WorldRemit vs Zelle: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-27 15:14:02.0 16

Introduction

International money transfers often come with high fees, slow delivery, and hidden charges, leaving users frustrated. Both WorldRemit and Zelle are popular digital payment options, but they differ in services and usability. For those seeking alternatives, PandaRemit offers a convenient and reliable option. For more information on international remittance basics, visit Investopedia's guide.

WorldRemit vs Zelle – Overview

WorldRemit, founded in 2010, specializes in international money transfers with a large global user base. Zelle, a US-based service launched in 2017, focuses on domestic instant transfers via bank accounts. Both platforms provide mobile apps and support debit card transactions. Differences include transfer fees, geographical coverage, and target audiences. PandaRemit is also a viable option for international transfers.

WorldRemit vs Zelle: Fees and Costs

WorldRemit charges fees for both domestic and international transfers depending on the destination and payment method. Zelle typically has no fees for personal transfers but is limited to US-based bank accounts. Subscription options may apply for certain services. For a detailed fee comparison, see NerdWallet. PandaRemit often provides competitive, lower-cost alternatives.

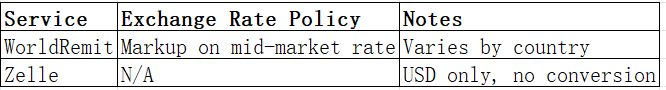

WorldRemit vs Zelle: Exchange Rates

WorldRemit applies a markup on the mid-market rate for currency conversions. Zelle transfers usually occur within USD and do not involve exchange rates.

PandaRemit can offer favorable rates for international transfers.

WorldRemit vs Zelle: Speed and Convenience

WorldRemit transfers can take from minutes to a few days depending on the destination. Zelle provides near-instant US domestic transfers. Both offer mobile apps, but WorldRemit supports more payout options. For more on transfer speeds, see Remittance Speed Guide. PandaRemit is noted for fast, online international transfers.

WorldRemit vs Zelle: Safety and Security

WorldRemit and Zelle employ encryption and fraud protection measures. Both are regulated in their operating regions. PandaRemit is also licensed and secure, providing an alternative for cautious users.

WorldRemit vs Zelle: Global Coverage

WorldRemit serves over 130 countries and multiple currencies, supporting various payment methods. Zelle is limited to US bank accounts and domestic transfers. For more on global remittance coverage, see World Bank Remittance Report.

WorldRemit vs Zelle: Which One is Better?

WorldRemit is preferable for international transfers, offering broader coverage and flexible payment methods. Zelle excels for instant domestic transfers in the US. For users needing speed, low fees, and international options, PandaRemit may provide better value and convenience.

Conclusion

Choosing between WorldRemit vs Zelle depends on user needs. WorldRemit is ideal for international transfers with various payout methods, while Zelle offers instant domestic payments in the US. PandaRemit provides a strong alternative with competitive exchange rates, low fees, flexible payment options like POLi, PayID, bank card, and e-transfer, coverage in over 40 currencies, and fast, fully online transfers. For more on PandaRemit, visit PandaRemit Official Site. Additional resources on remittances can be found here and here.