WorldRemit vs Zelle: Which is Better for International Money Transfers?

Benjamin Clark - 2025-10-24 15:18:06.0 15

Introduction

International money transfers are increasingly essential for global workers, students, and families supporting loved ones abroad. However, users often face high fees, hidden exchange rate markups, and slow delivery. Two popular platforms, WorldRemit and Zelle, offer very different approaches to sending money. While Zelle focuses mainly on instant U.S. domestic transfers, WorldRemit is designed for global remittances. For users looking for a reliable international option, PandaRemit offers a simple, secure, and low-cost alternative. Learn more about international transfer basics from trusted sources like Investopedia.

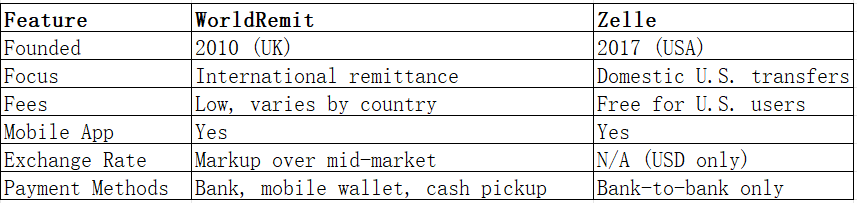

WorldRemit vs Zelle – Overview

WorldRemit was founded in 2010 in London and serves millions of users worldwide. It supports transfers to over 130 countries via bank deposits, cash pickups, and mobile wallets.

Zelle, launched in 2017, is a U.S.-based digital payment network integrated with major banks like Chase, Bank of America, and Wells Fargo. It allows instant domestic transfers between U.S. bank accounts.

Similarities:

-

Mobile app support

-

Fast transfers

-

Secure encryption and fraud protection

Differences:

-

WorldRemit: International coverage, multi-currency support, low fees

-

Zelle: U.S.-only, no foreign exchange function, free but limited to local transactions

PandaRemit is another trusted platform for international transfers, offering all-online transactions and competitive rates.

WorldRemit vs Zelle: Fees and Costs

Zelle is free for users within the United States. However, it cannot send or receive funds internationally, which limits its utility for cross-border transfers.

WorldRemit, on the other hand, charges small fees depending on the destination country, payment method, and payout type. Fees are transparent before sending and often lower than traditional banks.

According to NerdWallet, digital remittance platforms like WorldRemit can save users up to 50% compared to bank wire transfers.

PandaRemit is also known for maintaining low and transparent fees while providing competitive exchange rates.

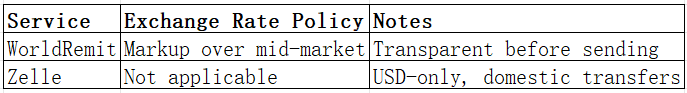

WorldRemit vs Zelle: Exchange Rates

Zelle does not provide foreign exchange services since it operates solely in USD.

WorldRemit applies a small margin above the mid-market rate, which is displayed upfront before confirming each transfer. This allows senders to understand exactly how much the recipient will receive.

While PandaRemit also adds a minimal markup, its rates are generally more competitive than traditional providers and it updates rates in real-time for user convenience.

WorldRemit vs Zelle: Speed and Convenience

Zelle is known for near-instant domestic transfers between participating U.S. banks. However, it cannot be used internationally.

WorldRemit’s delivery speed depends on the destination and method—bank transfers typically arrive within minutes to a few hours, while cash pickups are usually instant. Users can track transfer status in real time.

According to Finder, WorldRemit ranks among the fastest global remittance services.

If you prioritize speed for cross-border transactions, PandaRemit also provides rapid transfers through an all-online process.

WorldRemit vs Zelle: Safety and Security

Both WorldRemit and Zelle are regulated and use industry-standard encryption.

-

WorldRemit is licensed by the UK Financial Conduct Authority (FCA) and complies with local regulations in each country of operation.

-

Zelle operates through U.S. banks and uses their built-in authentication and fraud monitoring systems.

PandaRemit also follows strict regulatory standards, ensuring users' funds and data are protected throughout the process.

WorldRemit vs Zelle: Global Coverage

This is where the two services differ most significantly.

-

WorldRemit: Supports over 130 destination countries and multiple payout methods (bank deposit, mobile wallet, cash pickup).

-

Zelle: Limited to the United States; cannot send or receive money internationally.

The World Bank Remittance Report highlights the growing importance of global remittance accessibility, an area where Zelle falls short.

For users who need to send money abroad conveniently, PandaRemit provides wide international coverage and flexible online transfers.

WorldRemit vs Zelle: Which One is Better?

Ultimately, the choice depends on your needs:

-

Choose Zelle if you only transfer funds domestically within the U.S.

-

Choose WorldRemit if you need to send money internationally with transparency, flexibility, and speed.

However, if you want a combination of low fees, favorable rates, and fast digital transfers, PandaRemit is worth considering as an alternative. It caters to users looking for cost-efficient and reliable global remittance services.

Conclusion

In summary, WorldRemit vs Zelle reveals two very different money transfer solutions. Zelle is ideal for quick domestic transactions within the U.S., while WorldRemit is a global remittance leader with extensive coverage and strong digital infrastructure.

For international users seeking lower fees, fast transfers, and transparent rates, PandaRemit stands out as a modern, user-friendly alternative. It supports over 40 currencies, provides flexible payment options like PayID and bank cards, and ensures a secure all-online transfer experience.

For further reading, check out NerdWallet’s international transfer guide and Investopedia’s remittance insights.