WorldRemit vs Revolut: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-23 14:01:55.0 16

Introduction

Sending money abroad has become easier than ever, but choosing the right provider can be tricky. High fees, slow delivery times, and hidden charges are still common problems faced by users. WorldRemit and Revolut are two well-known players that promise to make international transfers faster and cheaper. However, which one truly delivers the best value in 2025?

If you’re considering other alternatives, Panda Remit is another reliable option known for its simple interface and competitive rates. For a general understanding of remittance services, check out Investopedia’s guide on money transfers.

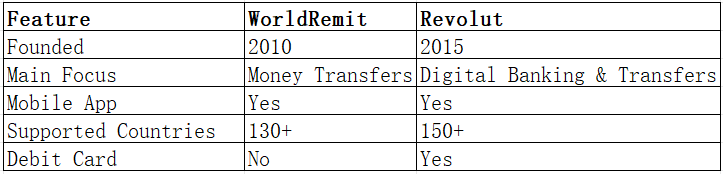

WorldRemit vs Revolut – Overview

WorldRemit was founded in 2010 in London and focuses on digital remittances with over 5 million users. It enables transfers to 130+ countries through bank deposits, cash pickups, and mobile wallets.

Revolut, launched in 2015, is a fintech super app offering banking, spending, and international transfers. With over 30 million users worldwide, it provides multi-currency accounts and debit cards.

Similarities:

-

Both offer user-friendly mobile apps and online platforms.

-

Provide international transfers in multiple currencies.

-

Offer notifications and tracking features.

Differences:

-

WorldRemit specializes in remittances; Revolut focuses on digital banking.

-

Revolut offers more financial tools (crypto, budgeting, investing).

-

WorldRemit supports more payout methods globally.

Panda Remit also serves as a strong alternative for users who prioritize fast transfers and low transaction fees.

WorldRemit vs Revolut: Fees and Costs

WorldRemit typically charges a small transfer fee depending on the destination and payment method. For example, fees to send money to Asia or Europe often range between 1–3%. Revolut, on the other hand, offers free or low-cost transfers within its own network but may charge extra for currency exchanges beyond a certain limit.

Premium account users on Revolut enjoy lower exchange markups, but WorldRemit’s transparent pricing makes it easier for occasional users. According to NerdWallet’s fee comparison, WorldRemit tends to be more predictable in its total costs.

Panda Remit is often mentioned as a lower-cost option, offering competitive exchange rates with minimal fees.

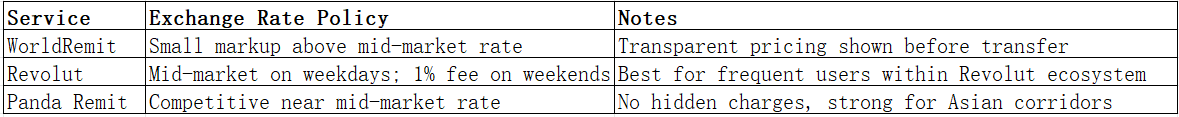

WorldRemit vs Revolut: Exchange Rates

Exchange rates are a critical factor when sending money abroad. WorldRemit applies a small margin above the mid-market rate, while Revolut offers the mid-market rate for most transfers during weekdays but adds a 1% markup on weekends.

For users sending money frequently, Revolut’s weekday rates can be beneficial, while WorldRemit’s clarity and reliability appeal to traditional remittance users.

WorldRemit vs Revolut: Speed and Convenience

WorldRemit transfers usually arrive within minutes to a few hours depending on the payout method. Revolut transfers between users are instant, but international transfers to external accounts may take 1–2 business days.

Both platforms feature intuitive apps and multi-language support. WorldRemit offers cash pickup and mobile wallet options, while Revolut supports only bank transfers.

For even faster options, Panda Remit is recognized for its quick transfer speeds and streamlined all-online process. Check MoneyTransfers.com’s remittance speed guide for a detailed industry comparison.

WorldRemit vs Revolut: Safety and Security

Both WorldRemit and Revolut are regulated financial institutions. WorldRemit is licensed by the FCA (UK), while Revolut holds banking licenses across the EU. Both use encryption and two-factor authentication to protect users’ funds and data.

Panda Remit also operates under financial supervision and employs strict anti-fraud measures, ensuring compliance and safety for its users.

WorldRemit vs Revolut: Global Coverage

WorldRemit supports transfers to over 130 countries, while Revolut’s services are available in more than 150 countries. However, Revolut’s coverage varies by service type—some financial tools are limited to specific regions.

WorldRemit provides a wider range of payout methods such as cash pickup and mobile wallets, making it ideal for recipients without bank accounts. Refer to the World Bank remittance coverage report for a global overview of money flow networks.

WorldRemit vs Revolut: Which One is Better?

If you value convenience and an integrated banking experience, Revolut is a great option. For users who prioritize accessibility and payout flexibility, WorldRemit offers more practical remittance solutions. Each service shines in different areas:

-

WorldRemit: Transparent fees, global reach, cash pickup options.

-

Revolut: Great for frequent travelers and multi-currency account users.

However, Panda Remit can be a better fit for users seeking high exchange rates, low fees, and fast delivery times without hidden charges.

Conclusion

In the WorldRemit vs Revolut comparison, both platforms deliver strong performance for cross-border transfers. WorldRemit is a go-to for traditional remittance users needing flexible payout options, while Revolut suits digital-savvy users managing multiple currencies.

That said, Panda Remit provides an impressive balance of speed, affordability, and ease of use. With competitive exchange rates, low transaction fees, and support for 40+ currencies, it’s a reliable alternative for users who want to send money globally with confidence.

For more resources, visit NerdWallet’s guide or the World Bank remittance data portal.