Western Union vs Currencies Direct: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-10 09:36:38.0 35

Introduction

Cross-border money transfers are essential for millions of people every year — whether it’s supporting family, paying overseas tuition, or funding international investments. Yet, users often face challenges like high fees, slow delivery, and unclear exchange rates.

Western Union and Currencies Direct are two popular providers offering different approaches to global remittances. Alongside them, Panda Remit (https://www.pandaremit.com) has emerged as a strong digital alternative, known for its competitive rates and fast online services.

For a detailed understanding of international transfers, you can check Investopedia’s guide to money transfer services (https://www.investopedia.com/articles/pf/08/send-money-internationally.asp).

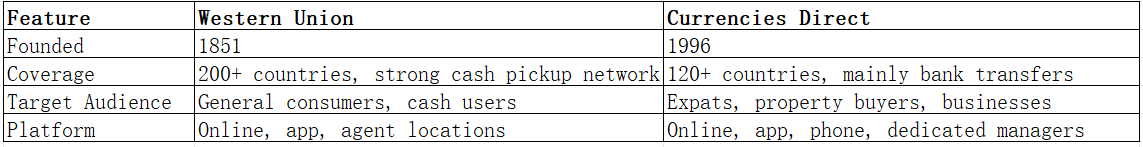

Western Union vs Currencies Direct – Overview

Western Union was founded in 1851 and is one of the world’s oldest and largest money transfer companies. It serves millions of customers across over 200 countries, offering online transfers, mobile apps, and extensive cash pickup locations.

Currencies Direct, established in 1996 in the UK, focuses on international money transfers for individuals and businesses. It offers bank-to-bank transfers, currency risk management tools, and dedicated account managers, making it especially popular with expats, property buyers, and businesses.

Similarities:

-

Both offer international transfers

-

Support online platforms and apps

-

Serve individuals and businesses

Differences:

-

Western Union has a vast cash pickup network

-

Currencies Direct focuses on bank transfers and better exchange rates

-

Western Union suits quick consumer transfers; Currencies Direct suits larger transactions and business users

Panda Remit (https://www.pandaremit.com) is another modern option for those who prefer fully digital, low-fee transfers.

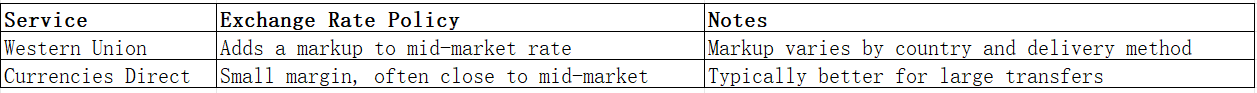

Western Union vs Currencies Direct: Fees and Costs

Western Union charges a combination of fixed fees and exchange rate markups. Costs depend on the sending amount, destination country, and chosen delivery method (e.g., cash pickup vs. bank deposit). Online transfers are usually cheaper than agent-based transactions.

Currencies Direct generally does not charge transfer fees for most transactions. Instead, they earn through a small exchange rate margin. For large transfers, especially business payments, this can be more cost-effective than traditional providers.

For a general fee comparison, see NerdWallet’s international money transfer guide (https://www.nerdwallet.com/best-money-transfer-services).

Panda Remit often offers zero fees and competitive exchange rates, making it a lower-cost alternative to both.

Western Union vs Currencies Direct: Exchange Rates

Exchange rate policies can significantly impact how much money your recipient gets.

Currencies Direct usually provides more competitive rates than Western Union, particularly for larger transfers. Panda Remit also focuses on mid-market rates with minimal markup, making it attractive for frequent users.

Western Union vs Currencies Direct: Speed and Convenience

Western Union is known for its speed, with many cash pickup transfers available within minutes. Online bank transfers may take 1–2 business days depending on the corridor.

Currencies Direct typically delivers funds within 1–3 business days, as it focuses on bank transfers rather than cash pickups.

For a deeper look at remittance speeds, check the World Bank remittance speed analysis (https://remittanceprices.worldbank.org/en).

Panda Remit stands out as a fast, all-online option, with many transfers arriving within minutes to a few hours.

Western Union vs Currencies Direct: Safety and Security

Both Western Union and Currencies Direct are fully regulated:

-

Western Union is licensed in multiple jurisdictions and uses encryption and anti-fraud measures.

-

Currencies Direct is authorized by the UK’s Financial Conduct Authority (FCA) and follows strict client money protection rules.

Panda Remit is also licensed and regulated, ensuring compliance and secure transfer processes.

Western Union vs Currencies Direct: Global Coverage

-

Western Union: 200+ countries, strong cash pickup and mobile wallet coverage.

-

Currencies Direct: 120+ countries, focused on bank transfers, ideal for Europe and major currency corridors.

For global remittance trends, see the World Bank’s remittance coverage report (https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues).

Western Union vs Currencies Direct: Which One is Better?

Choosing between Western Union and Currencies Direct depends on your needs:

-

Western Union is best for quick, small cash transfers to a wide range of destinations.

-

Currencies Direct is better for larger transfers, especially when you want better exchange rates and dedicated service.

For those who prioritize low fees and speed, Panda Remit (https://www.pandaremit.com) offers an excellent digital-first alternative.

Conclusion

In this Western Union vs Currencies Direct comparison, both services have clear strengths. Western Union stands out for its massive global reach and cash pickup network, while Currencies Direct offers competitive exchange rates and tailored support for larger or recurring transfers.

However, if your priority is low fees, high exchange rates, and fast, all-online service, Panda Remit (https://www.pandaremit.com) is a strong alternative. With support for 40+ currencies and flexible payment methods (POLi, PayID, bank card, e-transfer, etc.), it’s designed for modern users who want efficient and affordable cross-border payments.

For more insights into money transfer options, visit Investopedia’s guide (https://www.investopedia.com/articles/pf/08/send-money-internationally.asp) or check the World Bank’s remittance price database (https://remittanceprices.worldbank.org/en).