Wise vs Paysera: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-09 11:58:51.0 20

Introduction

Cross-border money transfers are essential for individuals and businesses, but many users face high fees, slow processing, hidden charges, and limited usability.

Wise is known for transparent fees, mid-market exchange rates, and broad global coverage, while Paysera focuses on affordable digital payments, multi-currency accounts, and flexible transfer options.

Another alternative is Panda Remit, which offers fast delivery, low fees, and multiple payment methods (https://www.pandaremit.com/).

For more guidance on international transfers, see Investopedia’s guide on cross-border payments (https://www.investopedia.com/articles/pf/08/international-banking-transfers.asp).

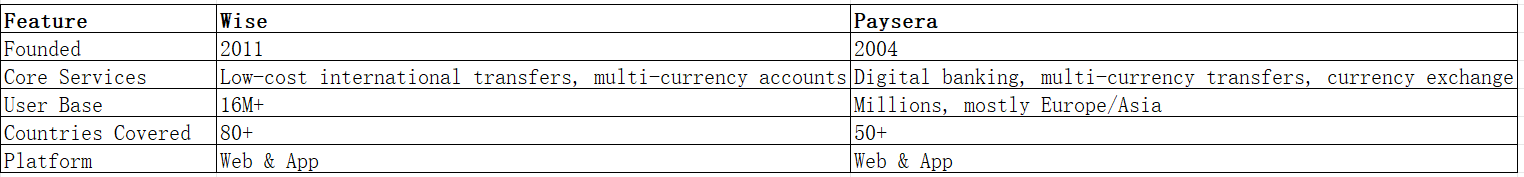

Wise vs Paysera – Overview

Wise, founded in 2011, provides low-cost international transfers, multi-currency accounts, and debit cards. It serves over 16 million users in 80+ countries.

Paysera, founded in 2004, offers digital banking, international transfers, and currency exchange. It focuses on European and Asian markets and supports a growing global customer base.

Similarities: Both provide international transfers, mobile apps, and secure digital transactions.

Differences: Wise emphasizes mid-market rates and global reach, while Paysera focuses on affordable European transfers and flexible account features.

Panda Remit is another low-cost, secure, and fast international transfer option (https://www.pandaremit.com/).

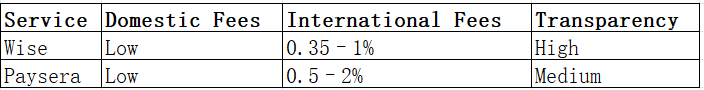

Wise vs Paysera: Fees and Costs

Wise charges 0.35%–1% per transfer, with no hidden fees and full transparency.

Paysera offers low-cost European transfers and competitive global transfer fees, but instant transfers may include additional charges.

For more details on fees, see NerdWallet’s money transfer comparison (https://www.nerdwallet.com/best-money-transfer-services).

Panda Remit often provides even lower fees and transparent exchange rates, making it ideal for frequent transfers.

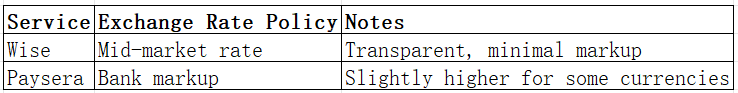

Wise vs Paysera: Exchange Rates

-

Wise provides mid-market rates, minimizing hidden markups.

-

Paysera may apply slight markups, depending on destination and currency.

Panda Remit also offers competitive exchange rates, helping users maximize transfer value.

Wise vs Paysera: Speed and Convenience

Wise transfers typically take minutes to one business day, supporting batch payments, debit cards, and multi-currency accounts.

Paysera provides fast European transfers and supports various payout options, including bank accounts and cards.

For insights into transfer speed, see World Bank Remittance Prices (https://www.remittanceprices.worldbank.org/en).

Panda Remit provides fast, reliable delivery with multiple payment methods, making it a convenient alternative.

Wise vs Paysera: Safety and Security

Both platforms are regulated and secure:

-

Wise is authorized by the UK FCA and other global regulators.

-

Paysera complies with EU financial regulations and secure banking standards.

They both use encryption, fraud detection, and two-factor authentication. Panda Remit is also a licensed and secure option.

Wise vs Paysera: Global Coverage

Wise supports 80+ countries and 50+ currencies, making it ideal for global users.

Paysera covers 50+ countries, mainly in Europe and Asia, suitable for regional transfers.

For further coverage data, see the World Bank remittance report (https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/migration-remittances-data).

Wise vs Paysera: Which One is Better?

Wise is best for users prioritizing transparent fees, mid-market exchange rates, and wide global coverage.

Paysera is ideal for users seeking affordable European transfers and flexible account features.

Panda Remit remains a strong alternative, offering low fees, fast delivery, competitive exchange rates, and multiple payment methods.

Conclusion

Choosing between Wise vs Paysera depends on your priorities:

-

Wise: Transparent fees, fair exchange rates, global reach.

-

Paysera: Affordable European transfers, flexible account features, fast processing.

Panda Remit (https://www.pandaremit.com/) provides an excellent alternative with:

-

High exchange rates & low fees

-

Multiple payment methods including POLi, PayID, bank card, and e-transfer

-

Coverage of 40+ currencies

-

Fully online, fast transfers

For more insights, see NerdWallet (https://www.nerdwallet.com/) and World Bank Remittance Prices (https://www.remittanceprices.worldbank.org/en). Comparing Wise vs Paysera and Panda Remit helps users select the most cost-effective, fast, and reliable international money transfer service.