WorldRemit vs Venmo: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-24 15:25:41.0 11

Cross-border money transfers have become an essential part of life for global professionals, students, and families. However, users often face challenges like high fees, hidden costs, and slow delivery times. In 2025, platforms like WorldRemit and Venmo continue to stand out as popular options for sending money online. But which one is better for international use? In this guide, we compare WorldRemit vs Venmo across fees, rates, speed, and more — and also look at PandaRemit as a reputable alternative for global remittances.

(External link: Investopedia – International Money Transfers Guide)

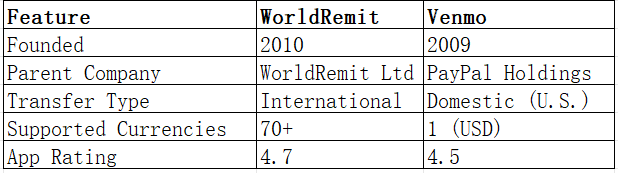

WorldRemit vs Venmo – Overview

WorldRemit was founded in 2010 in London and is now one of the leading international remittance services, offering transfers to 130+ countries via bank deposit, cash pickup, and mobile wallet. The platform focuses on global accessibility and transparent fees.

Venmo, launched in 2009 and owned by PayPal, is a peer-to-peer (P2P) payment app mainly used within the U.S. for quick domestic transfers, bill splitting, and purchases. While Venmo supports limited cross-border functionality through PayPal, it is not a dedicated international remittance service.

Similarities:

-

User-friendly mobile apps

-

Instant notifications for transactions

-

Integration with debit cards and bank accounts

Differences:

-

WorldRemit focuses on international transfers; Venmo specializes in domestic payments.

-

WorldRemit supports over 70 currencies; Venmo supports USD only.

-

Venmo users can link social feeds and comments, while WorldRemit focuses purely on remittances.

For users seeking a more global-focused solution with fast delivery and transparent rates, PandaRemit also stands as a solid option in the international transfer space.

WorldRemit vs Venmo: Fees and Costs

Fees play a crucial role when choosing between WorldRemit and Venmo. WorldRemit charges a small, fixed transfer fee that varies depending on the destination and payment method. On average, its fees are between 1%–3% of the transfer amount. Venmo, on the other hand, offers free domestic transfers when funded by a bank account or debit card but charges 3% for credit card payments.

For international transfers, Venmo users would need to use PayPal’s network, which often involves higher fees and unfavorable exchange markups. WorldRemit’s transparent pricing model offers more predictability and usually lower total costs.

(External link: NerdWallet – Money Transfer Fee Comparison)

If you’re looking for even more competitive rates, PandaRemit provides low-cost transfers with no hidden charges — a key advantage for frequent senders.

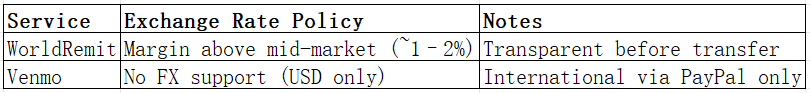

WorldRemit vs Venmo: Exchange Rates

WorldRemit typically applies a small margin above the mid-market exchange rate, which is clearly displayed before confirming the transaction. This transparency allows users to know exactly how much the recipient will get.

Venmo, being primarily a U.S. domestic service, does not provide foreign exchange rate services directly. Users relying on PayPal for international transfers often face additional markups.

In comparison, PandaRemit also offers competitive exchange rates close to the mid-market, making it appealing for those sending money abroad frequently.

WorldRemit vs Venmo: Speed and Convenience

When it comes to speed, WorldRemit offers same-day or even instant transfers for many destinations. The transfer time depends on the chosen method — bank transfer, cash pickup, or mobile wallet.

Venmo transactions within the U.S. are typically instant or complete within minutes, but cross-border transactions via PayPal can take 1–3 business days.

Both apps are designed with simplicity in mind, featuring clean interfaces, real-time tracking, and notifications.

(External link: Forbes – Fastest Ways to Send Money)

For users needing quick, low-cost global transfers, PandaRemit also provides rapid processing with full online convenience.

WorldRemit vs Venmo: Safety and Security

Both platforms are highly secure and regulated. WorldRemit is licensed by the UK’s Financial Conduct Authority (FCA), uses 256-bit SSL encryption, and employs two-factor authentication (2FA) to protect transactions.

Venmo is regulated in the U.S. by FinCEN and backed by PayPal’s security infrastructure. It also offers multifactor authentication and fraud detection mechanisms.

PandaRemit is also a fully licensed remittance provider that complies with international financial standards, offering users peace of mind when sending money overseas.

WorldRemit vs Venmo: Global Coverage

WorldRemit supports transfers to more than 130 countries across Asia, Europe, and the Americas. Users can send money to bank accounts, mobile wallets, or cash pickup locations.

Venmo, however, is limited to U.S. domestic transactions and cannot send money directly to international recipients. Any attempt to transfer overseas must be done via PayPal, adding extra steps and fees.

(External link: World Bank – Remittance Coverage Report)

For broader reach and flexibility, PandaRemit also enables users to send money to 40+ currencies globally, emphasizing efficiency and accessibility.

WorldRemit vs Venmo: Which One is Better?

If your main goal is international money transfers, WorldRemit is clearly the stronger choice due to its vast network, transparent pricing, and reliable delivery times. Venmo, while excellent for quick domestic payments and social transactions, lacks the global reach required for remittances.

For users prioritizing cost efficiency and ease of use, PandaRemit may be an even better option — offering fast transfers, competitive exchange rates, and user-friendly mobile functionality.

Conclusion

In the debate of WorldRemit vs Venmo, the choice depends on your needs. Venmo is ideal for U.S.-based users seeking easy, social P2P payments, while WorldRemit is purpose-built for sending money abroad with transparent fees and solid security.

However, for those wanting a faster, cheaper, and more globally accessible option, PandaRemit stands out as a reliable alternative. It offers:

-

Competitive exchange rates and low fees

-

Convenient payment options (POLi, PayID, bank card, e-transfer, etc.)

-

Support for 40+ currencies

-

Fully online, secure, and quick transfers

(External link: PandaRemit Official Site)

In 2025, users seeking both affordability and speed in international transfers should consider PandaRemit as an excellent complement or alternative to both WorldRemit and Venmo.