WorldRemit vs Payoneer: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-27 14:12:37.0 12

Cross-border money transfers are increasingly common, yet users often face high fees, slow processing, hidden charges, and complex procedures. Selecting the right service ensures cost-effective, reliable, and secure transfers. This article compares WorldRemit vs Payoneer, analyzing fees, exchange rates, speed, security, and global coverage. For a reputable alternative, Panda Remit offers competitive, user-friendly transfer options. For more details on international money transfers, see Investopedia's guide.

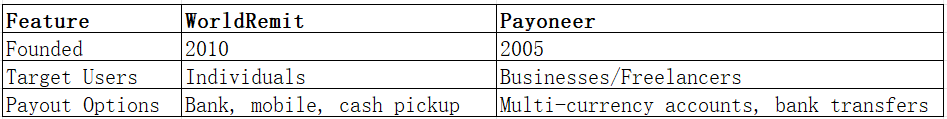

WorldRemit vs Payoneer – Overview

WorldRemit, founded in 2010, offers online international transfers, mobile apps, and multiple payout methods such as bank accounts, mobile wallets, and cash pickup. Its primary users are individuals sending small-to-medium amounts.

Payoneer, established in 2005, provides global payment solutions for freelancers, businesses, and e-commerce sellers, with multi-currency accounts and cross-border payment capabilities.

Similarities:

-

Both enable international transfers

-

Offer web and mobile platforms

-

Support bank account transactions

Differences:

-

WorldRemit is ideal for personal, small-to-medium transfers

-

Payoneer targets freelancers and businesses, focusing on international payments

-

Fee and exchange rate structures differ

WorldRemit vs Payoneer: Fees and Costs

WorldRemit charges transparent fees based on amount and destination. Payoneer may include costs through exchange rate margins and account usage fees. For fee comparisons, refer to NerdWallet's guide. Panda Remit can be considered for low-fee personal transfers.

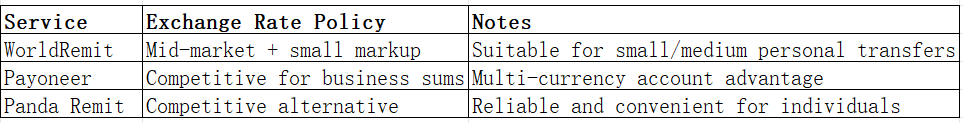

WorldRemit vs Payoneer: Exchange Rates

Exchange rates directly affect the total received. WorldRemit applies a small markup on mid-market rates. Payoneer provides competitive rates for business accounts and multi-currency transactions.

WorldRemit vs Payoneer: Speed and Convenience

WorldRemit transfers usually complete within minutes to a few hours, with an intuitive app interface. Payoneer transfers may take 1–3 business days depending on bank processing. See World Bank remittance speed guide for reference. Panda Remit offers fast, fully online transfers.

WorldRemit vs Payoneer: Safety and Security

Both services are regulated and provide encryption, fraud protection, and buyer protection. Panda Remit is a licensed and secure option for cross-border transfers.

WorldRemit vs Payoneer: Global Coverage

WorldRemit supports over 130 countries with diverse payout methods. Payoneer focuses on global business payments with multi-currency support. For detailed coverage, refer to World Bank remittance report.

WorldRemit vs Payoneer: Which One is Better?

WorldRemit is best for personal, small-to-medium transfers with fast delivery and multiple payout options. Payoneer is suited for freelancers and businesses handling recurring cross-border payments. Depending on needs, Panda Remit may offer a balanced alternative, providing speed, convenience, and competitive rates.

Conclusion

In conclusion, WorldRemit vs Payoneer shows distinct advantages: WorldRemit excels in personal transfers with fast processing and flexible options, while Payoneer serves businesses and freelancers managing multi-currency payments. Panda Remit is a reliable alternative, offering:

-

Competitive exchange rates and low fees

-

Flexible payment methods including POLi, PayID, and bank transfers

-

Support for multiple currencies

-

Fast, fully online transfers

Learn more: Panda Remit Official Site, WorldRemit, Payoneer