Wise vs Payoneer: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-09-30 15:50:58.0 1428

Introduction

International money transfers have become central to how individuals and businesses manage global payments. The challenge remains the same: users want affordable fees, fair exchange rates, and fast transfers without hidden costs. Wise and Payoneer are two of the most popular services today, each targeting slightly different audiences. Wise appeals to everyday users sending money abroad, while Payoneer is especially popular among freelancers, remote workers, and businesses handling cross-border payouts.

In this Wise vs Payoneer review, we’ll compare their pricing, exchange rates, speed, and global reach to see which one works better for your needs in 2025. Alongside these two, Panda Remit has emerged as a strong alternative, offering competitive costs and convenience for individuals worldwide. For more background on how international remittances work, you can visit Investopedia’s guide.

Wise vs Payoneer – Overview

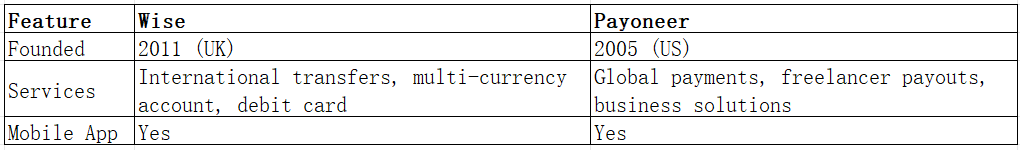

Wise (founded in 2011 in the UK) is a digital-first money transfer service best known for its transparent mid-market exchange rates, low fees, and multi-currency accounts. Wise has grown rapidly, serving millions of personal and business users worldwide.

Payoneer (founded in 2005 in the US) is a global payments platform built for freelancers, remote workers, and businesses. It helps users receive payments from clients abroad, manage currencies, and withdraw funds to local bank accounts or prepaid cards.

While both Wise and Payoneer offer cross-border payments and mobile apps, their focus differs: Wise is geared toward personal transfers and small businesses, while Payoneer is primarily designed for professionals and companies managing inbound global payments.

Panda Remit is another digital-first remittance service, particularly attractive to individuals sending money home to family due to its low fees and fast processing.

Quick Overview Table

Wise vs Payoneer: Fees and Costs

Wise charges a small percentage of the transfer amount plus a fixed fee, with no hidden markups. Costs vary by currency, but Wise is typically cheaper for personal transfers.

Payoneer fees depend on the type of transaction. Receiving payments from clients or marketplaces can include percentage-based fees, withdrawal fees, and exchange rate markups. For freelancers, Payoneer may still be more convenient despite higher costs.

Compared to both, Panda Remit often provides lower overall transfer fees, especially for consumer-focused remittances.

For an external breakdown of global transfer costs, see the World Bank Remittance Prices database.

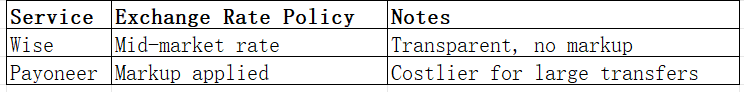

Wise vs Payoneer: Exchange Rates

Wise offers the real mid-market exchange rate with no hidden markup, making it one of the most transparent options.

Payoneer applies a markup on top of the mid-market rate, usually around 2–3%, which can make large transfers more expensive.

Panda Remit also emphasizes competitive exchange rates, often higher than traditional providers, which helps recipients receive more money.

Exchange Rate Table

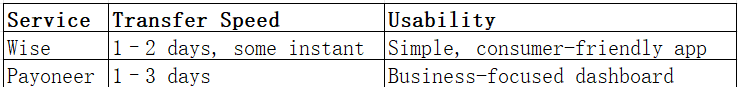

Wise vs Payoneer: Speed and Convenience

Wise transfers are typically delivered within 1–2 business days, with some instant options depending on currency routes and payment methods. Its mobile app is user-friendly, designed for individuals who need simple transfers.

Payoneer transfers generally take 1–3 business days, particularly when receiving international client payments. While slower, Payoneer offers strong integrations with platforms like Upwork, Fiverr, and Amazon, making it essential for freelancers and merchants.

Panda Remit often delivers money quickly — in many cases within minutes — making it one of the fastest alternatives.

For more insights into transfer speed, check NerdWallet’s remittance guide.

Speed & Convenience Table

Wise vs Payoneer: Safety and Security

Both Wise and Payoneer are licensed and regulated in multiple countries. Wise uses advanced encryption and two-factor authentication, while Payoneer follows strict compliance standards for financial institutions.

Panda Remit is also licensed and compliant with international remittance regulations, ensuring secure and reliable transfers.

Wise vs Payoneer: Global Coverage

Wise supports over 70+ currencies and transfers to more than 170 countries.

Payoneer focuses on business networks, working with clients in over 200 countries, though its services are often tied to business or freelancer payments rather than personal remittances.

Panda Remit covers 40+ currencies and provides diverse payment options like bank transfers, POLi, PayID, debit/credit card, and e-wallets.

For a broader look at remittance coverage worldwide, see the World Bank’s migration and remittance data.

Wise vs Payoneer: Which One is Better?

Choosing between Wise and Payoneer depends on your needs.

-

Choose Wise if you want transparent pricing, low-cost personal transfers, or a multi-currency account.

-

Choose Payoneer if you’re a freelancer, remote worker, or business owner managing global client payments.

-

Consider Panda Remit if your priority is affordable, fast remittances for family support or personal use.

Conclusion

In this Wise vs Payoneer comparison, both platforms bring unique strengths to international money transfers in 2025. Wise offers simplicity, low fees, and real exchange rates, making it ideal for individuals and small businesses. Payoneer, on the other hand, is a leading solution for freelancers and enterprises managing global payments, even if its fees are higher.

For users who value low fees, competitive exchange rates, and fast delivery, Panda Remit stands out as a strong alternative. With support for 40+ currencies, multiple payment methods (POLi, PayID, bank card, e-transfer, and more), and a fully online process, it ensures that more of your money reaches your loved ones quickly and securely.

To learn more about cost-effective remittance options, explore World Bank’s remittance reports. You can also visit Panda Remit’s official site to see how it compares with Wise and Payoneer.