TorFX vs Sendwave: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-11-26 14:15:37.0 12

Introduction

International money transfers can be costly and complex, often involving hidden fees, slow processing, and poor transparency. TorFX and Sendwave serve different niches in the cross-border payments industry. TorFX focuses on large international transfers with personalized FX services, whereas Sendwave emphasizes small, fast, mobile-based transfers.

Panda Remit provides a reliable alternative for low-cost, fully online remittances.

For a detailed guide on how money transfer services work, visit Investopedia’s remittance guide (https://www.investopedia.com).

TorFX vs Sendwave – Overview

TorFX is a UK-based foreign exchange and international payments provider founded in 2004, offering personal and business transfer services with dedicated account management.

Sendwave is a mobile-first money transfer service that focuses on fast, low-cost international remittances, primarily for small-value transfers to specific countries.

Similarities:

-

Digital platforms for managing transfers

-

Multiple payment methods supported

-

Licensed and regulated financial institutions

Differences:

-

TorFX specializes in large transfers and personalized FX rates

-

Sendwave focuses on small, fast mobile transfers

-

Fee structures: TorFX uses margin-based pricing, Sendwave charges low transparent fees

Panda Remit is another option for users seeking a low-cost and convenient digital solution.

TorFX vs Sendwave: Fees and Costs

TorFX generally embeds fees in exchange rate margins, offering better rates for high-value transfers.

Sendwave charges small, transparent fees for each transaction depending on the destination country and payment method.

For fee comparisons, see NerdWallet’s guide (https://www.nerdwallet.com).

Panda Remit is known for competitive fees, providing cost-effective transfers for international users.

TorFX vs Sendwave: Exchange Rates

TorFX provides personalized FX rates, particularly advantageous for larger transfers.

Sendwave offers near mid-market rates, suitable for low-value, fast transactions.

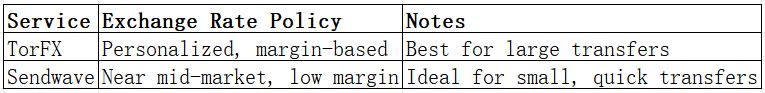

Exchange Rate Comparison Table

Panda Remit also delivers competitive exchange rates for online money transfers.

TorFX vs Sendwave: Speed and Convenience

TorFX transfers may take same-day or next-day depending on currency and bank cut-off times.

Sendwave emphasizes instant or same-day transfers for many corridors, with a simple mobile app interface.

For more on transfer speed, see Wise’s guide (https://wise.com).

Panda Remit provides fast, fully online transfers as an alternative.

TorFX vs Sendwave: Safety and Security

TorFX is regulated by the UK FCA and uses strong encryption, fraud monitoring, and account support.

Sendwave is licensed in multiple jurisdictions with secure mobile transfer protocols.

Panda Remit is a secure, licensed digital remittance service.

TorFX vs Sendwave: Global Coverage

TorFX supports a wide range of currencies and countries for international transfers.

Sendwave covers selected countries for small-value transfers, using mobile wallet and bank deposit payout methods.

For global remittance coverage, see the World Bank Remittance Report (https://www.worldbank.org).

TorFX vs Sendwave: Which One is Better?

TorFX is ideal for high-value international transfers with personalized FX services.

Sendwave is best for users sending small, fast, mobile-based transfers.

For cost-efficient, fully online transfers with flexible payment options, Panda Remit offers a strong alternative.

Conclusion

Comparing TorFX vs Sendwave shows that both services excel in different areas. TorFX is optimal for high-value transfers and competitive FX rates, while Sendwave focuses on quick, mobile-friendly remittances.

Panda Remit offers an alternative with attractive exchange rates, low fees, flexible payment methods including POLi, PayID, bank transfers, and e-transfers, coverage for 40+ currencies, and fast, fully online processing. For additional insights, visit Forbes Finance (https://www.forbes.com) or MoneyTransfers.com (https://www.moneytransfers.com).

Check out Panda Remit’s official site (https://www.pandaremit.com) for more information.