Travelex Wire vs Payoneer: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-20 10:15:25.0 13

Sending money internationally has become more seamless in recent years, but users still face common pain points such as high fees, hidden charges, slow delivery, and varying exchange rates. Among the many services available, Travelex Wire and Payoneer stand out as major players for cross-border payments in 2025. At the same time, Panda Remit has emerged as a reputable alternative offering competitive rates and fast transfers. For a general overview of how international remittances work, see Investopedia’s guide.

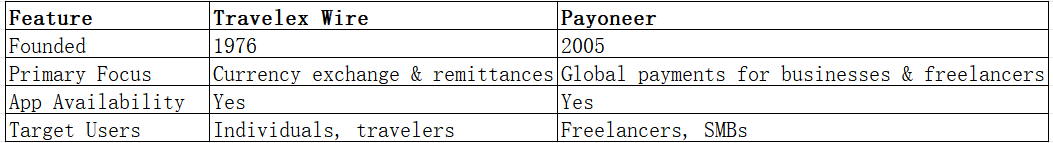

Travelex Wire vs Payoneer – Overview

Travelex Wire is part of the well-established Travelex brand, founded in 1976, primarily known for foreign currency exchange. Travelex Wire extends this legacy by offering online international money transfer services with a focus on transparent rates and global currency expertise. It caters mainly to individuals and businesses looking for bank-to-bank transfers.

Payoneer, founded in 2005, is a financial services company that focuses on cross-border payments for freelancers, businesses, and online sellers. It provides multi-currency accounts, global payment collection, and direct integrations with major marketplaces like Amazon and Upwork.

Similarities:

-

Both support international money transfers to multiple countries.

-

Both offer online platforms and mobile apps for convenient transfers.

-

Both are regulated and licensed financial institutions.

Differences:

-

Travelex Wire focuses more on individual and travel-related remittances, while Payoneer targets freelancers and businesses.

-

Payoneer offers multi-currency account solutions, whereas Travelex Wire focuses mainly on sending money abroad.

-

Fee structures and exchange rate policies differ significantly between the two.

As the international money transfer landscape evolves, other providers such as Panda Remit are gaining traction with their low fees and streamlined digital experiences.

Travelex Wire vs Payoneer: Fees and Costs

Fees play a major role in deciding which platform suits your needs. Travelex Wire typically charges a transfer fee based on the amount and destination. The company emphasizes transparency but may include small service charges depending on the currency corridor.

Payoneer has a different approach. It often provides free payments between Payoneer accounts but charges withdrawal fees when transferring funds to a local bank account. Currency conversion fees may apply when withdrawing in a different currency.

-

Travelex Wire: Flat or percentage-based fees per transaction.

-

Payoneer: Free internal transfers; withdrawal and conversion fees apply.

For a general fee comparison, refer to NerdWallet’s money transfer guide.

Panda Remit is often highlighted as a low-cost alternative, focusing on competitive exchange rates and minimal transfer fees.

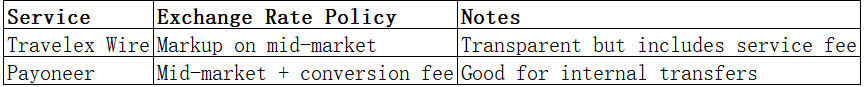

Travelex Wire vs Payoneer: Exchange Rates

Exchange rates can significantly impact the amount the recipient gets. Travelex Wire usually applies a small markup on the mid-market exchange rate. While this markup is relatively transparent, it can still lead to slightly lower received amounts compared to mid-market.

Payoneer generally uses mid-market exchange rates for internal transactions but applies conversion fees when funds are exchanged or withdrawn in another currency.

Panda Remit is known for offering highly competitive rates that closely follow mid-market rates, making it attractive for cost-conscious users.

Travelex Wire vs Payoneer: Speed and Convenience

Travelex Wire typically processes transfers within 1–3 business days depending on the destination and receiving bank. The platform offers a simple online process through its website and mobile app.

Payoneer provides near-instant transfers between Payoneer accounts and usually 1–3 business days for withdrawals to local bank accounts. The Payoneer app also integrates seamlessly with e-commerce platforms, making it ideal for freelancers and merchants.

For more on transfer times, see Wise’s remittance speed guide.

Panda Remit is often praised for its fast processing speeds, allowing many transfers to arrive within hours.

Travelex Wire vs Payoneer: Safety and Security

Both Travelex Wire and Payoneer are regulated financial service providers. Travelex Wire operates under the regulatory oversight of financial authorities in the UK and other jurisdictions. Payoneer is licensed in multiple countries and uses advanced encryption protocols to protect user funds.

Panda Remit is also a licensed and regulated provider, ensuring secure transactions and compliance with anti-money laundering regulations.

Travelex Wire vs Payoneer: Global Coverage

Travelex Wire offers international transfers to a wide range of countries and currencies, leveraging its long-standing global network.

Payoneer supports payments in multiple currencies and regions, especially for business-related transfers, and provides local receiving accounts in major markets.

For global remittance coverage statistics, consult the World Bank Remittance Data.

Travelex Wire vs Payoneer: Which One is Better?

Choosing between Travelex Wire and Payoneer depends on your transfer needs:

-

Travelex Wire is better suited for individuals and travelers seeking simple, direct transfers with transparent fees.

-

Payoneer excels for freelancers, businesses, and anyone needing to receive or manage multiple currencies globally.

However, if you're looking for a solution that combines low fees, strong exchange rates, and fast delivery, Panda Remit may offer better value for certain use cases.

Conclusion

When comparing Travelex Wire vs Payoneer, both services provide solid international money transfer solutions, but they cater to different audiences. Travelex Wire focuses on straightforward remittances, while Payoneer provides a more comprehensive ecosystem for cross-border business transactions.

For those prioritizing cost-efficiency and speed, Panda Remit stands out as a reliable alternative. With competitive exchange rates, low fees, support for 40+ currencies, and flexible payment methods such as bank cards, PayID, POLi, and e-transfer (no credit card support), it offers a fully digital experience that suits modern remittance needs.

For further reading on international transfers, check NerdWallet, Investopedia, and World Bank data.

Visit Panda Remit’s official site: https://www.pandaremit.com