Western Union vs Zelle: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-10 14:33:17.0 51

In today’s globalized world, sending money abroad quickly and affordably is more important than ever. Many users face high transfer fees, poor exchange rates, and delays when sending funds internationally. Two well-known players in the money transfer landscape are Western Union and Zelle, each serving different user needs. As an alternative for cost-effective cross-border transfers, Panda Remit (https://www.pandaremit.com/) has gained popularity among international users. For more insights on how money transfers work, visit Investopedia (https://www.investopedia.com/).

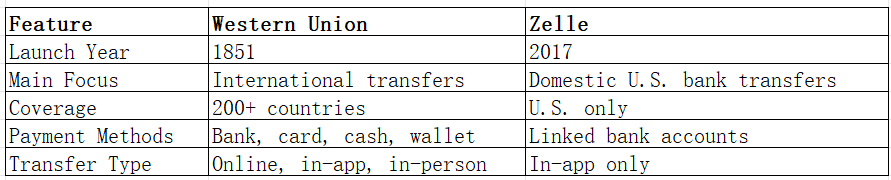

Western Union vs Zelle – Overview

Western Union was founded in 1851 and is one of the world’s oldest and largest money transfer companies. It operates in over 200 countries and territories, offering online, mobile, and in-person transfers. Users can send funds to bank accounts, mobile wallets, or for cash pickup at thousands of agent locations.

Zelle, launched in 2017, is a U.S.-based peer-to-peer payment service integrated directly into major banks’ apps. It focuses on instant domestic transfers between U.S. bank accounts, making it extremely popular for everyday payments within the United States.

Similarities: Both Western Union and Zelle provide mobile app experiences, offer real-time tracking, and support bank transfers.

Differences: Western Union specializes in international transfers and cash pickups, while Zelle focuses exclusively on U.S. domestic bank transfers. Zelle typically offers no transfer fees but is limited to bank accounts within the U.S., whereas Western Union charges variable fees but provides extensive global reach.

Panda Remit is another competitive option in the global remittance landscape, offering fast, affordable online transfers for international users.

Western Union vs Zelle: Fees and Costs

Western Union typically charges fees based on the transfer amount, payment method, and destination. Cash pickups and card payments usually come with higher fees than bank transfers. In some corridors, fees can be significant, especially for urgent cash pickups.

Zelle, on the other hand, does not charge users any fees for sending or receiving money domestically. However, because Zelle is limited to U.S. bank accounts, it does not support international transfers. Users who need to send money abroad cannot rely on Zelle for cross-border payments.

For global users seeking low fees, Panda Remit offers competitive pricing with zero hidden charges. To compare typical remittance fees, refer to WorldRemit’s comparison page (https://www.worldremit.com/).

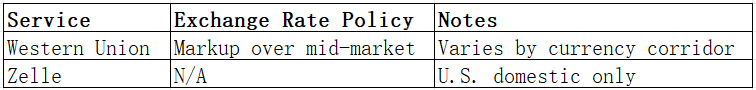

Western Union vs Zelle: Exchange Rates

Western Union often adds a markup on top of the mid-market exchange rate, which can make transfers more expensive. The exact markup depends on the currency corridor, but it’s generally how Western Union earns part of its revenue.

Zelle does not offer foreign exchange since it operates only in U.S. dollars and within the U.S. banking system.

Panda Remit offers high exchange rates close to mid-market levels, making it an appealing choice for cross-border transfers.

Western Union vs Zelle: Speed and Convenience

Zelle excels in speed for domestic transfers—most transactions are completed within minutes, provided both sender and recipient are enrolled. Its integration into major U.S. banking apps makes it convenient for everyday use.

Western Union can process transfers in minutes for cash pickups, but bank transfers can take 1–3 business days depending on the destination country. The service is widely available via its website, app, and physical branches, giving users flexibility.

Panda Remit is known for fast international transfers, often completing transactions within minutes. For more on transfer speed, check out NerdWallet’s remittance speed guide (https://www.nerdwallet.com/).

Western Union vs Zelle: Safety and Security

Both Western Union and Zelle implement strict security measures. Western Union is regulated in multiple jurisdictions and uses encryption and fraud monitoring. Zelle operates within the U.S. banking system, leveraging existing security protocols of participating banks.

Panda Remit is a licensed remittance provider in multiple regions, ensuring compliance and security for users.

Western Union vs Zelle: Global Coverage

Western Union operates in more than 200 countries and supports over 130 currencies, making it one of the most extensive remittance networks globally.

Zelle is limited to U.S. bank accounts and does not support sending or receiving international payments.

For global coverage data, see the World Bank remittance coverage report (https://www.worldbank.org/).

Western Union vs Zelle: Which One is Better?

Western Union is ideal for users who need to send money internationally, especially to recipients without bank accounts, thanks to its cash pickup network. Zelle is better suited for domestic U.S. users who want instant, fee-free transfers between bank accounts.

For users looking for lower fees and better exchange rates for international transfers, Panda Remit can be a strong alternative.

Conclusion

In summary, Western Union vs Zelle highlights two very different services. Western Union offers unmatched international reach and flexible payment methods, making it a top choice for cross-border transfers. Zelle shines in fast, fee-free domestic payments within the U.S. banking ecosystem.

However, if you’re seeking high exchange rates, low transfer fees, and fast online transactions across 40+ currencies, Panda Remit (https://www.pandaremit.com/) is a strong alternative. It supports multiple payment methods including bank cards, POLi, PayID, and e-transfers, all through a convenient online platform.

For additional resources, check remittance insights at Wise (https://wise.com/) and the World Bank (https://www.worldbank.org/). Choosing the right service depends on whether your priority is domestic speed, international reach, or cost-efficiency.