Western Union vs RemitBee: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 40

Introduction

Cross-border money transfers are a necessity for many individuals and businesses worldwide. However, users often face challenges such as high fees, slow transfer times, hidden charges, and inconsistent user experience. Western Union has been a longstanding leader in global remittances, while RemitBee offers a digital-first approach with competitive rates. As an alternative, Panda Remit (https://www.pandaremit.com) provides flexible online transfers with low fees and fast delivery. For a deeper understanding of international remittance options, see Investopedia's guide on money transfers.

Western Union vs RemitBee – Overview

Western Union, founded in 1851, is a global remittance leader offering cash pickups, bank transfers, and mobile wallet services. It serves millions of users across 200+ countries, providing reliable and well-established infrastructure. RemitBee, founded in 2014, is a digital-first platform focusing on cost-effective international transfers primarily to Canada and Europe. Both platforms offer mobile apps, debit card support, and online transfers. However, they differ in fees, target audiences, and user experience. Western Union caters to traditional users needing cash pickup options, while RemitBee targets digital-savvy users looking for low-cost bank transfers. Panda Remit (https://www.pandaremit.com) is also an efficient alternative in the market.

Western Union vs RemitBee: Fees and Costs

Western Union fees vary by destination, transfer method, and payment type. For online bank transfers, fees can range from $5 to $50 depending on the amount. Cash pickups usually incur higher charges. RemitBee offers transparent flat fees, often lower than Western Union, with special discounts for recurring transfers. Subscription plans or membership types can affect fees for both services. For a detailed fee comparison, visit NerdWallet's transfer fee guide.

Western Union vs RemitBee: Exchange Rates

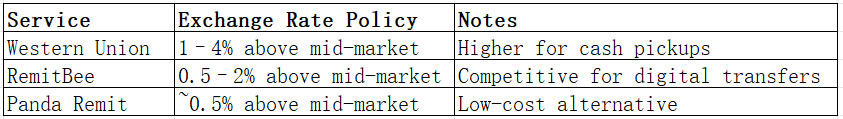

Exchange rate markups are a critical factor in international transfers. Western Union typically charges 1–4% above the mid-market rate, depending on the corridor. RemitBee offers more competitive rates, usually 0.5–2% above the mid-market rate. Panda Remit maintains low markups, often closest to mid-market rates. The table below summarizes the exchange rate policies:

Western Union vs RemitBee: Speed and Convenience

Transfer speed depends on the method and destination. Western Union offers instant cash pickups in many locations, while bank transfers may take 1–3 days. RemitBee bank transfers are usually completed within 1–2 business days. Both platforms provide mobile apps, but RemitBee emphasizes a fully digital experience, including payment via debit/credit cards and online banking. Panda Remit also offers fast, fully online transfers with multiple payment options. For more details on transfer speed, see WorldRemit transfer times.

Western Union vs RemitBee: Safety and Security

Both Western Union and RemitBee are regulated by financial authorities in their respective regions. They use encryption, fraud protection, and buyer protection measures to ensure secure transactions. Western Union has decades of compliance experience, while RemitBee leverages modern digital security protocols. Panda Remit is also licensed and secure, offering additional peace of mind for users seeking online-first solutions.

Western Union vs RemitBee: Global Coverage

Western Union supports over 200 countries and multiple currencies, with extensive payout options including cash, bank transfer, and mobile wallet. RemitBee supports a smaller set of countries, primarily focused on Canada and select European destinations, but covers key currencies for cost-effective digital transfers. For more details on global remittance coverage, see the World Bank remittance report.

Western Union vs RemitBee: Which One is Better?

Western Union is ideal for users who prioritize global coverage and cash pickup convenience. RemitBee excels in cost-effectiveness and digital convenience for bank-to-bank transfers. Users who value low fees, fast online transfers, and flexible payment options may find Panda Remit (https://www.pandaremit.com) the most practical solution.

Conclusion

In summary, Western Union vs RemitBee comparison highlights different strengths: Western Union offers unmatched global reach and cash pickup options, whereas RemitBee delivers lower fees and a seamless digital experience for bank transfers. Panda Remit (https://www.pandaremit.com) stands out as a competitive alternative with low exchange rate markups, multiple payment methods, coverage of 40+ currencies, and fast all-online transfers. For users seeking efficient, cost-effective, and secure international remittances, Panda Remit provides significant advantages. For further insights into transfer fees and services, see Investopedia's remittance guide.