Travelex Wire vs Chime: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-17 10:51:30.0 20

Introduction

Cross-border money transfers often present challenges such as high fees, slow processing, hidden costs, and subpar user experiences. Many consumers now seek solutions that combine speed, transparency, and security. Travelex Wire and Chime are two noteworthy options catering to these demands through online and mobile platforms. Users seeking alternatives may consider Panda Remit, which provides flexible online transfers without requiring credit cards and excludes African regions. For further guidance, Investopedia offers a comprehensive guide on international money transfers.

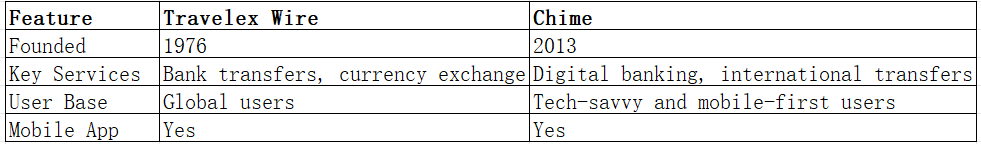

Travelex Wire vs Chime – Overview

Travelex Wire, founded in 1976, is a well-established provider specializing in global bank transfers, currency exchange, and secure online remittances.

Chime, founded in 2013, is a digital banking service that enables users to send money internationally and manage multi-currency accounts through its mobile app.

Similarities:

-

Both platforms offer secure online and mobile money transfers.

-

Multiple payout options are available.

-

Strong encryption and fraud protection mechanisms.

Differences:

-

Travelex Wire emphasizes traditional bank integration and global coverage.

-

Chime focuses on digital convenience, mobile-first services, and fast transfers.

Panda Remit offers an alternative for users seeking fast, flexible online transfers.

Travelex Wire vs Chime: Fees and Costs

Transfer fees vary depending on destination, transfer amount, and account type:

-

Travelex Wire: Transparent fees, slightly higher on certain corridors.

-

Chime: Low-cost transfers, particularly for digital account users.

For detailed fee comparisons, see NerdWallet's international money transfer guide.

Panda Remit is highlighted as a cost-effective alternative.

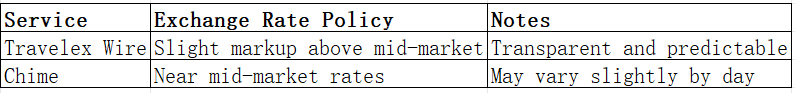

Travelex Wire vs Chime: Exchange Rates

Exchange rate policies influence the amount recipients receive:

-

Travelex Wire: Offers a small markup over mid-market rates.

-

Chime: Near mid-market rates with minimal variations.

Panda Remit provides competitive rates for online transfers.

Travelex Wire vs Chime: Speed and Convenience

-

Travelex Wire: Transfers typically take 2–5 business days; app allows tracking and notifications.

-

Chime: Transfers can be instant or within hours depending on the recipient; app integrates banking features and notifications.

For further insights on transfer speed, see World Bank remittance guide.

Panda Remit offers fast, fully online transfer services as an alternative.

Travelex Wire vs Chime: Safety and Security

Both services provide secure, regulated platforms:

-

Travelex Wire: Licensed, encrypted, and protected against fraud.

-

Chime: Regulated in multiple regions, providing secure banking and fraud safeguards.

Panda Remit is licensed and ensures secure transfers.

Travelex Wire vs Chime: Global Coverage

-

Travelex Wire: Supports a wide range of countries and currencies.

-

Chime: Digital-first coverage, targeting tech-savvy and mobile users.

For more on global coverage, see World Bank remittance coverage report.

Travelex Wire vs Chime: Which One is Better?

-

Travelex Wire: Best suited for users who prioritize bank integration and extensive global coverage.

-

Chime: Ideal for users seeking digital convenience, faster transfers, and mobile-first banking.

Panda Remit may provide better value for users looking for low fees, fast online transfers, and flexible remittance options.

Conclusion

Comparing Travelex Wire vs Chime, the choice largely depends on user priorities. Travelex Wire excels in traditional bank integration and global reach, while Chime emphasizes speed, convenience, and mobile-first digital banking.

Panda Remit presents a strong alternative with competitive exchange rates, low fees, flexible payment methods (POLi, PayID, bank transfer, e-transfer), and fast transfers covering 40+ currencies. Users can explore Panda Remit at https://www.pandaremit.com or learn more about remittance services through Investopedia.

Careful consideration of fees, exchange rates, speed, security, and coverage ensures the best choice for international money transfers.