Travelex Wire vs Zelle: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-21 09:08:50.0 11

Introduction

As global payments continue to grow, users are seeking fast, transparent, and affordable ways to send money across borders. Traditional methods often come with high fees, hidden costs, and delays. In this landscape, digital platforms like Travelex Wire and Zelle have become popular for their convenience and speed. However, each caters to different needs and regions.

If you’re looking for another trusted option, Panda Remit offers competitive rates and quick global transfers — an excellent alternative for international users.

For background on digital remittance trends, visit Investopedia’s guide to money transfers.

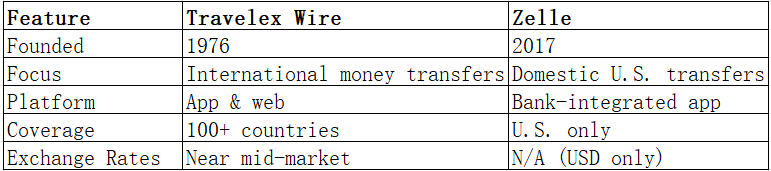

Travelex Wire vs Zelle – Overview

Travelex Wire is part of the well-known Travelex brand, established in 1976. It focuses on global money transfers, currency exchange, and digital remittance services. Travelex Wire is designed for users who need to send money abroad with transparent fees and mid-market exchange rates.

Zelle, on the other hand, launched in 2017 in the U.S., is a domestic peer-to-peer payment platform integrated into major American banks. It allows quick transfers between U.S. bank accounts, but it does not support international transfers.

For those who need global reach and low-cost transfers, Panda Remit is another great option that combines online convenience with fast delivery times.

Travelex Wire vs Zelle: Fees and Costs

When comparing Travelex Wire vs Zelle, the fee structures are entirely different due to their target markets.

-

Travelex Wire charges small transfer fees depending on the destination and payment method. The platform’s pricing is transparent and competitive for cross-border payments.

-

Zelle charges no transfer fees — but it’s limited to transfers within the U.S. only. This means users cannot send money internationally through Zelle.

For comparison, NerdWallet’s fee guide highlights that international transfer apps often have hidden markups. Panda Remit typically offers lower-cost options with clear pricing.

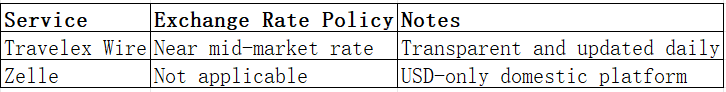

Travelex Wire vs Zelle: Exchange Rates

Exchange rates play a crucial role in determining total transfer value.

Travelex Wire offers better control for users sending money abroad, as it allows transfers in multiple currencies at competitive rates. Zelle operates solely in U.S. dollars, so there’s no exchange rate to consider.

For users seeking favorable exchange rates and minimal markup, Panda Remit is worth exploring.

Travelex Wire vs Zelle: Speed and Convenience

Both services provide convenience, but in different contexts:

-

Travelex Wire processes most international transfers within 1–2 business days, depending on the receiving country and method.

-

Zelle offers instant transfers within the U.S., as long as both sender and receiver are enrolled.

In terms of usability, Zelle is embedded directly in banking apps, while Travelex Wire offers a web platform and mobile app for easy access.

If you prioritize both speed and cross-border capability, Panda Remit delivers transfers quickly — often within minutes — using an all-online process.

For insights on transfer speed, visit Finder’s remittance speed guide.

Travelex Wire vs Zelle: Safety and Security

Both brands emphasize user protection:

-

Travelex Wire is regulated by financial authorities and uses advanced encryption and verification tools to safeguard transactions.

-

Zelle works through FDIC-insured U.S. banks, ensuring secure domestic transfers.

Panda Remit also operates under strict licensing regulations and uses robust security systems to protect users from fraud, providing peace of mind for international senders.

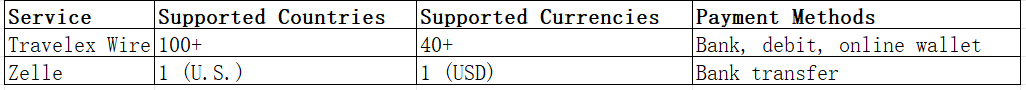

Travelex Wire vs Zelle: Global Coverage

Travelex Wire clearly outperforms Zelle in terms of global reach. While Zelle is ideal for quick domestic payments, Travelex Wire enables transfers to numerous destinations.

For worldwide remittance data, refer to the World Bank Remittance Data Report.

Travelex Wire vs Zelle: Which One is Better?

The answer depends on your needs:

-

If you send money within the U.S., Zelle is fast, free, and convenient.

-

If you send money internationally, Travelex Wire offers better rates, transparency, and multi-currency support.

However, for users looking for even lower fees and faster delivery worldwide, Panda Remit stands out as a solid alternative.

Conclusion

In summary, this Travelex Wire vs Zelle comparison reveals two services serving very different audiences:

-

Zelle is perfect for instant, fee-free domestic transfers in the U.S.

-

Travelex Wire is better for global users needing multi-currency transfers and reliable exchange rates.

If you’re looking for a flexible, affordable, and secure international transfer platform, Panda Remit deserves consideration. It offers:

-

Competitive exchange rates and low fees

-

Fast and secure transfers

-

Support for 40+ currencies

-

Convenient payment options like POLi, PayID, bank cards, and e-transfer

For further reading on money transfer options, check MoneySavingExpert’s remittance comparison.

Ultimately, both Travelex Wire and Zelle have their strengths — but for international users prioritizing cost, speed, and convenience, Panda Remit is a standout choice.