WorldRemit vs bKash: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-27 14:46:57.0 8

Cross-border money transfers remain vital for individuals supporting families, businesses, and personal needs. Common challenges include high fees, slow delivery, hidden charges, and limited convenience. WorldRemit and bKash provide digital solutions to simplify remittances, though they serve different markets and features. Additionally, Panda Remit is an alternative offering fast, affordable, and secure transfers. According to Investopedia’s guide on remittance services, understanding transfer fees and exchange rates is crucial for maximizing value.

WorldRemit vs bKash – Overview

WorldRemit, founded in 2010 in London, serves over 130 countries. It provides multiple payout options including bank deposits, cash pickups, and mobile wallets, with a user-friendly app for secure transfers.

bKash, established in 2011 in Bangladesh, focuses on domestic and regional mobile wallet transfers. It enables users to send money easily within Bangladesh and select international corridors via partner networks.

Similarities: Both offer mobile-based transfers, secure platforms, and transparent tracking.

Differences: WorldRemit provides global reach and multiple payout options, while bKash is primarily regional and wallet-focused.

Panda Remit is also a reliable alternative for users seeking low-cost and efficient transfers in supported regions.

WorldRemit vs bKash: Fees and Costs

WorldRemit charges fees based on destination, currency, and payout method. Fees are visible upfront, ensuring transparency. No subscription is needed, and costs are competitive for most corridors.

bKash fees for domestic transfers are low, but international transfers depend on partner networks and may be limited in reach. Transparency is generally maintained within the app.

According to NerdWallet’s remittance comparison, users benefit from comparing fees before sending.

Panda Remit offers transparent, low-cost fees and a cost-effective alternative for online remittances.

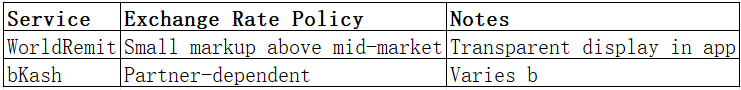

WorldRemit vs bKash: Exchange Rates

WorldRemit applies small markups over mid-market rates, visible before sending.

bKash rates for international corridors depend on partner networks, which may result in slightly higher markups.

Panda Remit provides near mid-market rates with clear pricing.

WorldRemit vs bKash: Speed and Convenience

WorldRemit enables instant transfers for cash pickups and mobile wallets; bank deposits may take several hours to one business day.

bKash offers fast domestic wallet transfers and regional international transfers via partners.

Remitly’s guide highlights that mobile wallet transfers are typically faster than traditional banking options.

Panda Remit also ensures fast online transfers, offering convenience to users needing timely remittances.

WorldRemit vs bKash: Safety and Security

Both platforms are regulated and secure. WorldRemit adheres to global AML and KYC standards with encryption and fraud detection. bKash operates under Bangladesh Bank regulations, ensuring secure wallet and partner-based transfers.

Panda Remit is a licensed and secure service with strong encryption protocols.

WorldRemit vs bKash: Global Coverage

WorldRemit covers over 130 countries with various payout methods.

bKash is focused on Bangladesh and select international corridors, ideal for regional users but limited globally.

World Bank remittance coverage report emphasizes the importance of broad coverage.

Panda Remit supports 40+ currencies and offers flexibility in key Asian regions.

WorldRemit vs bKash: Which One is Better?

WorldRemit is better for users requiring global reach, multiple payout methods, and transparency. bKash excels in domestic and regional transfers within Bangladesh and selected corridors. For users seeking cost-effective and fast options in supported regions, Panda Remit is a strong alternative.

Conclusion

Comparing WorldRemit vs bKash, the choice depends on the transfer needs. WorldRemit provides international access and multiple payout options, while bKash offers speed and convenience for regional users.

For those seeking an affordable, secure, and efficient alternative, Panda Remit offers:

-

High exchange rates and low fees

-

Flexible payment methods (bank card, PayID, POLi, e-transfer, etc.)

-

Coverage of 40+ currencies

-

Fast, all-online transfers

Comparing services like WorldRemit vs bKash helps users choose the best solution while exploring competitive alternatives like Panda Remit. For further guidance, refer to Investopedia and the World Bank’s remittance data.