TransferWise in 2025: Everything New Users Should Know

Benjamin Clark - 2025-09-15 18:07:01.0 19

If you’re searching for TransferWise, you might have noticed that it’s now called Wise. Don’t worry — it’s the same company trusted by millions of users worldwide.

In this article, we’ll explain:

-

The history behind the TransferWise rebrand

-

Wise’s current features and security measures

-

How to create and log in to a Wise account

-

Fees and exchange rates

-

Alternative platforms, including Panda Remit, and their advantages

By the end, you’ll have a clear understanding of Wise and options for global money transfers.

What is TransferWise (Now Known as Wise)?

TransferWise was founded in 2011 with the mission to make international money transfers cheaper and more transparent. Traditional banks often charge high hidden fees and use unfavorable exchange rates.

In 2021, TransferWise rebranded as Wise to reflect its growing services beyond simple transfers. Today, Wise offers:

-

Sending and receiving money internationally

-

Multi-currency accounts

-

Debit card options

-

Business payment solutions

The rebrand emphasizes Wise’s vision: “money without borders”.

Why Did TransferWise Change Its Name to Wise?

The original name, TransferWise, suggested a service purely for transferring money. As Wise’s platform evolved to include multi-currency accounts, spending, and holding money globally, the name needed to reflect its broader mission.

Key reasons for the rebrand:

-

Broader Services: Users can now hold balances in 50+ currencies and get local account details in 30+ countries.

-

Clear Brand Vision: “Wise” reflects transparency, simplicity, and global accessibility.

-

Modern Identity: Updated logo, app interface, and marketing reflect the company’s vision of borderless money.

Is TransferWise Safe and Reliable in 2025?

Security is a top priority for Wise, making it one of the most trusted global money transfer platforms.

Safety highlights:

-

Regulated globally: FCA UK, FinCEN US, MAS Singapore, ASIC Australia

-

Publicly listed: Wise went public on the London Stock Exchange in 2021

-

Millions of users: 16+ million people worldwide trust Wise

-

Transparent fees: No hidden charges; uses mid-market exchange rate

For detailed guidance on account security, visit Wise Help Center.

How to Create and Log in to Your TransferWise/Wise Account

Getting started is simple:

Step 1: Register an Account

-

Visit Wise Registration

-

Enter your email and set a password

Step 2: Verify Your Identity

-

Wise may ask for ID verification depending on your location or transfer amount

-

Follow the step-by-step guide in this article

Step 3: Log In

-

Use your email and password at Wise login page

-

Supports two-factor authentication for extra security

Key Features of Wise (Formerly TransferWise)

Wise is not just about sending money — it’s a full-featured platform for global finances.

| Feature | Wise | Notes |

|---|---|---|

| International Transfers | Send money in 40+ currencies | Low fees, mid-market rates |

| Multi-Currency Account | Hold balances in 50+ currencies | Receive in USD, EUR, GBP, AUD, INR, etc. |

| Wise Card | Debit card usable worldwide | Works with multi-currency account |

| Business Account | Accept international payments easily | Ideal for freelancers, SMEs |

| Mobile & Web Access | Fully functional web & mobile apps | Manage your money anytime |

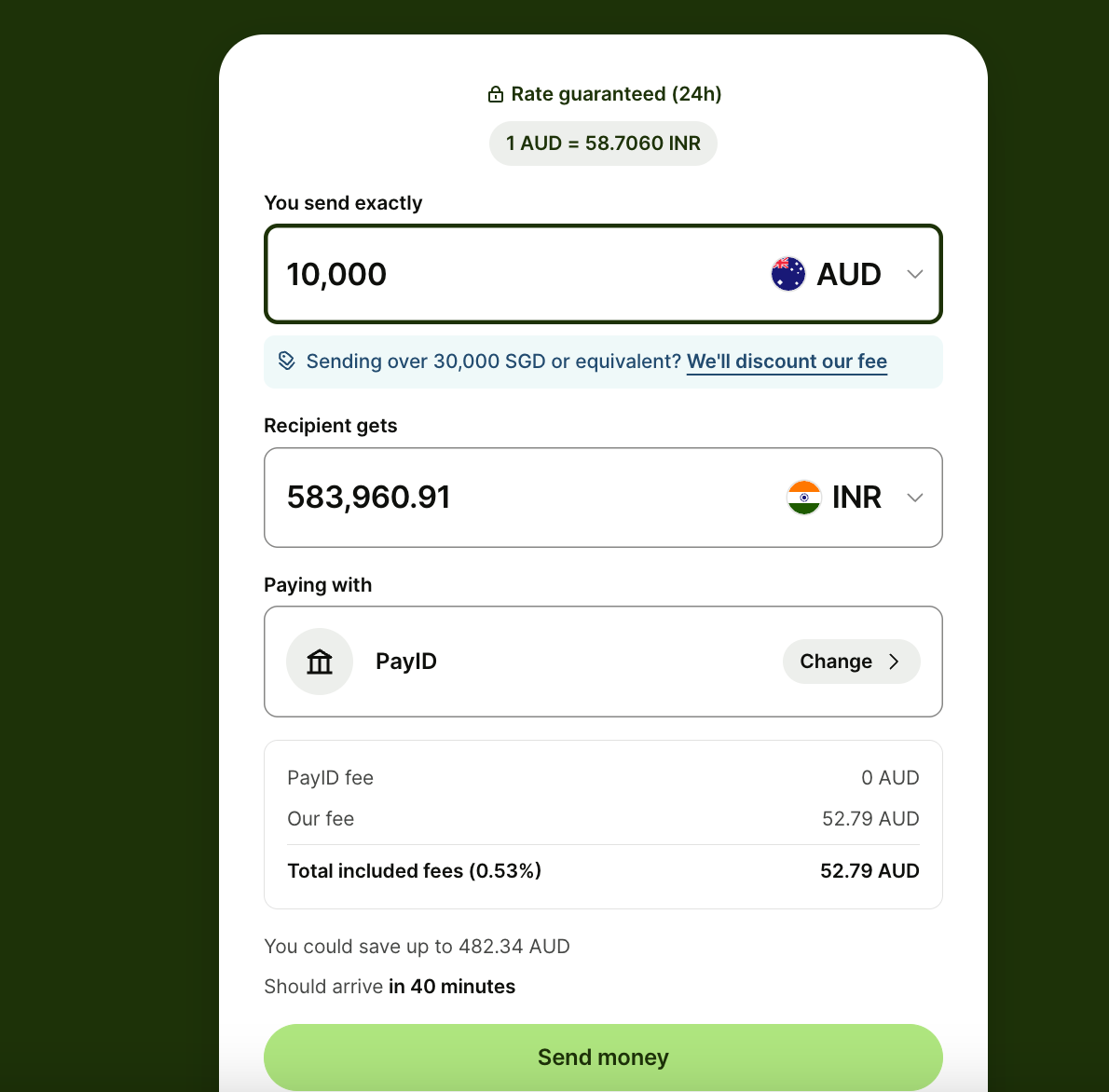

TransferWise Fees and Exchange Rates

Wise is known for transparent pricing.

-

Example: Sending £1000 GBP → INR

-

Wise: ~£4–5 fee, uses real mid-market exchange rate

-

Traditional bank: £20+ hidden fees, worse exchange rate

-

Check Wise current fees for your corridor.

Alternatives to TransferWise (Wise)

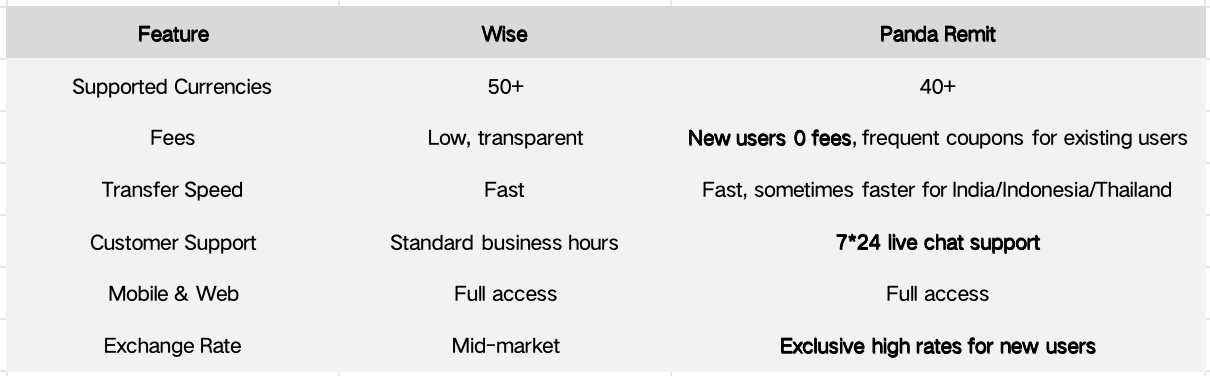

While Wise is trusted worldwide, Panda Remit offers some unique advantages, especially for new users:

Panda Remit is particularly attractive for Asia-focused transfers, providing extra value to both new and returning users.

Final Thoughts

In 2025, TransferWise is now Wise — a safe, reliable, and modern platform for global money transfers.

For new users:

-

Learn the history of TransferWise → Wise

-

Explore Wise’s features and check fees for your transfer corridor

-

Compare with alternatives like Panda Remit to maximize savings, enjoy 0-fee promotions, and benefit from exclusive high rates

-

By understanding your options, you can confidently choose the platform that fits your needs — whether it’s Wise or Panda Remit.