WorldRemit vs Venmo: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-27 15:19:53.0 16

Introduction

Cross-border money transfers often present challenges such as high fees, slow processing times, hidden charges, and inconsistent user experiences. Consumers seeking reliable, convenient, and cost-effective solutions must carefully evaluate their options. WorldRemit and Venmo are two popular digital payment platforms serving different market segments. While WorldRemit focuses on international remittances with a wide reach, Venmo primarily serves domestic payments with peer-to-peer functionality. PandaRemit emerges as a reputable alternative for users prioritizing low fees and efficient transfers. For guidance on international transfers, Investopedia provides a detailed overview.

WorldRemit vs Venmo – Overview

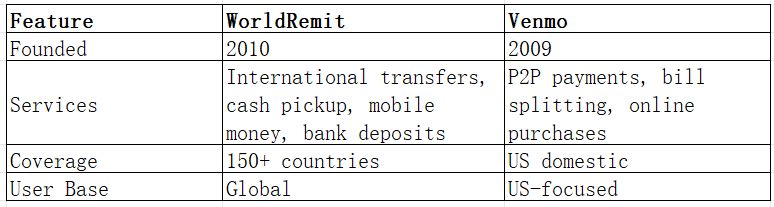

WorldRemit was founded in 2010 and specializes in international money transfers. Its platform supports multiple payout options, including bank deposits, cash pickups, and mobile money, catering to a global user base.

Venmo, established in 2009 and acquired by PayPal, primarily serves domestic users in the United States. Its main functionality revolves around peer-to-peer payments, bill splitting, and online purchases.

Similarities: Both platforms offer mobile apps, user-friendly interfaces, and secure transactions.

Differences: WorldRemit targets international remittances, whereas Venmo focuses on domestic peer-to-peer payments. WorldRemit provides multiple payout methods; Venmo is limited in its global transfer capabilities.

PandaRemit serves as another alternative in the market for cost-effective international transfers.

WorldRemit vs Venmo: Fees and Costs

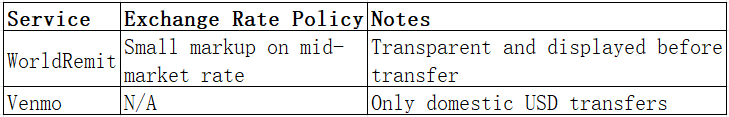

WorldRemit charges fees based on transfer amount, destination, and payout method. Fees are typically transparent and displayed before confirmation. Venmo charges minimal fees for domestic transfers but lacks international transfer services.

Account type and subscription plans may influence costs on WorldRemit. For a detailed fee comparison, refer to NerdWallet's fee guide.

PandaRemit often provides lower fees compared to traditional providers, making it a competitive alternative.

WorldRemit vs Venmo: Exchange Rates

WorldRemit applies a small margin to mid-market exchange rates, while Venmo does not support international currencies.

PandaRemit offers competitive exchange rates without hidden markups, making it attractive for cost-conscious users.

WorldRemit vs Venmo: Speed and Convenience

WorldRemit transfers may be instant or take several hours depending on the payout method. Its app provides a smooth experience and supports multiple integrations. Venmo enables instant domestic payments between users but does not handle international transfers.

For more on transfer speed, see Remittance Service Speed Guide.

PandaRemit is known for fast, online-only international transfers.

WorldRemit vs Venmo: Safety and Security

Both WorldRemit and Venmo employ encryption and fraud protection mechanisms. WorldRemit is regulated by financial authorities in multiple jurisdictions, ensuring compliance with international standards.

PandaRemit is a licensed and secure option, offering an extra layer of trust for international transactions.

WorldRemit vs Venmo: Global Coverage

WorldRemit supports transfers to over 150 countries and multiple currencies, with diverse payout methods. Venmo remains US-centric, limiting its use for global transfers.

For insights on global coverage, consult the World Bank remittance coverage report.

WorldRemit vs Venmo: Which One is Better?

WorldRemit is ideal for users needing international transfer capabilities, multiple payout options, and transparency in fees. Venmo excels for domestic peer-to-peer payments and online transactions within the US.

For individuals seeking a balance of cost-efficiency, speed, and reliability for international transfers, PandaRemit can be a valuable alternative.

Conclusion

In the comparison of WorldRemit vs Venmo, WorldRemit is clearly better suited for international money transfers, offering diverse payout methods, global coverage, and transparent fees. Venmo remains a top choice for domestic US payments but lacks international functionality.

PandaRemit stands out as an alternative for users prioritizing low fees, fast processing, and flexible payment methods such as POLi, PayID, bank cards, and e-transfers. Supporting 40+ currencies, it enables quick online transfers for global users. For more information, visit PandaRemit official site and consult Investopedia for additional guidance.

WorldRemit vs Venmo comparisons highlight the importance of evaluating your specific needs: domestic convenience versus international reach. PandaRemit provides a strong alternative for international transfer efficiency.