WorldRemit vs RemitBee: Which Money Transfer Service is Better for International Money Transfers?

Benjamin Clark - 2025-10-24 14:12:24.0 13

Introduction

Cross-border money transfers are vital for individuals and businesses, yet high fees, slow delivery, hidden charges, and poor usability often frustrate users. Selecting the right service can enhance convenience and reduce costs. This article examines WorldRemit vs RemitBee, considering fees, speed, security, and coverage. Additionally, PandaRemit is highlighted as a reputable alternative for efficient and affordable transfers. For further guidance on international remittances, see Investopedia’s money transfer guide.

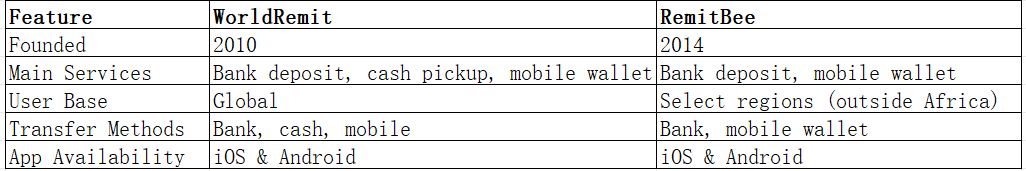

WorldRemit vs RemitBee – Overview

WorldRemit, founded in 2010, specializes in online international transfers including bank deposits, cash pickups, and mobile wallet transfers, serving a global audience via a user-friendly app.

RemitBee, established in 2014, focuses on fast, low-cost transfers to select countries outside Africa, emphasizing bank deposits and mobile wallet services.

Similarities:

-

Both offer mobile app-based international transfers.

-

Support secure digital transactions.

-

Accept debit card payments (credit cards not supported).

Differences:

-

Fees: WorldRemit charges vary by method and destination, while RemitBee emphasizes low-cost transfers.

-

Target Audience: WorldRemit has a global reach; RemitBee focuses on specific regions.

-

Transfer Methods: WorldRemit supports bank, cash, and mobile wallets; RemitBee focuses on bank and wallet deposits.

PandaRemit is an additional option for flexible and fast transfers.

WorldRemit vs RemitBee: Fees and Costs

WorldRemit charges fees depending on transfer method and destination, typically ranging from $1–$5 for smaller amounts. RemitBee focuses on low-cost transfers with transparent pricing.

For detailed fee comparison, see NerdWallet’s money transfer fees guide.

PandaRemit offers competitive, low-cost alternatives for frequent or small transfers.

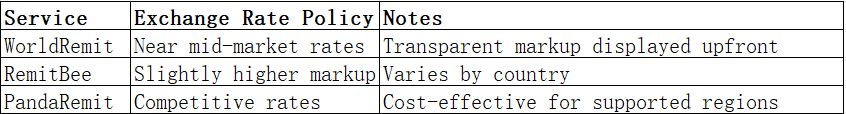

WorldRemit vs RemitBee: Exchange Rates

WorldRemit generally provides exchange rates near the mid-market rate. RemitBee may apply slightly higher margins depending on currency and region.

WorldRemit vs RemitBee: Speed and Convenience

WorldRemit delivers funds quickly to mobile wallets (minutes to hours) and 1–2 days for bank deposits. RemitBee offers fast transfers to bank accounts and wallets in supported regions.

For speed insights, see Remittance Transfer Speed Guide.

PandaRemit provides fast, all-online transfer options.

WorldRemit vs RemitBee: Safety and Security

Both WorldRemit and RemitBee are regulated and use encryption and fraud protection to safeguard transactions.

PandaRemit is also a licensed and secure option.

WorldRemit vs RemitBee: Global Coverage

WorldRemit supports 150+ countries and 90+ currencies, while RemitBee focuses on selected regions outside Africa. Both accept debit card payments; credit card transfers are not supported.

Refer to World Bank Remittance Data for coverage details.

WorldRemit vs RemitBee: Which One is Better?

WorldRemit excels in global coverage, multiple transfer methods, and transparent fees, making it ideal for international users. RemitBee is suitable for users in select regions seeking quick, low-cost bank or wallet transfers. PandaRemit is a convenient, cost-effective alternative for fast online transfers in supported regions.

Conclusion

Comparing WorldRemit vs RemitBee, WorldRemit is best for global users needing diverse transfer options and transparent fees. RemitBee works well for rapid, low-cost transfers in supported areas.

PandaRemit stands out as a competitive alternative, offering high exchange rates, low fees, flexible payment methods (POLi, PayID, bank card, e-transfer), coverage of 40+ currencies, and fast all-online transfers. For more details, visit PandaRemit official site and see their FAQs on transfer speed.