Travelex Wire vs Venmo: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 8

Introduction

Sending money has never been easier, yet users still face challenges such as high transaction fees, slow delivery times, and hidden exchange markups. In 2025, digital payment platforms like Travelex Wire and Venmo continue to reshape how people move money — both locally and globally.

While Travelex Wire caters to international users, Venmo remains a favorite for peer-to-peer payments in the U.S. For users looking for a faster and more global alternative, Panda Remit offers competitive rates and seamless transfers worldwide.

For more insight into digital remittance trends, visit Investopedia’s money transfer guide.

Travelex Wire vs Venmo – Overview

Travelex Wire, launched by the global foreign exchange company Travelex, provides international money transfers with transparent fees and near mid-market exchange rates. Its services target users who need reliable, cross-border remittances and competitive foreign exchange support.

Venmo, founded in 2009 and owned by PayPal, is a U.S.-based mobile payment service allowing users to send and receive funds domestically via a smartphone app. It’s best known for its social payment features and instant bank transfers.

Both platforms offer convenience and ease of use, but they cater to different markets — Travelex Wire for international users, and Venmo for domestic U.S. payments. For those who need to send money globally with low fees and a user-friendly interface, Panda Remit is a strong market alternative worth considering.

Travelex Wire vs Venmo: Fees and Costs

Travelex Wire uses a transparent pricing structure, charging small transfer fees depending on the country, amount, and payment method. While these fees are competitive for international remittance, they vary by corridor.

Venmo, on the other hand, offers free transfers between Venmo users using a linked bank account or debit card within the U.S. However, there’s a 3% fee when using a credit card, and international transfers are not supported.

For reference, NerdWallet’s comparison of money transfer apps shows that specialized remittance services often provide more favorable rates than general payment apps. In this regard, Panda Remit offers lower-cost international transfers compared to traditional providers.

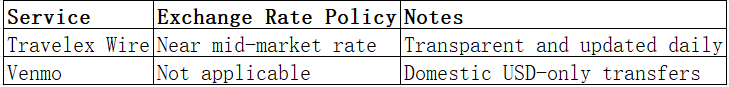

Travelex Wire vs Venmo: Exchange Rates

Exchange rate transparency is one of the most critical factors in cross-border transactions.

Travelex Wire provides competitive exchange rates close to the mid-market level, giving users better value when sending money overseas. Venmo, however, doesn’t offer currency exchange since all its transfers are denominated in U.S. dollars.

If you want to avoid hidden markups, Panda Remit is known for transparent exchange rates and fair conversion policies.

Travelex Wire vs Venmo: Speed and Convenience

Travelex Wire typically completes transfers within 1–2 business days, depending on destination and recipient bank. Its digital platform supports various payment methods and currencies.

Venmo, by contrast, enables instant or same-day transfers within the U.S., especially when using linked debit cards. It’s designed for everyday, small-value payments between friends and family.

For users who value both international speed and digital efficiency, Panda Remit offers fast online transfers that often arrive within minutes.

For detailed insights on transfer times, see Finder’s guide to transfer speed.

Travelex Wire vs Venmo: Safety and Security

Both platforms implement robust security standards:

-

Travelex Wire is regulated by international financial authorities and uses advanced encryption to protect user information.

-

Venmo benefits from PayPal’s security infrastructure, offering two-factor authentication and fraud monitoring.

Likewise, Panda Remit is fully licensed and uses encrypted technology to ensure safe and secure money transfers globally.

Travelex Wire vs Venmo: Global Coverage

Travelex Wire supports transfers to over 100 countries in more than 40 currencies, offering users diverse options for global payments. Venmo, however, is limited to the United States and supports only USD.

For official remittance statistics, refer to the World Bank remittance report.

Travelex Wire vs Venmo: Which One is Better?

The better option depends on your needs:

-

For domestic U.S. transfers, Venmo is convenient, fast, and cost-effective.

-

For international transfers, Travelex Wire offers transparent fees, competitive exchange rates, and wide coverage.

That said, users seeking lower fees and faster processing may find Panda Remit an excellent middle ground — offering quick and secure cross-border transfers online.

Conclusion

To conclude, the Travelex Wire vs Venmo comparison highlights two distinct platforms built for different purposes. Venmo excels at everyday U.S. payments, while Travelex Wire provides a robust international money transfer network.

If you’re seeking a modern remittance solution combining affordability, speed, and transparency, consider Panda Remit. It offers:

-

Competitive exchange rates and low fees

-

Secure online transfers with encryption

-

Over 40 supported currencies

-

Convenient payment options such as POLi, PayID, bank card, and e-transfer

For more comparisons, check MoneySavingExpert’s guide on global remittance services.

Ultimately, while Venmo is ideal for domestic payments and Travelex Wire for global remittances, Panda Remit stands out as a flexible alternative combining the best of both worlds.