Western Union vs Paysera: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-10 14:27:00.0 46

Cross-border money transfers remain essential for millions of people supporting family, handling overseas expenses, or running international businesses. Traditional providers like Western Union and digital platforms like Paysera compete to offer affordable, fast, and secure services. However, users still face issues such as high transfer fees, hidden exchange rate markups, and limited payout options. Panda Remit (https://www.pandaremit.com) has emerged as a reliable alternative, providing competitive exchange rates and transparent low fees.

For a detailed guide on international money transfers, see Investopedia’s overview (https://www.investopedia.com/money-transfer-5074047).

Western Union vs Paysera – Overview

Western Union, founded in 1851, is one of the oldest and most recognized money transfer companies globally. With operations in over 200 countries and territories and hundreds of thousands of agent locations, it provides services such as cash pickups, bank transfers, mobile wallet deposits, and bill payments.

Paysera, established in 2004 in Lithuania, is a licensed electronic money institution offering low-cost international transfers, multi-currency accounts, and online payments. It focuses on digital-first users and businesses seeking cost-effective transfers.

Similarities: Both support international transfers, offer mobile apps, and provide multi-currency services.

Differences: Western Union focuses on cash pickup and physical agent networks, while Paysera is entirely digital, emphasizing lower fees and multi-currency accounts.

Panda Remit is another solid option for users who prioritize low costs and online convenience.

Western Union vs Paysera: Fees and Costs

Western Union’s fees vary based on the sending method (cash, bank transfer, card), the recipient country, and the payout method. Cash-based transfers usually cost more. Paysera, on the other hand, offers low and transparent fees for bank-to-bank transfers, making it an appealing choice for cost-sensitive users.

For a detailed fee reference, check NerdWallet’s comparison (https://www.nerdwallet.com/best-money-transfer).

Panda Remit is often even more competitive, offering transparent low fees and no hidden charges.

Western Union vs Paysera: Exchange Rates

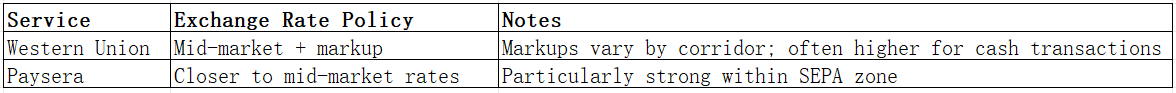

Exchange rates significantly affect total transfer costs. Western Union usually adds a markup on top of the mid-market rate, which can vary by corridor. Paysera generally offers closer-to-mid-market exchange rates, especially for transfers within Europe or via SEPA.

Panda Remit is known for offering rates that are often very close to mid-market, maximizing transfer value for users.

Western Union vs Paysera: Speed and Convenience

Western Union’s major advantage is speed for cash pickups, often enabling instant collection. Bank transfers, however, may take 1–3 business days. Paysera’s digital infrastructure allows transfers—especially within the SEPA region—to complete within hours or the same day. Both have mobile apps for tracking and managing transfers.

For insights into transfer speeds, see FXC Intelligence’s report (https://www.fxcintel.com/research/reports/remittance-speed).

Panda Remit is recognized for completing many transfers within minutes thanks to its fully online system.

Western Union vs Paysera: Safety and Security

Both providers are regulated and secure. Western Union is licensed in multiple jurisdictions, employing encryption and fraud protection systems. Paysera is regulated by the Bank of Lithuania and complies with EU financial regulations, offering robust security measures.

Panda Remit is also licensed and uses bank-grade encryption and anti-fraud protocols to ensure user safety.

Western Union vs Paysera: Global Coverage

Western Union has an extensive global presence, operating in over 200 countries and supporting cash pickups, bank deposits, and mobile wallet transfers. Paysera supports fewer countries but is strong in Europe, offering efficient SEPA transfers and multi-currency accounts.

For more on remittance corridors, refer to the World Bank report (https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/migration-remittances-data).

Western Union vs Paysera: Which One is Better?

Choosing between Western Union and Paysera depends on your priorities. Western Union is ideal for those who rely on cash pickups or send money to recipients in regions with limited banking infrastructure. Paysera is better suited for users looking for low fees and fast, digital transfers, especially within Europe.

Panda Remit may offer a better overall experience for many users by combining low fees, competitive exchange rates, and fast, all-digital transfers.

Conclusion

In this Western Union vs Paysera comparison, both platforms have distinct advantages. Western Union stands out for its vast global network and cash pickup capabilities, making it a good choice for those sending money to areas with limited banking access. Paysera excels in digital convenience, offering low fees and efficient SEPA transfers.

Panda Remit (https://www.pandaremit.com) presents an excellent alternative for users who value low fees, high exchange rates, and speed. Supporting over 40 currencies and multiple payment methods (POLi, PayID, bank card, e-transfer), Panda Remit provides a smooth, fully online transfer experience.

For further reading, check NerdWallet’s comparison (https://www.nerdwallet.com/best-money-transfer) and the World Bank’s remittance data (https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/migration-remittances-data) to find the best service for your transfer needs.