Western Union vs XE Money Transfer: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-10 09:30:34.0 54

Introduction

Cross-border money transfers have improved drastically in recent years, but users still face challenges like high fees, hidden exchange rate markups, and slow delivery. Choosing the right provider can mean the difference between your recipient getting less or more money.

Two of the most popular services are Western Union and XE Money Transfer, both well-known globally for international remittances. At the same time, Panda Remit has emerged as a modern, digital-first alternative offering faster and cheaper transfers for users worldwide.

To better understand how international transfers work, check out Investopedia’s guide:https://www.investopedia.com/articles/pf/08/international-money-transfer.asp

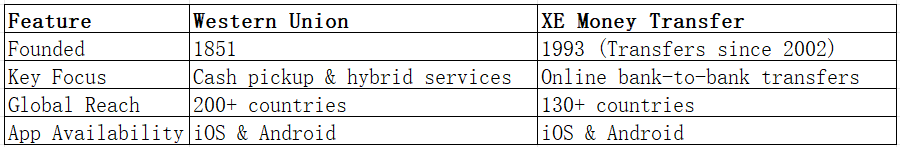

Western Union vs XE Money Transfer – Overview

Western Union

Founded in 1851, Western Union is one of the oldest and largest money transfer companies in the world. With over 500,000 agent locations and support for 200+ countries, it offers a mix of cash pickups, online transfers, and in-person services, making it ideal for users without bank accounts.

XE Money Transfer

Launched in 1993 as a currency exchange information site, XE expanded into international money transfers in 2002. It focuses on online and bank-to-bank transfers, offering competitive exchange rates and no transfer fees, particularly suited for individuals and businesses transferring large sums.

While both services allow users to send money internationally, Western Union targets those needing cash availability and global reach, while XE focuses on competitive exchange rates for digital bank transfers.

Meanwhile, Panda Remit offers an alternative that combines low fees, competitive rates, and speed in one digital platform.

Western Union vs XE Money Transfer: Fees and Costs

Fees can vary dramatically between the two:

-

Western Union fees depend on:

-

Transfer amount

-

Payment method (credit card, bank transfer, cash)

-

Delivery option (cash pickup vs bank deposit)

In general, cash pickup and card-funded transfers are more expensive.

-

-

XE Money Transfer is known for charging no fixed transfer fees, regardless of the amount or destination. However, it may still apply a small exchange rate margin (covered below).

For reference, NerdWallet provides useful fee comparisons across providers:https://www.nerdwallet.com/best-money-transfer-apps

👉 Panda Remit uses a zero-fee model for many corridors, making it an affordable choice for users who want transparency and savings.

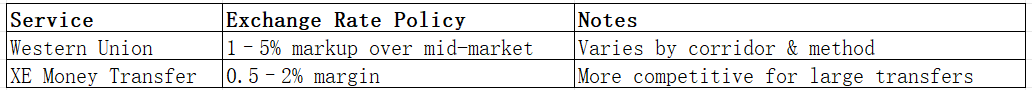

Western Union vs XE Money Transfer: Exchange Rates

Exchange rate markups often have a bigger impact than transfer fees:

-

Western Union typically adds a 1–5% markup above the mid-market rate. This markup varies by country and delivery method, and in-store rates can differ from online rates.

-

XE Money Transfer is known for tight margins, typically 0.5–2% above mid-market, depending on the currency pair and amount. Its real-time currency expertise helps keep costs down for larger transfers.

Panda Remit often uses mid-market or near mid-market rates, providing highly competitive pricing compared to traditional providers.

Western Union vs XE Money Transfer: Speed and Convenience

-

Western Union offers instant cash pickup in many destinations, with most bank transfers arriving within 1–2 business days. Its hybrid model (online + physical agents) provides flexibility for recipients without bank accounts.

-

XE Money Transfer typically takes 1–3 business days, depending on the currency and destination. Transfers are fully online, with no cash pickup option.

Both have user-friendly mobile apps and online platforms, but Western Union’s agent network gives it an advantage for users sending to cash-only recipients.

For more details on how long transfers usually take, see Wise’s transfer speed guide:https://wise.com/help/articles/2961656/how-long-does-an-international-money-transfer-take

Panda Remit is known for fast transfers, often delivering funds within minutes on popular routes.

Western Union vs XE Money Transfer: Safety and Security

Both companies are regulated and use industry-standard security:

-

Western Union is regulated in over 200 countries, uses encryption, fraud detection, and complies with local laws.

-

XE Money Transfer is regulated by FINTRAC in Canada, FCA in the UK, and other authorities worldwide.

Panda Remit is also fully licensed, following international anti-money laundering standards and using modern encryption technology to secure transactions.

Western Union vs XE Money Transfer: Global Coverage

Western Union is unmatched in geographic coverage, operating in 200+ countries and territories with extensive agent locations, ideal for regions with limited banking infrastructure.

XE Money Transfer covers 130+ countries and focuses exclusively on bank-to-bank transfers, which may limit options for recipients who prefer or need cash pickup.

For more insights, see the World Bank’s remittance coverage data:

https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/migration-remittances-data

Western Union vs XE Money Transfer: Which One is Better?

The best choice depends on your priorities:

-

Choose Western Union if:

-

You need instant cash pickup

-

You're sending to countries with limited banking infrastructure

-

You value physical agent support

-

-

Choose XE Money Transfer if:

-

You prioritize better exchange rates

-

You send larger amounts through bank-to-bank transfers

-

You prefer fully digital transfers

-

For users seeking a balance of low fees, competitive rates, and fast online transfers, Panda Remit provides an excellent alternative.

Conclusion

When comparing Western Union vs XE Money Transfer, both offer reliable international transfers, but they serve different audiences:

-

Western Union excels in reach and speed, especially for cash pickup in remote regions.

-

XE Money Transfer stands out for low or no fees, competitive exchange rates, and online convenience, particularly for large transfers.

Meanwhile, Panda Remit (https://www.pandaremit.com/) represents the new wave of digital remittance platforms, offering:

-

High exchange rates and low or zero fees

-

Flexible payment options like PayID, POLi, bank card, and e-transfer

-

Coverage in 40+ currencies

-

Fast, secure, fully online transfers

As global remittance needs evolve, exploring both traditional providers and modern fintech solutions ensures you’ll find the best balance of cost, speed, and convenience for your transfers.

For further reading, see Forbes’ guide to international money transfers:https://www.forbes.com/advisor/money-transfer/