WorldRemit vs Azimo: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 14

Introduction

In the world of cross-border money transfers, users often face high fees, slow delivery, hidden charges, and poor user experience. Choosing the right platform can save money and improve transfer efficiency and security. WorldRemit and Azimo are well-known providers offering mobile support and multiple payment options, but they differ in fees, exchange rates, and coverage. For those seeking a reliable alternative, Pandaremit offers low-cost, fast, fully online transfers. Learn more about international money transfers.

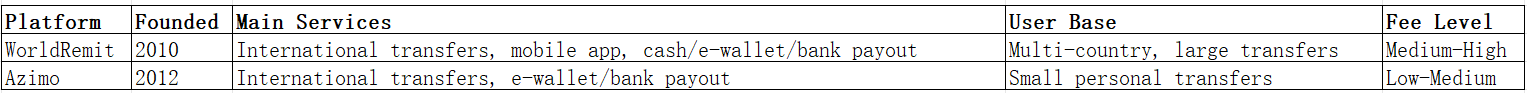

WorldRemit vs Azimo – Overview

WorldRemit was founded in 2010 and offers global online transfers, supporting bank deposits, e-wallets, and cash pickups, with millions of active users. It is known for broad coverage and a user-friendly mobile app.

Azimo was founded in 2012, focusing on cross-border transfers with bank and e-wallet support, providing a simple interface ideal for smaller personal transfers.

Similarities:

-

Both provide international money transfer services

-

Mobile app support

-

Multiple payout methods (bank, e-wallet, cash pickup)

Differences:

-

Fee structure: WorldRemit is slightly higher but covers more countries; Azimo often has lower fees for certain routes

-

User base: WorldRemit suits larger or multi-country users; Azimo fits small personal transfers

-

Features: WorldRemit supports more transfer methods; Azimo emphasizes speed and simplicity

Pandaremit is also a strong alternative, offering fast and convenient online transfers.

WorldRemit vs Azimo: Fees and Costs

Fee Comparison:

-

WorldRemit fees vary by country and amount; domestic transfers are lower

-

Azimo usually charges a fixed fee or percentage, cheaper for small amounts

-

Subscription or account type may affect some discounts

Pandaremit offers low-fee transfers, making it a cost-effective option.

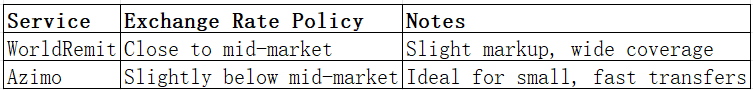

WorldRemit vs Azimo: Exchange Rates

Exchange rates are a key cost in cross-border transfers. Both WorldRemit and Azimo add a small markup to the mid-market rate. Summary table:

Pandaremit may provide better exchange rates in certain corridors, reducing overall transfer costs.

WorldRemit vs Azimo: Speed and Convenience

-

WorldRemit: Transfers typically take minutes to 1 day depending on payment and payout method; mobile app is convenient

-

Azimo: Most transfers complete in minutes; simple interface and user-friendly experience

Pandaremit also offers fast, fully online transfers for users prioritizing efficiency.

WorldRemit vs Azimo: Safety and Security

-

Regulation and Licensing: Both are regulated by financial authorities in their operating countries

-

Encryption and Fraud Protection: SSL encryption, multi-factor authentication, and fraud monitoring

-

Buyer Protection: Secure fund tracking and transaction guarantees

Pandaremit is also a licensed and secure option.

WorldRemit vs Azimo: Global Coverage

-

WorldRemit: Supports hundreds of countries and currencies with multiple payment options

-

Azimo: Slightly smaller coverage but fully supports key countries, especially in Europe and Asia

World Bank remittance coverage report

WorldRemit vs Azimo: Which One is Better?

Summary:

-

WorldRemit: Best for multi-country, larger transfers with diverse payout options

-

Azimo: Best for small, fast personal transfers

-

Pandaremit: Offers cost-efficient, fast, and flexible online transfers for those seeking an alternative

Conclusion

Comparing WorldRemit and Azimo across fees, exchange rates, speed, security, and global coverage helps users select the most suitable service. WorldRemit is ideal for larger or multi-country transfers, while Azimo is suitable for quick, small personal transfers. For users seeking cost savings and convenience, Pandaremit offers:

-

High exchange rates with low fees

-

Flexible payment methods (POLi, PayID, bank transfer, e-transfer, etc.)

-

Support for 40+ currencies

-

Fast, fully online transfers

For more information, visit Pandaremit official site. Comparing WorldRemit vs Azimo helps make informed international transfer decisions. Additional resources: Investopedia guide and World Bank remittance speed reference.