TransferWise: How to Send Money from the UK to India Safely and Quickly

Benjamin Clark - 2025-09-12 18:29:25.0 247

Introduction

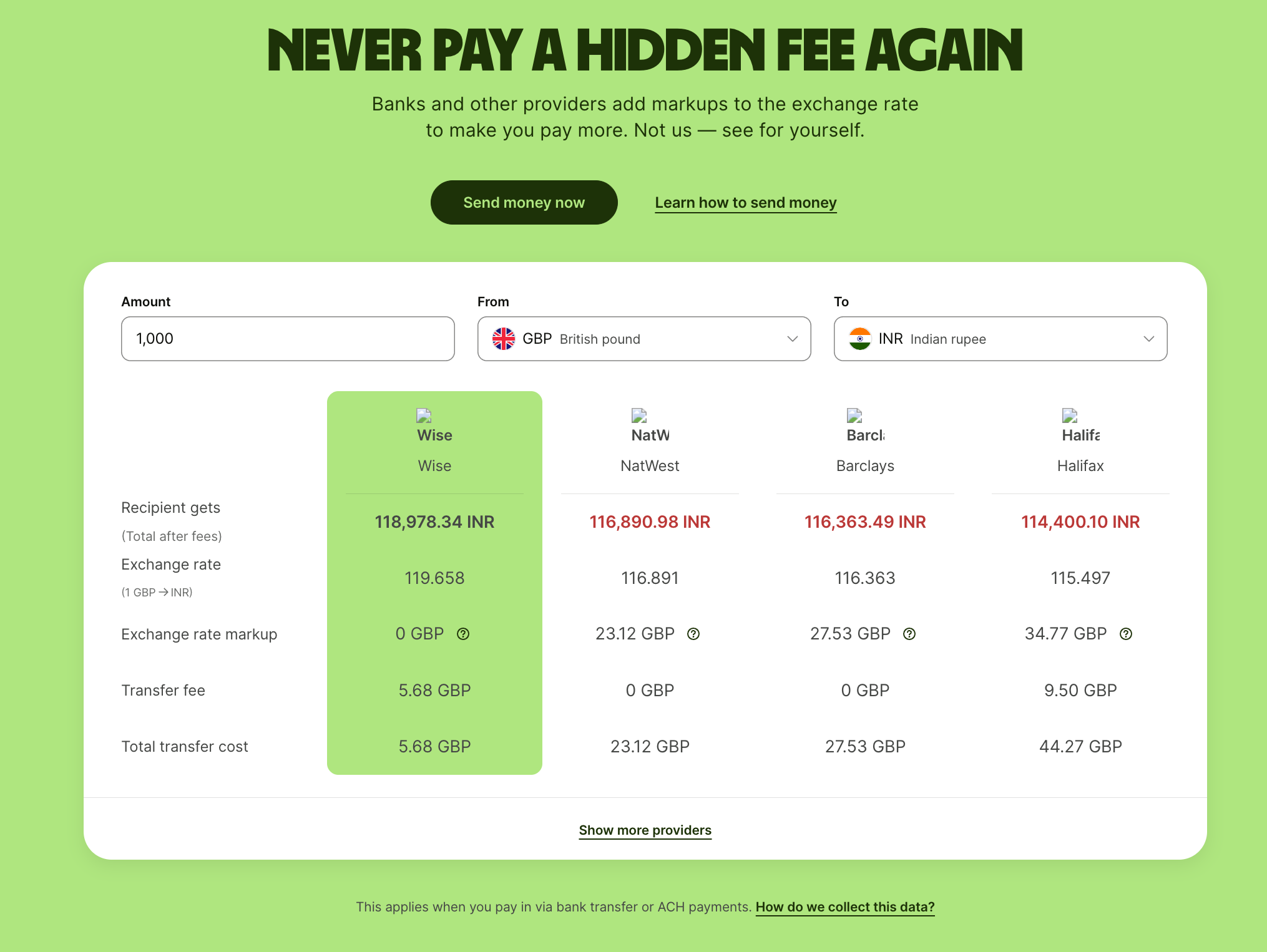

Looking to send money from the UK to India? TransferWise (now Wise) is one of the most popular platforms for international money transfers. Millions of users trust it for transparent fees, fast delivery, and reliable service.

In this guide, we’ll cover how TransferWise works, step-by-step instructions for UK-to-India transfers, its fees, and pros and cons. Later, we’ll share a real-life example and helpful tips—including how Panda Remit can complement your transfer experience.

Learn more about TransferWise accounts.

What is TransferWise?

TransferWise, founded in 2011, rebranded as Wise in 2021. It provides:

-

Mid-market exchange rates with no hidden fees

-

Multi-currency accounts to hold money in 50+ currencies

-

International bank transfers with transparent delivery times

It’s widely used for sending money for family support, tuition, or business needs.

How to Send Money from the UK to India Using TransferWise

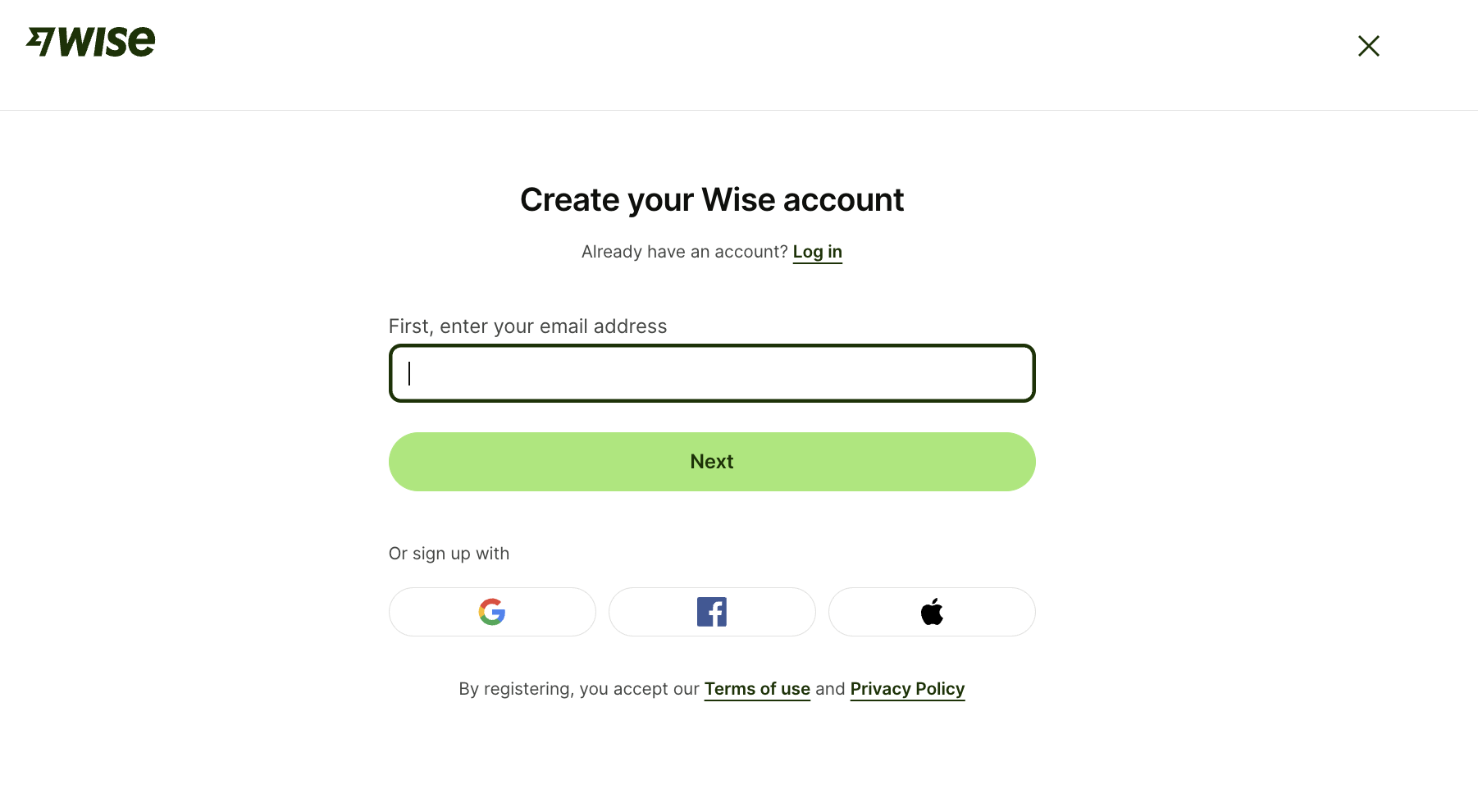

Step 1: Sign Up and Log In

-

Visit the Wise registration page to create an account.

-

Log in via web or mobile (Wise login guide).

Step 2: Add Recipient Details

-

Enter the recipient’s bank information in India.

-

Confirm the currency (GBP → INR).

Step 3: Choose Payment Method

-

Options include bank transfer, debit/credit card, or other local payment methods.

Step 4: Confirm and Track

-

Review the fees and delivery time.

-

TransferWise will notify you when the money is on its way.

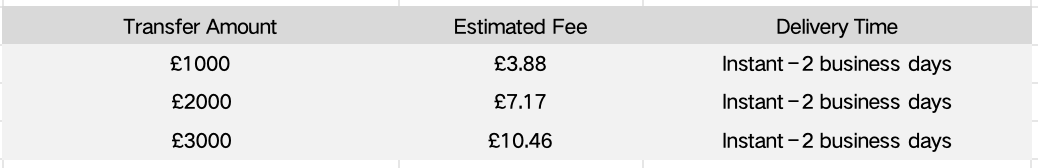

TransferWise Fees and Transfer Times

Pay for what you use. Fees are transparent and displayed before sending. Delivery time depends on payment method and recipient bank.

Pros and Cons of TransferWise

Pros:

-

Transparent, mid-market exchange rates

-

Multi-currency accounts for easier global transfers

-

User-friendly web and mobile interface

-

Generally faster than traditional banks

Cons:

-

Transfers may take 1–2 business days

-

Limited promotional offers

-

Customer support may vary by region

Sending Money from the UK to India

Emma, a UK-based student, needs to send £2000 monthly to her family in India. She tried TransferWise and appreciated the low fees and clear tracking.

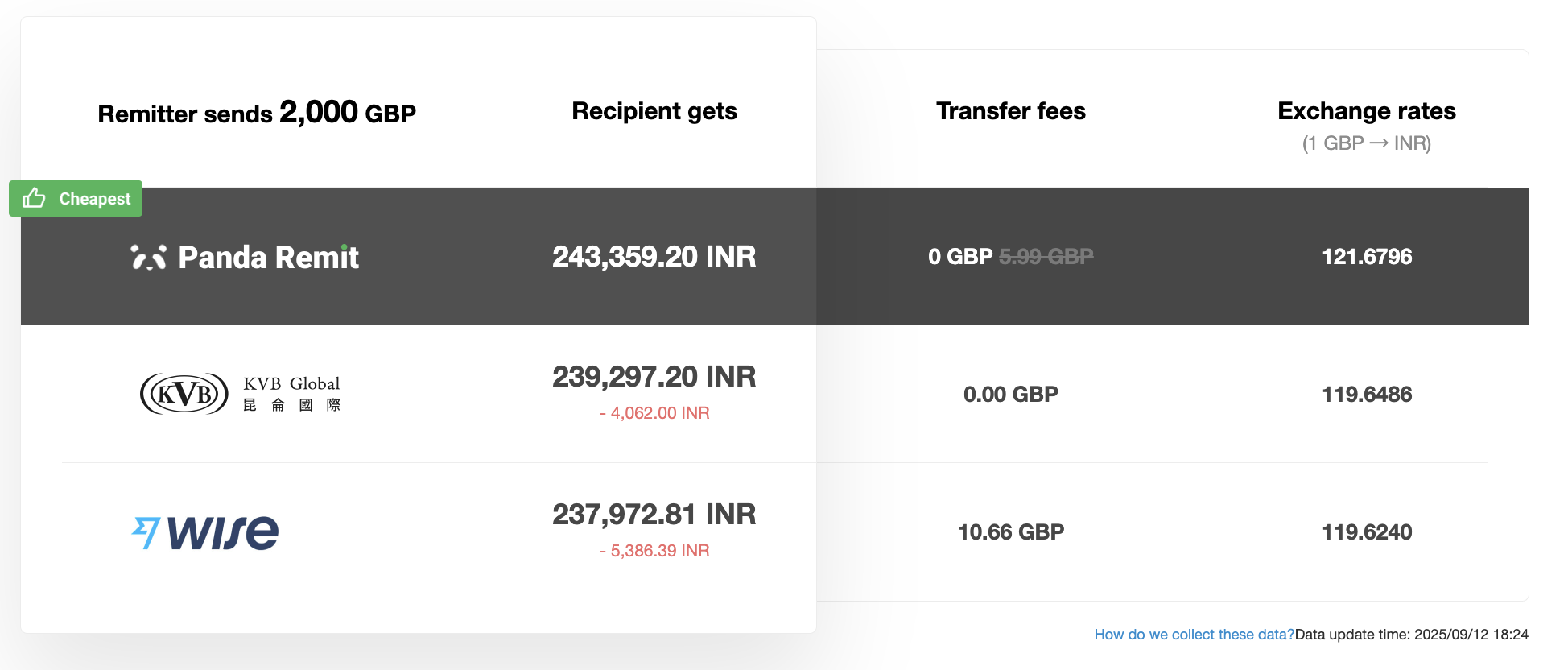

However, she discovered that Panda Remit offered a small welcome bonus and slightly higher exchange rates for her transfers. By using both services, she could save money while ensuring fast delivery.

FAQ: Common Questions About TransferWise

Q1: Is TransferWise safe?

-

Yes, TransferWise is regulated by financial authorities in the UK and other regions.

Q2: How long does a transfer take from the UK to India?

-

Usually 1–2 business days, depending on the payment method.

Q3: Are there alternatives to TransferWise for faster or cheaper transfers?

-

Some users consider Panda Remit for certain corridors. It offers competitive rates, occasional bonuses, and 24/7 online support.

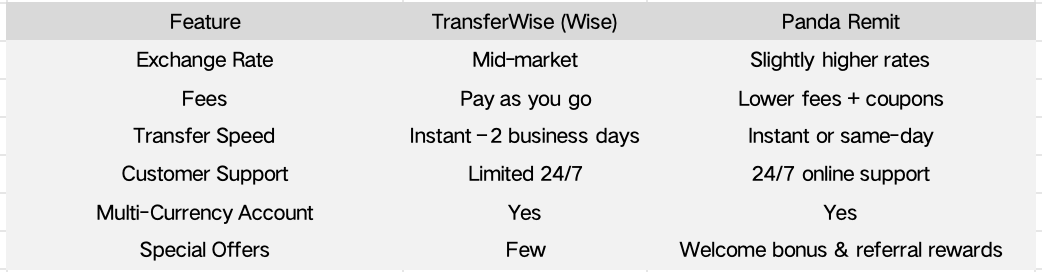

TransferWise vs Panda Remit: Quick Comparison

This comparison helps UK users decide which service best fits their needs.

Conclusion

TransferWise remains a reliable choice for sending money from the UK to India, thanks to transparent fees and easy-to-use tools.

For users looking to maximize savings and enjoy 24/7 support, Panda Remit can be a helpful complement—especially for recurring transfers.