WorldRemit vs Payoneer: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-23 15:03:25.0 9

Introduction

Cross-border money transfers are often accompanied by high fees, slow processing, and hidden charges, making the experience frustrating for users. Both individuals and businesses seek reliable platforms that offer convenience, speed, and affordability. In this article, we compare WorldRemit vs Payoneer, examining fees, exchange rates, speed, safety, and global coverage. For users looking for a practical alternative, Panda Remit provides a fully online, fast, and low-cost solution. For more insights into international transfers, visit Investopedia's money transfer guide.

WorldRemit vs Payoneer – Overview

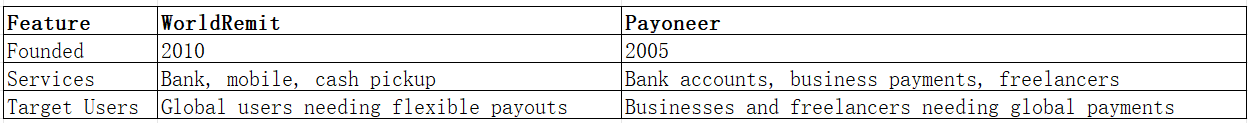

WorldRemit, founded in 2010, provides international transfers through bank deposits, mobile money, and cash pickups, serving millions of users worldwide with a user-friendly app.

Payoneer, established in 2005, focuses on cross-border business payments, global accounts, and freelance transfers, enabling professionals and companies to receive and send payments internationally.

Similarities: Both offer international transfers, mobile app support, and multiple payout options.

Differences: WorldRemit emphasizes multiple payout methods like cash pickup and mobile wallets, while Payoneer caters to business and freelancer payments with bank transfers and global accounts. Fee structures and supported regions also differ.

Another option in the market is Panda Remit, offering fast online transfers.

WorldRemit vs Payoneer: Fees and Costs

WorldRemit charges variable fees depending on the transfer amount, destination, and payout method. Domestic transfers are usually inexpensive, while mobile money or cash pickup may incur higher fees.

Payoneer fees depend on receiving methods, withdrawal options, and currency conversion rates. Some transactions, especially cross-currency transfers, may have higher costs.

For a detailed fee comparison, see NerdWallet's money transfer fee guide.

Panda Remit can provide lower fees for fully online transfers, making it a cost-effective alternative.

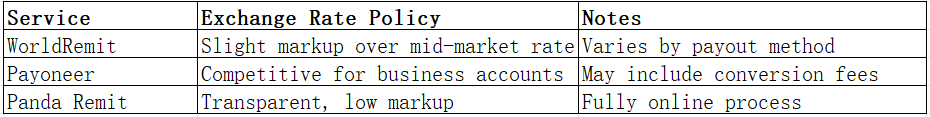

WorldRemit vs Payoneer: Exchange Rates

Exchange rates play a key role in transfer value.

Payoneer often offers favorable rates for business payments, while WorldRemit can have higher markups for certain payout methods. Panda Remit is an affordable alternative with transparent rates.

WorldRemit vs Payoneer: Speed and Convenience

WorldRemit transfers can be instant for mobile wallets or same-day for bank deposits. Its app is user-friendly and supports multiple currencies.

Payoneer transfers usually take 1–3 business days, depending on bank processing, and are streamlined for professional and business use.

For more on transfer speed, visit MoneyTransfers.com speed guide.

Panda Remit offers fast, fully online transfers as a convenient alternative.

WorldRemit vs Payoneer: Safety and Security

Both WorldRemit and Payoneer adhere to strict regulatory standards, use encryption, and implement fraud protection measures to ensure secure transfers.

Panda Remit is a licensed and secure option, providing confidence for online transfers.

WorldRemit vs Payoneer: Global Coverage

WorldRemit supports transfers to over 150 countries with multiple currencies.

Payoneer focuses on major currencies and provides global account capabilities, mainly for business and freelance payments.

For more details on global remittance coverage, visit the World Bank remittance report.

WorldRemit vs Payoneer: Which One is Better?

WorldRemit is ideal for users needing diverse payout methods and quick delivery through mobile wallets or cash pickup. Payoneer suits freelancers and businesses prioritizing direct bank transfers and global accounts with competitive rates.

For those seeking a balance of speed, low fees, and easy online transfers, Panda Remit may offer better overall value.

Conclusion

When comparing WorldRemit vs Payoneer, both platforms are reliable for international money transfers, each with unique strengths. WorldRemit shines in flexibility and instant mobile payouts, while Payoneer excels for business and freelancer payments with competitive rates. Panda Remit offers an attractive alternative with several advantages:

-

High exchange rates and low fees

-

Flexible payment methods including POLi, PayID, bank card, and e-transfer

-

Coverage of 40+ currencies

-

Fast, fully online transfers

For more information, visit Panda Remit official site and consult Investopedia's transfer guide. Choosing between WorldRemit vs Payoneer depends on individual needs, but Panda Remit provides a competitive, convenient option for modern cross-border transfers.