Western Union vs Venmo: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-10 14:37:44.0 49

Cross-border money transfers are essential for individuals and businesses worldwide. Many users face challenges like high fees, poor exchange rates, and slow delivery. Western Union and Venmo offer different approaches to money transfers: Western Union is renowned for global coverage and multiple payout options, while Venmo focuses on instant, fee-free domestic payments in the U.S. For a reliable low-cost international option, Panda Remit (https://www.pandaremit.com/) provides fast, transparent online transfers. For more on international transfers, see Investopedia (https://www.investopedia.com/).

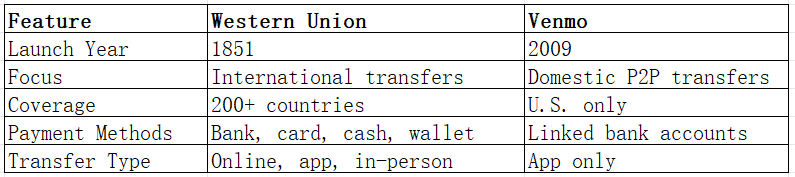

Western Union vs Venmo – Overview

Western Union, founded in 1851, is a global money transfer leader with operations in over 200 countries and territories. Services include online transfers, app-based payments, in-person cash pickups, and mobile wallet deposits.

Venmo, launched in 2009, is a U.S.-based peer-to-peer payment platform, integrated with major banks. It enables instant domestic transfers and social payments within the U.S.

Similarities: Both provide mobile app support, easy tracking, and bank transfer options.

Differences: Western Union is international and supports cash pickups; Venmo is domestic-only, focusing on app-based bank-to-bank transfers in the U.S.

Panda Remit is a strong alternative for cost-effective global transfers.

Western Union vs Venmo: Fees and Costs

Western Union’s fees depend on payment method, destination, and transfer speed, with cash pickups typically costing more. Venmo does not charge for standard domestic transfers but is limited to the U.S. Users needing international transfers cannot rely on Venmo.

Panda Remit offers competitive, transparent fees for international transfers. For fee comparisons, see NerdWallet (https://www.nerdwallet.com/best-money-transfer).

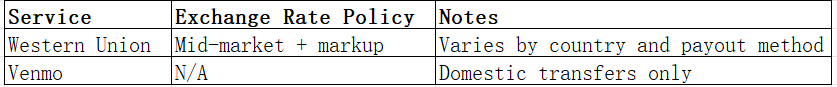

Western Union vs Venmo: Exchange Rates

Western Union applies a markup on mid-market rates, which can vary by corridor. Venmo does not provide foreign exchange, as it is U.S. domestic only.

Panda Remit offers rates close to mid-market, maximizing transfer value for international users.

Western Union vs Venmo: Speed and Convenience

Venmo excels in domestic speed, with transfers typically instant between U.S. bank accounts. Western Union offers quick cash pickups but bank transfers may take 1–3 business days. Both have mobile apps for managing and tracking transfers.

Panda Remit enables fast online international transfers. For speed insights, check FXC Intelligence (https://www.fxcintel.com/research/reports/remittance-speed).

Western Union vs Venmo: Safety and Security

Western Union is regulated globally, employing encryption and fraud detection. Venmo leverages U.S. banking security standards, ensuring safe domestic payments.

Panda Remit is a licensed provider with robust security protocols for cross-border transfers.

Western Union vs Venmo: Global Coverage

Western Union supports 200+ countries and 130+ currencies. Venmo operates only in the U.S.

For global coverage data, refer to the World Bank remittance report (https://www.worldbank.org/).

Western Union vs Venmo: Which One is Better?

Western Union is best for international transfers and recipients without bank accounts. Venmo suits U.S. users needing instant, fee-free transfers. Panda Remit provides a fast, low-cost alternative for international users seeking high exchange rates and online convenience.

Conclusion

The Western Union vs Venmo comparison highlights two distinct services. Western Union is ideal for global reach and flexible payout options, while Venmo is optimal for instant U.S. domestic transfers.

For international users wanting low fees, high exchange rates, and fast online transfers, Panda Remit (https://www.pandaremit.com/) is a strong alternative. It supports over 40 currencies and multiple payment methods, including POLi, PayID, bank cards, and e-transfers, all through a fully online platform.

For further reading, see Wise (https://wise.com/) and the World Bank (https://www.worldbank.org/). Choosing the right service depends on whether speed, international reach, or cost-efficiency is your priority.