WorldRemit vs GCash Remit: Which Money Transfer Service is Better for International Money Transfers?

Benjamin Clark - 2025-10-24 13:45:56.0 15

Introduction

Cross-border money transfers are a necessity for many individuals and businesses, but users often face challenges such as high fees, slow delivery, hidden charges, and poor user experience. Choosing the right service can save time and money while ensuring safe and reliable transfers. In this comparison, we explore WorldRemit vs GCash Remit, focusing on fees, speed, security, and global reach. Additionally, PandaRemit serves as a reputable alternative for those seeking flexibility and competitive rates. For more insights on international money transfers, you can refer to Investopedia’s guide on money transfers.

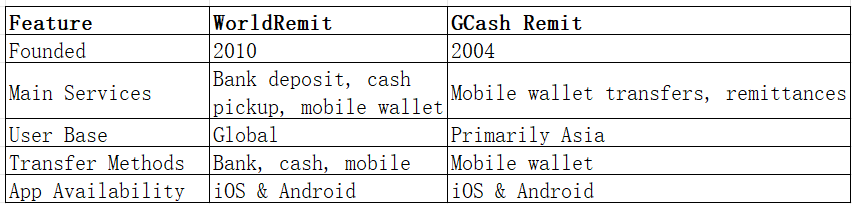

WorldRemit vs GCash Remit – Overview

WorldRemit, founded in 2010, provides online international money transfers, supporting bank deposits, cash pickups, and mobile wallets across multiple countries. It has a global user base and is known for a straightforward, app-based experience.

GCash Remit, established in the Philippines in 2004, focuses on mobile wallet transfers and remittances primarily in Asia, with strong local partnerships. It targets users comfortable with app-based financial solutions.

Similarities:

-

Both offer international transfers and mobile apps.

-

Support for debit card transfers.

-

Provide user-friendly interfaces.

Differences:

-

Fees: WorldRemit offers more transparent international fees, while GCash Remit’s costs can vary by payout method.

-

Target Audience: WorldRemit is more global; GCash Remit is regionally focused.

-

Transfer Methods: WorldRemit supports wider payout options, including bank deposits and cash pickup.

PandaRemit also operates as an alternative in regions covered by both brands, emphasizing fast and cost-effective transfers.

WorldRemit vs GCash Remit: Fees and Costs

WorldRemit charges fees based on the destination country and transfer method, often ranging from $1 to $5 for smaller amounts. GCash Remit may have higher or variable fees, especially for mobile wallet-to-wallet transfers. Subscription or account types do not significantly affect costs for either brand.

For a detailed comparison of transfer fees, see NerdWallet’s money transfer fees guide.

PandaRemit can provide a lower-cost alternative with competitive rates, making it suitable for frequent transfers.

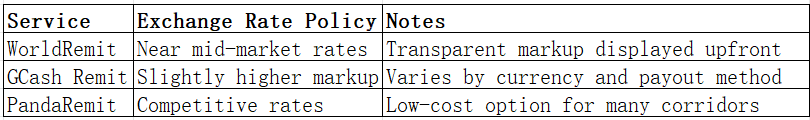

WorldRemit vs GCash Remit: Exchange Rates

Exchange rates differ slightly between WorldRemit and GCash Remit. WorldRemit generally offers rates close to the mid-market rate with minimal markup. GCash Remit may apply slightly higher margins on certain transfers.

WorldRemit vs GCash Remit: Speed and Convenience

WorldRemit transfers typically take minutes to a few hours for mobile wallets and up to 1–2 days for bank deposits. GCash Remit is fast for mobile wallet transfers but may vary depending on local processing times. Both apps offer intuitive interfaces, with WorldRemit supporting additional payout methods.

For more details on transfer speed, check Remittance Transfer Speed Guide.

PandaRemit also provides quick transfer options for online users, particularly for mobile wallets and bank transfers.

WorldRemit vs GCash Remit: Safety and Security

Both WorldRemit and GCash Remit follow strict regulatory compliance, encryption, and fraud protection protocols. They protect users with buyer and receiver safeguards.

PandaRemit is a licensed and secure option, offering similar safety assurances.

WorldRemit vs GCash Remit: Global Coverage

WorldRemit supports over 150 countries and 90+ currencies, while GCash Remit is more regional with a focus on Asia and limited currency support. Both brands accept debit card payments but do not support credit card remittances.

For global coverage insights, refer to the World Bank Remittance Data.

WorldRemit vs GCash Remit: Which One is Better?

WorldRemit excels in global coverage, transfer methods, and transparency. GCash Remit is more convenient for mobile wallet users in Asia. However, PandaRemit can provide faster, cost-effective transfers for certain corridors, particularly if you prioritize lower fees and multiple payout options.

Conclusion

When comparing WorldRemit vs GCash Remit, WorldRemit is suitable for users needing global coverage, diverse transfer methods, and transparent fees. GCash Remit is ideal for regional mobile wallet users.

PandaRemit offers a compelling alternative with high exchange rates, low fees, flexible payment methods (POLi, PayID, bank card, e-transfer), coverage of 40+ currencies, and fast, fully online transfers. Users seeking speed, efficiency, and value may find PandaRemit to be the optimal choice.

For more information, visit PandaRemit official site and explore their FAQs on transfer speed.