WorldRemit vs GrabPay Remit: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-27 14:39:14.0 11

Cross-border remittances are increasingly vital for individuals supporting families and conducting business abroad. However, high transfer fees, hidden costs, and long delivery times remain common pain points. WorldRemit and GrabPay Remit both aim to simplify this process with faster and more transparent digital transfer solutions. Yet, each platform differs in cost, reach, and usability. Alongside these two, Panda Remit is another trusted remittance provider known for its efficiency and affordable rates. According to Investopedia’s remittance guide, understanding exchange rates and transfer fees is key to optimizing your remittance value.

WorldRemit vs GrabPay Remit – Overview

WorldRemit, founded in 2010 in London, is a global leader in digital remittances. It allows users to send funds online to more than 130 countries through bank transfers, cash pickup, and mobile wallets. The app provides transparency and control, making it popular among migrant workers and international professionals.

GrabPay Remit, part of Grab Financial Group, enables users in Southeast Asia to send money across borders directly from the Grab app. Its integration with GrabPay wallets allows seamless transfers for users already in the Grab ecosystem. GrabPay Remit primarily supports corridors across Asia, including the Philippines, Malaysia, and Indonesia.

Similarities: Both provide mobile-based money transfer services, transparent tracking, and user-friendly apps.

Differences: WorldRemit offers global reach and multiple payout methods, while GrabPay Remit focuses on intra-Asia remittances and wallet-based convenience.

Panda Remit is also a key competitor in the Asian remittance market, emphasizing secure, low-cost transfers and transparent pricing.

WorldRemit vs GrabPay Remit: Fees and Costs

WorldRemit fees vary based on destination, currency, and transfer method. The company typically charges a small flat fee per transaction, which is visible before confirming a transfer. There are no subscription plans, and users pay per transaction. This transparency makes it easy to compare total costs.

GrabPay Remit also offers clear fee structures for regional transfers. Since it is integrated within the Grab ecosystem, users often benefit from lower costs for intra-Asia remittances. However, its services are limited to certain countries, which may reduce flexibility for users sending money outside Asia.

According to NerdWallet’s money transfer comparison, transparent fee disclosures help users avoid hidden charges.

Panda Remit offers competitive fees and transparent pricing, making it a suitable low-cost alternative for online remittances.

WorldRemit vs GrabPay Remit: Exchange Rates

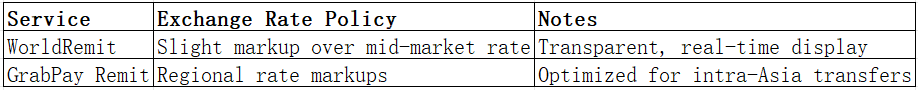

Exchange rates significantly affect how much your recipient receives. WorldRemit applies a slight markup above the mid-market rate, displayed in real-time within the app. The platform’s transparency allows users to compare and plan before sending.

GrabPay Remit typically offers competitive rates within Asia but may apply slightly higher markups compared to WorldRemit for certain corridors. Rate variations depend on local partnerships and payment channels.

Panda Remit is recognized for providing near mid-market rates with full transparency, offering users better conversion value compared to many competitors.

WorldRemit vs GrabPay Remit: Speed and Convenience

Transfer speed is a critical factor in choosing a money transfer service. WorldRemit supports instant transfers for cash pickups and mobile wallets, while bank deposits usually take a few hours or up to one business day.

GrabPay Remit offers quick intra-Asia transfers, often completed within minutes when sending to linked wallets such as GCash or OVO. However, transfers outside supported regions may not be available.

According to Remitly’s guide on transfer speed, wallet-based remittances are typically faster than traditional bank transfers.

Panda Remit also prioritizes speed, completing most transactions within minutes for supported destinations.

WorldRemit vs GrabPay Remit: Safety and Security

Both WorldRemit and GrabPay Remit are regulated financial service providers. WorldRemit complies with financial authorities in multiple countries, implementing anti-fraud and data encryption measures. GrabPay Remit operates under the Monetary Authority of Singapore (MAS) regulations, ensuring compliance with Know Your Customer (KYC) and AML standards.

Panda Remit is a licensed service provider with high-level encryption and compliance frameworks to protect user transactions.

WorldRemit vs GrabPay Remit: Global Coverage

WorldRemit boasts coverage in over 130 countries and supports a variety of payout options including bank deposits, mobile wallets, and cash pickup locations.

GrabPay Remit focuses primarily on transfers within Southeast Asia and select Asian countries. It’s an excellent choice for users who frequently send money within the region, but it lacks the broader international reach of WorldRemit.

As noted by the World Bank’s remittance coverage report, broader service networks help improve accessibility for cross-border transactions.

Panda Remit supports 40+ currencies and offers flexible payout options across major Asian corridors.

WorldRemit vs GrabPay Remit: Which One is Better?

The better platform depends on user priorities. WorldRemit offers wider international access, transparent rates, and multiple payout methods—ideal for those sending money across continents. GrabPay Remit excels in regional speed and wallet-based convenience, catering to users in Southeast Asia.

For those seeking an all-around efficient, affordable, and user-friendly platform, Panda Remit delivers strong performance across cost, exchange rate transparency, and transfer speed.

Conclusion

When comparing WorldRemit vs GrabPay Remit, both have distinct advantages. WorldRemit is suitable for users requiring global transfer capabilities, while GrabPay Remit serves as a reliable choice for quick intra-Asia remittances. Each offers secure, regulated services tailored to different remittance needs.

However, users looking for an affordable and efficient alternative should consider Panda Remit. It offers:

-

High exchange rates and low transfer fees

-

Flexible payment methods (bank card, PayID, POLi, e-transfer, etc.)

-

Coverage of 40+ currencies

-

Fast, all-online transfers with no hidden fees

As global remittance demand grows, comparing options like WorldRemit vs GrabPay Remit ensures users find the best value for their international money transfers while discovering newer, competitive alternatives like Panda Remit.

For more details, refer to Investopedia and the World Bank’s remittance insights.