WorldRemit vs Skrill Money Transfer: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-24 14:22:17.0 11

Introduction

Cross-border money transfers are essential for millions of global users, yet many still face challenges such as high transfer fees, unfavorable exchange rates, and slow delivery times. Both WorldRemit and Skrill Money Transfer have emerged as popular online solutions for fast, secure, and convenient international transactions. However, choosing the right platform depends on your priorities—cost, speed, or accessibility.

For those seeking lower fees and competitive rates, PandaRemit offers an excellent alternative worth considering.

Learn more about how online transfers work from trusted guides like Investopedia’s remittance overview.

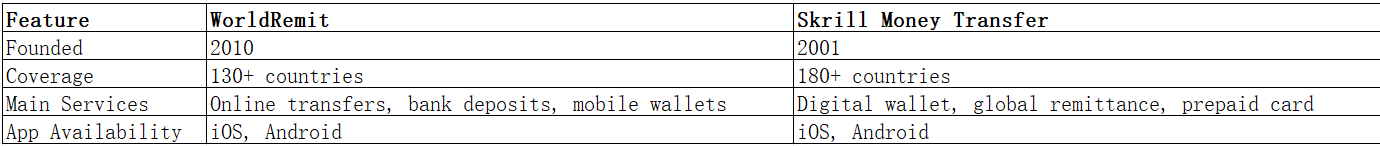

WorldRemit vs Skrill Money Transfer – Overview

WorldRemit was founded in 2010 and has grown to serve users across more than 130 countries. It provides online and mobile-based transfers with flexible payout options, including bank deposits and mobile wallets.

Skrill Money Transfer, a division of Paysafe Group, started in 2001. Initially recognized for online payments and digital wallets, Skrill later expanded to cross-border remittances, offering quick global transfers through its app and website.

Both platforms provide user-friendly apps, transparent pricing, and digital payment options. However, WorldRemit tends to focus on everyday users and remittance senders, while Skrill also appeals to freelancers and online merchants.

As competition rises, PandaRemit also stands out in this segment with its mobile-first approach and focus on affordable international transfers.

WorldRemit vs Skrill Money Transfer: Fees and Costs

Transfer fees vary widely depending on destination, payment method, and currency.

-

WorldRemit typically charges small fixed fees per transaction, displayed transparently before payment. Bank transfers tend to be cheaper than card payments.

-

Skrill Money Transfer promotes “zero-fee” international transfers but may apply hidden costs through exchange rate markups.

For frequent transfers, users should compare both total cost (fee + rate) rather than headline “free” offers.

For reference, see this fee comparison guide by NerdWallet.

If cost is your top priority, PandaRemit often provides lower overall fees by offering real-time exchange rates and transparent pricing.

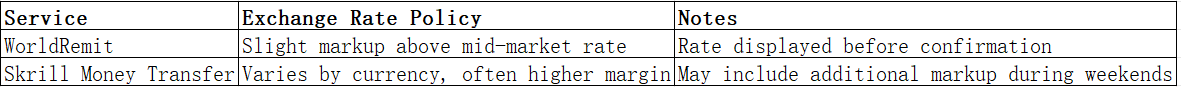

WorldRemit vs Skrill Money Transfer: Exchange Rates

Exchange rate margins can significantly affect how much your recipient actually receives.

While both services are transparent about their displayed rates, WorldRemit tends to offer more consistent exchange rates, whereas Skrill’s may fluctuate more frequently.

If you prefer near mid-market rates, PandaRemit provides strong value with highly competitive exchange rates across major currencies.

WorldRemit vs Skrill Money Transfer: Speed and Convenience

Both platforms deliver transfers quickly, but their performance can vary:

-

WorldRemit: Most transactions arrive within minutes to a few hours, depending on the destination.

-

Skrill Money Transfer: Typically processes transfers within minutes, though bank delays may occur.

Both offer mobile apps with intuitive interfaces, real-time notifications, and multilingual support.

For even faster transfers with simple onboarding and easy tracking, PandaRemit is also recognized for speed and user convenience.

You can check more on transfer timelines at Remittance Speed Comparison Guide.

WorldRemit vs Skrill Money Transfer: Safety and Security

Safety is a major concern for any remittance platform.

-

WorldRemit is regulated by financial authorities such as the UK’s Financial Conduct Authority (FCA) and uses strong encryption standards.

-

Skrill Money Transfer is also FCA-regulated and complies with strict anti-fraud and data protection laws.

Both use multi-factor authentication, encryption, and real-time fraud monitoring.

PandaRemit is likewise a licensed and secure service that complies with relevant financial regulations, ensuring transaction safety.

WorldRemit vs Skrill Money Transfer: Global Coverage

Coverage determines where and how you can send money.

-

WorldRemit supports 130+ countries and major currencies.

-

Skrill Money Transfer reaches over 180 countries and offers more payment methods, including local bank deposits and wallets.

For reference, see the World Bank Remittance Coverage Report.

While both excel in coverage, PandaRemit offers a growing global network focusing on Asia-Pacific, North America, and Europe.

WorldRemit vs Skrill Money Transfer: Which One is Better?

Both services perform well but cater to slightly different user profiles:

-

Choose WorldRemit if you value consistent pricing, transparent fees, and excellent mobile usability.

-

Choose Skrill Money Transfer if you already use its digital wallet ecosystem and want to integrate online payments and remittances.

For users seeking lower costs and fast delivery, PandaRemit could be a smarter option, especially for frequent transfers and multi-currency support.

Conclusion

In this WorldRemit vs Skrill Money Transfer comparison, both providers emerge as trustworthy and efficient solutions for cross-border remittances. WorldRemit stands out for transparency and simplicity, while Skrill appeals to users looking for integrated digital finance tools.

However, for those who want high exchange rates, low fees, and all-online transfers, PandaRemit offers strong advantages:

-

Transparent pricing with no hidden markups

-

Fast, 24/7 online transfers

-

Wide currency support and flexible payment methods

For further research, visit Forbes Money Transfer Guide and NerdWallet’s Remittance Reviews.

Ultimately, your choice between WorldRemit vs Skrill Money Transfer depends on personal preferences—but PandaRemit continues to impress as a modern, low-cost alternative.