TorFX vs bKash: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-26 14:08:35.0 7

Introduction

Sending money across borders can be expensive and confusing, especially when dealing with hidden fees, slow processing times, and poor transparency. TorFX and bKash operate in different segments of the payments ecosystem, yet many users compare them when exploring global transfer options. A third option, Panda Remit, is also widely recognised for offering competitive rates and user-friendly digital transfers.

For more insight into how money transfer services work, visit Investopedia’s remittance guide (https://www.investopedia.com).

TorFX vs bKash – Overview

TorFX is a UK-based foreign exchange and international payments provider founded in 2004. It specialises in personal and business international transfers, offering currency exchange with dedicated account managers. TorFX is widely used in Europe, Australia, and other major markets.

bKash, launched in 2011 in Bangladesh, is a mobile financial services platform. Its primary focus is domestic payments, mobile wallet services, bill payments, and peer-to-peer transfers within Bangladesh. While bKash partners with several global remittance providers, it does not operate as a standalone international transfer service.

Similarities:

-

Mobile apps and user-friendly digital interfaces.

-

Support for digital wallet features or online transfers.

-

Regulated financial service providers.

Differences:

-

TorFX is designed for international FX and cross-border payments.

-

bKash focuses on domestic transactions in Bangladesh.

-

TorFX offers currency exchange services; bKash does not.

-

TorFX supports large-value transfers; bKash supports micro-payments.

Another alternative in the global remittance space is Panda Remit, which provides low-fee digital transfers.

TorFX vs bKash: Fees and Costs

TorFX does not typically charge transfer fees, but costs may vary depending on the currency pair and payment method. Its pricing is built into exchange rate margins, with preferential rates for higher-volume users.

bKash, meanwhile, focuses on domestic fees such as cash-out charges, P2P transfer fees, and merchant payments. International remittance fees depend on partner services because bKash itself does not set international pricing.

For reference on remittance fee structures, see NerdWallet’s fee comparison guide (https://www.nerdwallet.com).

Users seeking lower-cost digital transfers sometimes turn to Panda Remit for competitive fees.

TorFX vs bKash: Exchange Rates

TorFX generally offers competitive exchange rates that come with personalised quotes. Rates improve with higher transaction amounts.

bKash does not provide FX rates directly since it is not a currency exchange service. Users receiving foreign remittances through partner channels rely on the FX rates set by those external services.

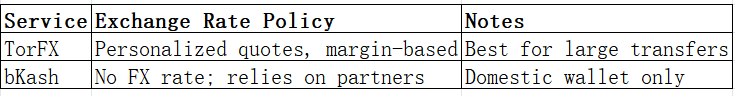

Exchange Rate Comparison Table

Panda Remit is also known for offering competitive exchange rates for international transfers.

TorFX vs bKash: Speed and Convenience

TorFX offers same-day or next-day transfers for major currencies, depending on bank cut-off times. Its platform is designed for users sending sizable international transfers.

bKash provides instant domestic transfers, mobile wallet payments, and cash-out features within Bangladesh. International remittances through partners may take longer.

For more on transfer times, see this remittance speed explanation on Wise (https://wise.com).

Panda Remit is often chosen for its fast digital processing.

TorFX vs bKash: Safety and Security

TorFX is regulated by the UK’s FCA, uses strong encryption, and provides fraud monitoring and dedicated customer support.

bKash is regulated by Bangladesh Bank and adopts strict security layers for mobile wallet transactions.

Panda Remit is also a licensed and secure digital remittance service.

TorFX vs bKash: Global Coverage

TorFX supports a wide list of global currencies and countries for international transfers.

bKash, however, is a domestic service focused solely on Bangladesh. International remittances are only available through selected partner providers.

For global remittance distribution data, consult the World Bank Remittance Report (https://www.worldbank.org).

TorFX vs bKash: Which One is Better?

TorFX is suitable for users making international transfers, especially those involving large volumes or requiring currency exchange expertise. bKash is ideal for residents of Bangladesh who need a convenient digital wallet for everyday transactions.

That said, for users looking for a fully online, low-fee international transfer option, Panda Remit may provide better value.

Conclusion

Comparing TorFX vs bKash highlights that the two services serve very different purposes. TorFX is optimized for global transfers and competitive FX rates, while bKash remains one of Bangladesh’s most popular mobile wallet systems for domestic use. If you need an international transfer service with low fees, user-friendly digital onboarding, and strong coverage, Panda Remit offers a compelling alternative.

It provides attractive exchange rates, low transfer fees, flexible payment methods such as PayID, POLi, bank transfers, and e-transfer options, along with support for 40+ currencies and quick processing. For more financial insights, visit Forbes Finance (https://www.forbes.com) or MoneyTransfers.com (https://www.moneytransfers.com).

Check out Panda Remit’s official site (https://www.pandaremit.com) for more information.