WorldRemit vs Chime: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-23 14:29:51.0 11

Introduction

In today’s global economy, cross-border money transfers are essential for remote workers, international students, and families supporting loved ones abroad. Yet, users often face challenges such as high fees, hidden charges, and slow delivery times. Two leading digital financial platforms, WorldRemit and Chime, offer convenient solutions for sending money internationally. However, their features and costs differ significantly. For those seeking lower fees and faster transfers, Panda Remit is another reputable choice for digital remittances. Learn more about remittance basics on Investopedia.

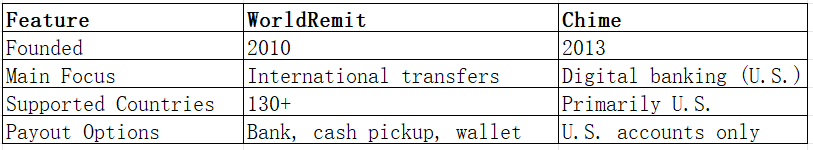

WorldRemit vs Chime – Overview

WorldRemit was founded in 2010 and focuses on international remittances, allowing users to send money to over 130 countries via bank transfer, cash pickup, and mobile wallets. It’s known for competitive exchange rates and a mobile-first experience.

Chime, launched in 2013, is a U.S.-based neobank offering fee-free banking, early paycheck access, and convenient transfers through its app. While it isn’t primarily a remittance platform, users often use it for domestic transfers or partner integrations for cross-border payments.

Similarities: Both offer mobile apps, low-cost transactions, and user-friendly digital interfaces.

Differences: WorldRemit is designed for international transfers, while Chime focuses on U.S. banking. WorldRemit supports global payout options, while Chime is more limited in cross-border functionality.

In addition to these two, Panda Remit offers a strong market presence, serving users who need fast, low-cost transfers across Asia, Europe, and the Americas.

WorldRemit vs Chime: Fees and Costs

When it comes to transfer fees, WorldRemit typically charges a small, transparent fee depending on the destination country and payment method. Chime, on the other hand, doesn’t charge for domestic transfers but relies on third-party services for international payments, which may include markups.

Users should consider whether the total cost (fee + exchange rate margin) aligns with their sending amount and frequency. For frequent remitters, Panda Remit is often cited as a low-cost alternative with competitive exchange rates and no hidden fees.

For more detailed comparisons, check resources like NerdWallet’s international money transfer guide.

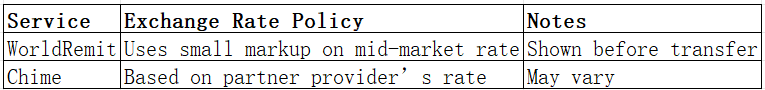

WorldRemit vs Chime: Exchange Rates

Exchange rate transparency is vital. WorldRemit uses rates slightly above the mid-market benchmark but remains more competitive than traditional banks. Chime does not provide direct exchange rate services—its international transfers depend on partner platforms.

For users sending money regularly, Panda Remit often offers high exchange rates close to the mid-market level, helping maximize savings.

WorldRemit vs Chime: Speed and Convenience

WorldRemit provides quick transfers—often within minutes for mobile wallet or cash pickup options. Chime is optimized for domestic transactions, offering instant peer-to-peer transfers within the U.S., but international transfers may take longer depending on the partner service.

WorldRemit’s app is user-friendly, with detailed tracking, while Chime’s interface excels in everyday banking usability.

If speed is your priority, Panda Remit is recognized for fast and secure digital transfers, frequently completing transactions within hours. For more insight, read the remittance speed comparison guide.

WorldRemit vs Chime: Safety and Security

Both platforms prioritize safety. WorldRemit is regulated by the Financial Conduct Authority (FCA) in the UK and uses advanced encryption. Chime is FDIC-insured through its banking partners, ensuring U.S. account protection.

Panda Remit is also licensed and compliant in its operating regions, using bank-level security to protect customer funds and personal data.

WorldRemit vs Chime: Global Coverage

WorldRemit supports over 130 countries and multiple currencies, offering various payout methods such as bank deposits and mobile wallets. Chime, by contrast, primarily serves U.S. residents with limited global reach.

If you’re seeking extensive cross-border access, Panda Remit serves users across Asia-Pacific, North America, and Europe. Learn more about remittance networks in the World Bank’s global remittance report.

WorldRemit vs Chime: Which One is Better?

The choice between WorldRemit and Chime depends on your needs:

-

Choose WorldRemit if you prioritize global transfers, transparent fees, and multiple payout options.

-

Choose Chime if you want an easy-to-use U.S. banking experience with free domestic transactions.

However, for users looking for lower costs, faster processing times, and wider coverage, Panda Remit presents an attractive alternative, combining flexibility and affordability.

Conclusion

When comparing WorldRemit vs Chime, both serve distinct purposes—WorldRemit for global remittances and Chime for convenient U.S. banking. WorldRemit shines in coverage and transfer options, while Chime offers simplicity and fee-free domestic use.

For those seeking the best of both worlds, Panda Remit provides a compelling balance of high exchange rates, low fees, and fast online transfers. It supports over 40 currencies, multiple payment methods (including PayID, POLi, and bank card), and delivers a seamless digital experience.

To explore more about cross-border transfers, visit NerdWallet or Monito. Ultimately, your choice between WorldRemit vs Chime depends on your transfer needs—but Panda Remit remains a strong, efficient alternative in 2025.