Travelex Wire vs XE Money Transfer: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-17 11:19:47.0 16

Introduction

Cross-border money transfers can be challenging due to high fees, hidden charges, and slow delivery times. Many users look for reliable services that offer transparency and convenience. Travelex Wire and XE Money Transfer are two popular options that cater to these needs, each with its own strengths and target audience. For users seeking a simpler alternative, Panda Remit provides an easy-to-use platform for international transfers. Learn more about remittance best practices on Investopedia.

Travelex Wire vs XE Money Transfer – Overview

Travelex Wire, founded in 1976, specializes in international money transfers and foreign exchange services with a strong global presence and a mobile app for convenience. XE Money Transfer, established in 1993, focuses on digital transfers with competitive exchange rates and an easy-to-use online platform.

Similarities:

-

Both offer international transfers.

-

Mobile app support.

-

Debit card integration.

Differences:

-

Travelex Wire has physical branches; XE is primarily online.

-

Fee structures vary, with XE often offering lower costs for smaller transfers.

-

Travelex targets travelers and business clients, XE focuses on digital-first consumers.

Panda Remit also provides an alternative for users looking for low-cost, online international transfers.

Travelex Wire vs XE Money Transfer: Fees and Costs

Travelex Wire charges a combination of fixed fees and percentage-based fees, which can be higher for smaller transfers. XE Money Transfer offers transparent fees and sometimes fee-free transfers for specific corridors. Account type and transfer method may affect fees for both services.

For a detailed comparison of international transfer fees, check NerdWallet. Panda Remit may offer lower fees for select transfers, making it a cost-effective alternative.

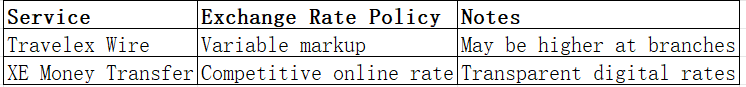

Travelex Wire vs XE Money Transfer: Exchange Rates

Both services add a margin to the mid-market exchange rate. Travelex Wire’s rates can vary by branch and currency, while XE provides consistently competitive online rates.

Panda Remit offers competitive exchange rates with minimal markup, providing value for frequent users.

Travelex Wire vs XE Money Transfer: Speed and Convenience

Travelex Wire transfers typically take 1–3 business days, depending on the currency and method. XE Money Transfer usually delivers within 1–2 business days online. Both platforms provide mobile apps, but XE’s fully digital approach streamlines the process.

For more on transfer speeds, see WorldRemit speed guide. Panda Remit offers fast online transfers as a convenient alternative.

Travelex Wire vs XE Money Transfer: Safety and Security

Both services are regulated and provide encryption, fraud protection, and buyer safeguards. Travelex Wire is licensed in multiple countries, and XE Money Transfer is regulated by major financial authorities.

Panda Remit is also licensed and secure, providing a safe option for online transfers.

Travelex Wire vs XE Money Transfer: Global Coverage

Travelex Wire supports transfers to numerous countries with multiple payout options, including bank accounts and cash pickups. XE Money Transfer supports over 130 currencies and destinations with bank-to-bank transfers.

See World Bank remittance coverage for insights into global remittance flows.

Travelex Wire vs XE Money Transfer: Which One is Better?

Travelex Wire offers convenience through physical locations and personalized service, ideal for travelers and business clients. XE Money Transfer excels in digital transfers with competitive rates and quick delivery for online users.

For users seeking a simple, fast, and cost-effective alternative, Panda Remit provides competitive rates, multiple online payment methods, and user-friendly transfers.

Conclusion

In summary, Travelex Wire vs XE Money Transfer both provide reliable services for international money transfers, each with unique advantages. Travelex Wire is suitable for clients preferring branch support and tailored service, while XE Money Transfer is optimal for digital-first users seeking competitive rates.

Panda Remit stands out as an alternative with high exchange rates, low fees, fast online transfers, and flexible payment options including POLi, PayID, bank cards, and e-transfers. Panda Remit supports 40+ currencies, making it an excellent choice for frequent international transfers. Explore more about Panda Remit on pandaremit.com and learn about efficient remittance strategies on Investopedia.