WorldRemit vs OFX: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-23 14:33:41.0 18

Introduction

Sending money abroad has become easier thanks to digital platforms like WorldRemit and OFX, but users still face issues such as high transaction fees, currency markups, and slow processing times. Choosing the right provider can save significant time and money. In this article, we’ll compare these two trusted brands in detail. For those seeking faster and lower-cost transfers, Panda Remit is another strong player in the digital remittance industry. Learn more about international transfer basics at Investopedia.

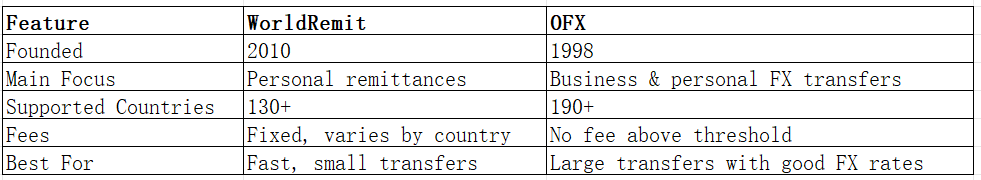

WorldRemit vs OFX – Overview

WorldRemit, founded in 2010, is a global remittance service specializing in fast online transfers to over 130 countries. It supports multiple payout methods, including bank transfers, mobile wallets, and cash pickup.

OFX, established in 1998 in Australia, focuses on international currency transfers for individuals and businesses. It offers strong foreign exchange services, dedicated account managers, and zero transfer fees above certain thresholds.

Similarities: Both offer online platforms, mobile apps, and regulated money transfer operations. They provide real-time exchange rate tracking and support various currencies.

Differences: WorldRemit focuses on speed and convenience for small transfers, while OFX targets high-value transactions with better FX rates. OFX also provides corporate transfer solutions.

Another option for users prioritizing low fees and fast processing is Panda Remit, known for its seamless digital transfers.

WorldRemit vs OFX: Fees and Costs

WorldRemit charges a small, transparent fee that varies depending on the destination country, payment method, and payout type. Costs are shown upfront before confirming a transfer.

OFX, by contrast, eliminates fixed fees for large transfers (typically over USD 10,000). However, smaller transfers may incur higher costs due to exchange rate margins.

For users seeking lower total costs, especially for frequent or smaller transactions, Panda Remit can be an affordable choice with minimal fees and transparent pricing.

You can read more about fee comparisons at NerdWallet’s international transfer guide.

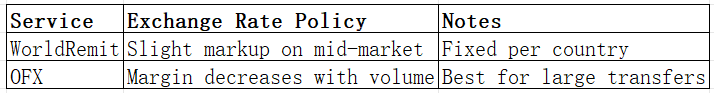

WorldRemit vs OFX: Exchange Rates

Exchange rate margins can significantly affect how much your recipient receives. WorldRemit adds a small markup above the mid-market rate but provides transparency within the app. OFX offers better rates for high-value transfers since its FX specialists negotiate tighter spreads.

For users who value consistent, competitive rates, Panda Remit often offers high exchange rates close to the mid-market level.

WorldRemit vs OFX: Speed and Convenience

WorldRemit is designed for quick delivery — most transfers are completed within minutes for mobile wallet or cash pickup options. OFX typically takes 1–3 business days, as it processes larger transactions through banking networks.

WorldRemit offers instant tracking via its mobile app, while OFX provides personalized service with account managers for corporate clients.

Those prioritizing speed and a fully online experience might find Panda Remit more suitable, as it completes many transfers within hours. Explore more on remittance speeds at Monito’s comparison guide.

WorldRemit vs OFX: Safety and Security

Both platforms maintain high security standards. WorldRemit is regulated by the UK’s Financial Conduct Authority (FCA), while OFX holds licenses across Australia, the UK, Canada, and the U.S. They both use encryption and compliance protocols for fraud prevention.

Panda Remit also prioritizes security, operating under financial regulations in its service regions with strict data protection and encryption systems.

WorldRemit vs OFX: Global Coverage

WorldRemit supports over 130 countries, enabling transfers to bank accounts, cash pickup points, and mobile wallets. OFX covers 190+ countries and supports more than 50 currencies, particularly for bank-to-bank transfers.

If you’re looking for competitive coverage in Asia, Europe, or North America, Panda Remit provides wide currency support and flexible payment methods. Learn more about global remittance trends in the World Bank’s report.

WorldRemit vs OFX: Which One is Better?

If your goal is fast, small-scale remittances, WorldRemit is likely the better choice due to its accessibility and speed. For larger transfers, especially business-related or high-value remittances, OFX provides better exchange rates and no-fee options.

However, users who value simplicity, competitive rates, and low fees may find Panda Remit to be an excellent alternative — combining the best features of both platforms with a streamlined digital process.

Conclusion

When it comes to WorldRemit vs OFX, both platforms cater to different transfer needs. WorldRemit is ideal for personal, quick transfers, while OFX suits large, business-oriented transactions.

For those who seek faster, low-fee, and flexible online transfers, Panda Remit stands out as a powerful alternative. It offers:

-

Competitive exchange rates and minimal fees

-

Fast digital transfers, often within hours

-

Support for 40+ currencies across Asia, Europe, and North America

-

Convenient payment methods such as PayID, POLi, and bank card

To explore more comparisons, visit Monito or NerdWallet. In the end, your choice between WorldRemit vs OFX depends on transfer size and speed — but Panda Remit remains a versatile, affordable option for 2025.