WorldRemit vs Starling Bank: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-23 14:25:05.0 11

Introduction

In 2025, digital banking and online remittances continue to transform how people send money abroad. Yet, users still face pain points such as high transfer fees, slow delivery times, and hidden exchange rate markups. This comparison of WorldRemit vs Starling Bank explores which service offers better value for global money transfers. For those seeking an efficient and low-cost option, Panda Remit is also a trusted alternative worth considering. To better understand the global remittance landscape, you can refer to Investopedia’s guide on money transfers.

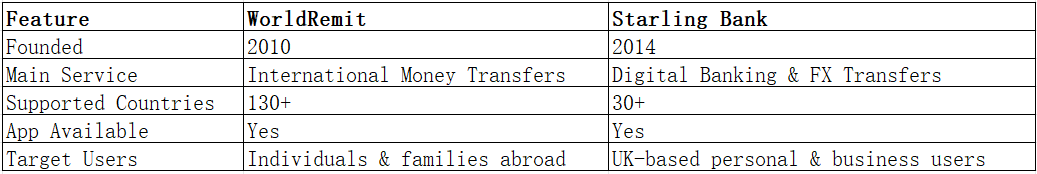

WorldRemit vs Starling Bank – Overview

WorldRemit, founded in 2010, is a global money transfer platform that allows users to send funds to over 130 countries through bank deposits, cash pickups, and mobile wallets. It’s designed primarily for migrants and individuals supporting family members abroad.

Starling Bank, established in 2014 in the UK, started as a digital challenger bank. While its main services revolve around personal and business banking, it also supports international transfers via partnerships and direct FX services through its app.

Both providers offer convenient mobile apps and easy online transfers. However, WorldRemit focuses solely on cross-border transfers, while Starling integrates remittance options within a full-service banking app.

For users prioritizing competitive exchange rates and fast transfers, Panda Remit also serves as a strong contender in this space.

WorldRemit vs Starling Bank: Fees and Costs

When comparing fees, the two services differ significantly:

-

WorldRemit applies a small, transparent fee per transfer that varies by destination and payout method. Fees typically range from USD $1 to $5 depending on the corridor.

-

Starling Bank, on the other hand, offers low or zero transfer fees but includes a small markup in the exchange rate.

WorldRemit’s strength lies in its clear upfront pricing, while Starling’s appeal comes from its integration with daily banking services. However, for users sending money frequently, fee accumulation can still add up.

According to NerdWallet’s money transfer fee comparison, specialized remittance apps often provide better value than general banks. Panda Remit, for example, is known for maintaining consistently low fees across multiple transfer corridors.

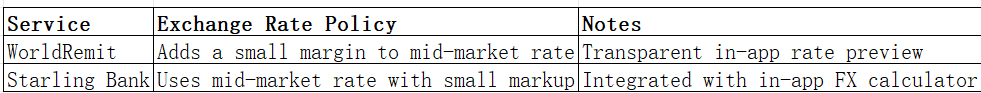

WorldRemit vs Starling Bank: Exchange Rates

Exchange rate margins play a crucial role in determining overall transfer value. Here’s how the two services compare:

While Starling Bank tends to provide closer-to-market rates for major currencies, WorldRemit remains competitive for remittance-heavy destinations like the Philippines, India, or Indonesia.

For users seeking even stronger rates, Panda Remit often provides exchange rates very close to the mid-market value, especially for transfers from Asia-Pacific regions.

WorldRemit vs Starling Bank: Speed and Convenience

Transfer speed depends on payout methods and destination countries:

-

WorldRemit typically delivers within minutes to a few hours for mobile wallet or cash pickup transfers.

-

Starling Bank transfers may take 1–2 business days, depending on partner banks and corridors.

Both offer highly rated mobile apps, 24/7 availability, and intuitive user interfaces. However, WorldRemit’s dedicated remittance infrastructure generally enables faster global payouts.

According to Remitly’s transfer speed guide, specialized transfer services are usually faster than traditional banks. In this regard, Panda Remit also performs well, providing quick, online-only transfers with minimal delays.

WorldRemit vs Starling Bank: Safety and Security

Both WorldRemit and Starling Bank operate under strict regulatory frameworks:

-

WorldRemit is licensed in multiple jurisdictions, including the UK’s FCA and various regional authorities.

-

Starling Bank holds a full UK banking license and follows high security standards with encryption and fraud detection systems.

Both platforms protect user data and transactions using two-factor authentication and encryption technologies. Similarly, Panda Remit is also a licensed and secure platform that complies with global AML (anti-money laundering) and KYC (know your customer) regulations.

WorldRemit vs Starling Bank: Global Coverage

Coverage remains a key differentiator:

-

WorldRemit supports transfers to 130+ countries across Asia, Europe, and the Americas.

-

Starling Bank allows transfers to 30+ countries, mainly in Europe and select major markets.

WorldRemit’s reach and diverse payout options (bank, cash pickup, or mobile wallet) make it better suited for users sending funds to developing regions. Starling, while more limited in scope, integrates seamlessly with banking functions.

For users transferring money across Asia-Pacific or North America, Panda Remit also offers extensive coverage and competitive rates. For further insights, the World Bank’s remittance coverage report provides valuable data on global transfer networks.

WorldRemit vs Starling Bank: Which One is Better?

Both WorldRemit and Starling Bank provide reliable and user-friendly money transfer options, but they serve different purposes:

-

WorldRemit excels for frequent international senders who prioritize accessibility and speed.

-

Starling Bank is ideal for UK users who want integrated banking with occasional foreign transfers.

For users seeking low-cost, fast, and convenient transfers, Panda Remit combines the strengths of both platforms with high exchange rates and minimal fees — all managed via an intuitive online system.

Conclusion

In conclusion, choosing between WorldRemit vs Starling Bank depends largely on your needs:

-

Choose WorldRemit if you send money frequently to family abroad and want flexible payout options.

-

Choose Starling Bank if you prefer a full-featured digital bank that also supports international transfers.

However, if your priority is low fees, competitive exchange rates, and fast online transfers, then Panda Remit stands out as an appealing alternative. With support for 40+ currencies, various payment methods such as POLi, PayID, bank card, and e-transfer, and near-instant processing, it’s designed for users who value both affordability and speed.

To further explore the best remittance solutions in 2025, visit NerdWallet’s money transfer guide or the World Bank’s global remittance data portal.