructure.

Starling Bank vs iPayLinks: Global Coverage

Starling Bank supports transfers to many major countries and currencies, particularly across Europe, Asia, and the Americas.

iPayLinks provides multi-currency settlement services in various global regions, supporting merchants selling internationally.

For broader context on global remittance reach, users can consult resources such as the World Bank remittance coverage report.

Starling Bank vs iPayLinks: Which One Is Better?

Choosing between Starling Bank vs iPayLinks depends heavily on your needs. Starling Bank is ideal for individuals or SMEs wanting transparent banking tools and straightforward international transfers. iPayLinks, on the other hand, is designed for global merchants needing structured settlement systems, payment processing, and multi-currency business infrastructure.

For some users—especially individuals needing fast, low-fee remittances—Panda Remit may provide better convenience and pricing.

Conclusion

Starling Bank vs iPayLinks is ultimately a comparison between personal digital banking and enterprise-grade global payment processing. Starling Bank stands out for its seamless mobile experience, transparent fees, and suitable features for daily users and small businesses. iPayLinks excels in international merchant settlements, payment gateways, and scalable B2B payment structures.

Panda Remit offers an additional alternative with benefits such as competitive exchange rates, low fees, flexible payment methods like PayID, POLi, bank card, and e-transfer, along with coverage across 40+ currencies and quick online processing. Users seeking a simple and fully digital transfer solution may find Panda Remit a strong fit.

For more insights, explore trusted resources such as NerdWallet or Investopedia. To learn more about Panda Remit, visit the official site: https://www.pandaremit.com.