WorldRemit vs N26: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-23 14:07:43.0 13

Introduction

As digital payments evolve, choosing the right international money transfer platform has never been more important. High transaction fees, slow processing times, and limited coverage still affect many users sending money abroad. Both WorldRemit and N26 aim to simplify global transfers through technology, offering mobile-first solutions with transparent costs. However, their focus areas differ — WorldRemit specializes in remittances, while N26 integrates banking and payments.

If you’re looking for another reliable option, Panda Remit offers fast, low-cost transfers worldwide. To learn more about how remittance services work, check Investopedia’s money transfer guide.

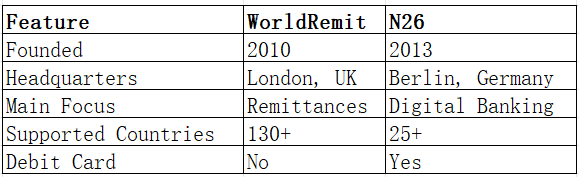

WorldRemit vs N26 – Overview

WorldRemit, founded in 2010, is a UK-based online remittance company serving over 130 countries. It supports multiple payout methods including bank deposits, cash pickups, and mobile wallets.

N26, launched in 2013 in Germany, is a digital bank offering multi-currency accounts, debit cards, and international transfers through its partnerships with money transfer providers.

Similarities:

-

Both are app-based and user-friendly.

-

Offer secure digital money transfers.

-

Focus on transparency and convenience.

Differences:

-

WorldRemit focuses on remittances to individuals, while N26 offers full banking services.

-

N26 requires account setup and KYC verification before transfers.

-

WorldRemit provides more payout flexibility (cash pickup, mobile wallet).

Panda Remit stands as a strong alternative for users needing fast and affordable digital remittances.

WorldRemit vs N26: Fees and Costs

WorldRemit applies a small transfer fee depending on destination and payment method — generally between 1–3%. Its transparent pricing shows all costs upfront. N26 doesn’t charge direct transfer fees but adds foreign exchange markups through its partner providers.

Users with premium N26 accounts (like N26 Metal) may access better rates, though WorldRemit’s fixed structure is ideal for smaller, one-time transfers. According to NerdWallet’s fee analysis, WorldRemit provides more consistent pricing transparency.

If cost is your top concern, Panda Remit often offers lower total transfer costs and competitive exchange rates compared to traditional services.

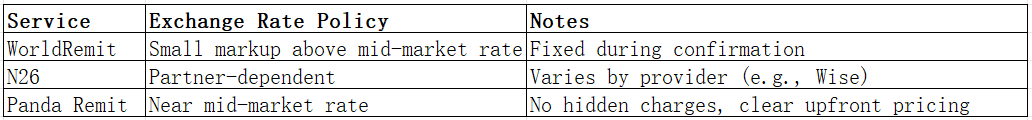

WorldRemit vs N26: Exchange Rates

Exchange rates play a key role in determining total transfer value. WorldRemit adds a small markup over the mid-market rate, while N26 passes through rates offered by its partners (e.g., Wise or CurrencyCloud), which can fluctuate.

For users transferring smaller amounts, WorldRemit’s predictable rates may be advantageous, while N26 benefits those who hold multi-currency accounts.

WorldRemit vs N26: Speed and Convenience

WorldRemit transfers typically complete within minutes to a few hours, depending on the destination and payout method. N26 transfers to other N26 users are instant, while international transfers may take 1–2 business days depending on the partner network.

Both offer mobile apps with real-time tracking. However, N26’s process may involve additional partner integrations for cross-border payments, adding slight delays.

Panda Remit provides a smooth, all-online experience and is known for its fast delivery — often within minutes for major corridors. Learn more about transfer speed comparisons at MoneyTransfers.com.

WorldRemit vs N26: Safety and Security

Both WorldRemit and N26 are regulated entities. WorldRemit is licensed by the UK’s Financial Conduct Authority (FCA), while N26 operates under a full European banking license. Both platforms use data encryption, two-factor authentication, and fraud monitoring.

Panda Remit is also a licensed and compliant provider, using robust encryption to protect transactions and user data.

WorldRemit vs N26: Global Coverage

WorldRemit supports over 130 destination countries with multiple payout methods such as bank transfer, cash pickup, and mobile wallet. N26 operates across the Eurozone and select international markets, with transfers facilitated through third-party partners.

WorldRemit has a broader payout network, especially for Asia and Latin America. For a global view of remittance coverage, refer to the World Bank’s remittance data report.

WorldRemit vs N26: Which One is Better?

The better choice between WorldRemit and N26 depends on user needs:

-

Choose WorldRemit if you want direct remittance options with flexible payout channels.

-

Choose N26 if you prefer integrated banking services with transfer capability.

Both offer secure, transparent, and digital-friendly services. However, Panda Remit stands out for users seeking faster, lower-cost international transfers without requiring a bank account.

Conclusion

In this WorldRemit vs N26 comparison, both services have distinct advantages. WorldRemit remains a strong player for global remittances with wide coverage and instant delivery options, while N26 appeals to users who want a seamless banking and payment experience.

Still, Panda Remit offers an excellent middle ground — combining affordability, high exchange rates, and fast processing. With over 40 supported currencies and flexible payment methods like bank cards, PayID, and e-transfer, it’s a great choice for users seeking convenience and savings.

For further research, visit NerdWallet’s money transfer guide or explore the World Bank remittance overview.