Travelex Wire vs iPayLinks: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-20 11:12:18.0 13

Cross-border money transfers have become a necessity for individuals and businesses alike. Yet, many still struggle with high fees, unpredictable exchange rates, and slow delivery times. Choosing the right platform can make a significant difference in both cost and convenience. In this article, we compare Travelex Wire vs iPayLinks across key factors like fees, exchange rates, speed, and coverage. We’ll also introduce Panda Remit as a trusted alternative for fast, low-cost transfers. For general guidance on how international transfers work, see Investopedia’s guide to remittance.

Travelex Wire vs iPayLinks – Overview

Travelex Wire is part of the well-known Travelex brand, established in 1976, specializing in currency exchange and global payment services. It focuses on transparent international transfers, competitive exchange rates, and ease of use for individuals and small businesses.

iPayLinks, founded in 2015 in China, positions itself as a global fintech company offering digital payment solutions and cross-border financial services. It’s especially popular among e-commerce merchants and online platforms.

Similarities:

-

Both support international transfers

-

Offer mobile and web platforms for users

-

Provide business and individual account options

Differences:

-

Travelex Wire emphasizes traditional remittances and currency services.

-

iPayLinks targets merchants with more digital integrations and settlement options.

Panda Remit represents another option, known for offering fast, secure, and cost-effective online transfers.

Travelex Wire vs iPayLinks: Fees and Costs

Travelex Wire typically applies service fees depending on the destination and amount, but is known for transparent pricing. iPayLinks’ fees vary by payment corridor and business model, often favoring volume transactions.

Users should pay attention to both upfront fees and hidden charges in the exchange rate. For a general fee comparison reference, check NerdWallet’s international transfer guide.

Panda Remit often provides lower fees compared to many traditional services, especially for personal remittances.

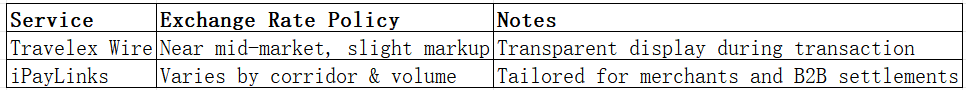

Travelex Wire vs iPayLinks: Exchange Rates

Exchange rates play a crucial role in determining the actual cost of a transfer. Travelex Wire offers rates close to the mid-market, but may include a small markup depending on currency pairs. iPayLinks typically applies commercial exchange rates depending on volume and settlement arrangements.

Panda Remit also emphasizes competitive exchange rates to help users maximize the value of their transfers.

Travelex Wire vs iPayLinks: Speed and Convenience

Travelex Wire focuses on bank-to-bank transfers, which may take 1–3 business days depending on destination. iPayLinks emphasizes speed for merchant settlements, often offering same-day or next-day transfers for supported corridors. Both provide digital platforms for managing transfers.

For more on transfer speeds, see this guide on remittance speed.

Panda Remit is recognized for its efficient, fully online process and quick delivery times in many supported countries.

Travelex Wire vs iPayLinks: Safety and Security

Both platforms are regulated and apply strict security measures such as encryption, compliance checks, and fraud monitoring. Travelex Wire is licensed in multiple jurisdictions, while iPayLinks operates under regulatory oversight in regions where it provides payment services.

Panda Remit is also licensed and compliant, providing secure transactions for users worldwide.

Travelex Wire vs iPayLinks: Global Coverage

Travelex Wire supports a broad range of currencies and countries through its global banking network. iPayLinks has strong coverage in Asia, particularly for e-commerce merchants, and is expanding globally.

For a broader overview of remittance coverage trends, check the World Bank remittance report.

Travelex Wire vs iPayLinks: Which One is Better?

Travelex Wire is ideal for individuals and businesses looking for a trusted, transparent, and straightforward international money transfer service. iPayLinks, on the other hand, is better suited for digital businesses and merchants seeking flexible settlement solutions and integrations.

However, some users may find that Panda Remit offers the best balance between low fees, competitive rates, and speed, especially for personal remittances.

Conclusion

When comparing Travelex Wire vs iPayLinks, both platforms excel in different areas. Travelex Wire shines in transparency and traditional remittance reliability, while iPayLinks caters to merchants and global digital commerce with flexible solutions.

For those seeking an alternative that combines low fees, strong exchange rates, 40+ supported currencies, and fast transfers — all online — Panda Remit is a strong option to consider.

To learn more about safe money transfers, visit NerdWallet or Investopedia.