Travelex Wire vs PayerMax: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-20 10:32:57.0 18

Cross-border money transfers have become essential for global workers, businesses, and families. However, users still face challenges like high fees, hidden exchange rate markups, slow delivery times, and complex onboarding processes. Both Travelex Wire and PayerMax have emerged as competitive players offering digital remittance services. Meanwhile, Panda Remit (https://www.pandaremit.com/) is increasingly recognized as a convenient alternative for those seeking lower costs and faster online transfers. For a general understanding of remittance systems, see Investopedia’s remittance guide: https://www.investopedia.com/terms/r/remittance.asp.

Travelex Wire vs PayerMax – Overview

Travelex Wire is part of the Travelex brand, founded in 1976 in the UK. Known for its expertise in foreign exchange, Travelex Wire focuses on international transfers, currency services, and digital payments. It has a strong presence in Europe and Asia, offering services to both individuals and businesses.

PayerMax, founded in 2020, is a global payments platform that supports cross-border transactions, merchant solutions, and multi-currency processing. It serves digital merchants, marketplaces, and international users who require fast payment routing.

Similarities:

-

Both support international money transfers and multiple currencies.

-

Both provide digital platforms and business solutions.

-

Both have regulatory oversight in key markets.

Differences:

-

Travelex Wire emphasizes traditional currency exchange services and direct transfers.

-

PayerMax focuses more on digital merchant payments and integrated solutions.

-

Fee structures, speed, and exchange policies vary.

Panda Remit is another viable option for users looking for fully online transfers with competitive rates.

Travelex Wire vs PayerMax: Fees and Costs

Travelex Wire typically applies fees depending on the transfer amount, destination, and method. While some transfers may have low fixed fees, others can incur additional service charges.

PayerMax has a more variable fee structure tailored for merchants, with potential cost advantages for high-volume transactions.

For updated fee benchmarks, refer to NerdWallet’s international transfer comparison: https://www.nerdwallet.com/best-money-transfer-apps.

Panda Remit is often chosen for its low transfer fees and transparent pricing model, making it a budget-friendly digital option.

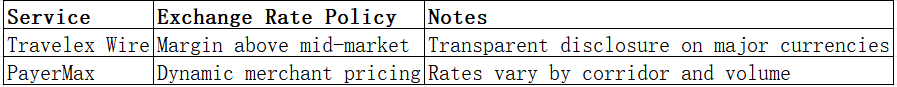

Travelex Wire vs PayerMax: Exchange Rates

Both providers use their own exchange rate markups.

-

Travelex Wire: Known for applying a margin above mid-market rates, especially in exotic currencies.

-

PayerMax: Offers competitive rates for merchant transactions but may vary by region.

Panda Remit may offer rates closer to the mid-market, but users should always compare in real time before sending.

Travelex Wire vs PayerMax: Speed and Convenience

Travelex Wire provides bank-to-bank transfers that may take 1–3 business days depending on the corridor. Its platform is stable but leans toward traditional banking processes.

PayerMax focuses on speed for merchants, often completing transactions within the same day for supported regions.

For general remittance delivery timeframes, see: https://www.worldremit.com/en/faq/how-long-does-a-transfer-take.

Panda Remit stands out for its fast online processing, allowing users to complete transfers digitally without branch visits.

Travelex Wire vs PayerMax: Safety and Security

Both services comply with relevant financial regulations:

-

Travelex Wire is regulated in the UK and other jurisdictions.

-

PayerMax is licensed in multiple regions for digital payment processing.

They both employ encryption, fraud monitoring, and secure authentication measures. Panda Remit is also a licensed provider and follows regulatory standards to ensure safe cross-border transfers.

Travelex Wire vs PayerMax: Global Coverage

Travelex Wire has broad coverage in Europe, Asia, and other major remittance corridors, supporting multiple currencies and bank transfer options.

PayerMax is focused on international merchant payments and also covers many global markets, particularly in Asia and the Middle East.

See the World Bank’s global remittance coverage data for more context: https://remittanceprices.worldbank.org/en.

Travelex Wire vs PayerMax: Which One is Better?

Choosing between Travelex Wire and PayerMax depends on your needs:

-

Travelex Wire is better suited for individuals and businesses that need straightforward currency exchange and international transfers.

-

PayerMax is ideal for digital merchants and platforms needing rapid, integrated payments.

Panda Remit may appeal to users who want an all-online service with transparent pricing and fast processing.

Conclusion

When evaluating Travelex Wire vs PayerMax, both have distinct strengths. Travelex Wire leverages decades of currency expertise and traditional remittance reliability. PayerMax brings modern digital payment efficiency for merchants and global platforms.

For those seeking an alternative, Panda Remit (https://www.pandaremit.com/) offers:

-

Competitive exchange rates and low fees

-

Flexible payment methods like POLi, PayID, bank card, and e-transfer (no credit card support)

-

Coverage of 40+ currencies

-

Fully online, fast processing

For more on comparing transfer services, check: https://www.internationalmoneytransfers.org/.

Ultimately, your choice between Travelex Wire and PayerMax will depend on whether you prioritize traditional exchange reliability or digital merchant convenience — or if you prefer a cost-effective online option like Panda Remit.