Xoom vs Azimo: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-15 11:50:47.0 15

Introduction

Cross-border money transfers often involve high fees, slow delivery, hidden charges, and complicated user experiences. Users need a secure, fast, and cost-effective solution. Xoom and Azimo are two major options, each with unique advantages. For users looking for lower-cost and more convenient alternatives, Panda Remit is a notable option. For more information, see the Investopedia international money transfer guide.

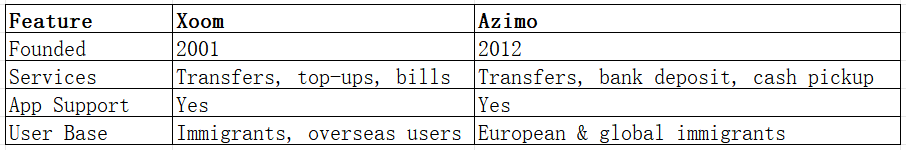

Xoom vs Azimo – Overview

Xoom

-

Founded: 2001

-

Services: International transfers, mobile top-ups, bill payments

-

User base: Millions worldwide, especially U.S. immigrants and overseas communities

Azimo

-

Founded: 2012

-

Services: Digital transfers, bank deposits, cash pickups

-

User base: European and global immigrants and cross-border workers

Similarities

-

Offer international money transfers

-

Mobile app support

-

Bank account transfers supported

Differences

-

Fees: Xoom charges higher fees for small transfers; Azimo varies fees by destination and amount

-

User experience: Xoom offers fully online operation; Azimo focuses on fast digital transfers, supporting some European local payment options

-

Target users: Xoom for tech-savvy users; Azimo for European users needing fast delivery

Another option in the market is Panda Remit, offering convenient, low-cost transfers.

Xoom vs Azimo: Fees and Costs

Xoom fees depend on transfer amount, destination, and payment method; debit card payments generally cost more than bank transfers. Azimo charges vary depending on transfer amount, speed, and destination.

Account Types & Promotions

-

Xoom offers first-time user promotions; Azimo varies fees based on standard or fast delivery options.

Detailed fee comparisons can be found at NerdWallet's money transfer fee guide.

Panda Remit can serve as a lower-cost alternative.

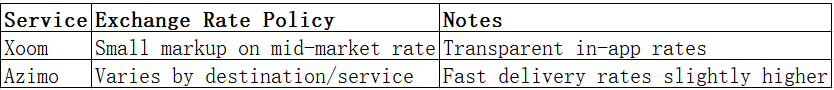

Xoom vs Azimo: Exchange Rates

Exchange rates significantly impact total transfer costs. Xoom applies a small markup on the mid-market rate, while Azimo rates vary by destination and service type.

Panda Remit also offers competitive rates for everyday transfers.

Xoom vs Azimo: Speed and Convenience

Xoom

-

Delivery time: Minutes to a few hours

-

App: Fully online operation

-

Payout: Bank deposits, cash pickups, mobile wallets

Azimo

-

Delivery time: Standard 1–3 days, fast minutes to hours

-

App: Digital fast transfers

-

Payout: Bank deposits, cash pickups

More on transfer speed: World Bank remittance guide.

Panda Remit provides fast, convenient online transfers.

Xoom vs Azimo: Safety and Security

Both Xoom and Azimo are licensed and regulated, using encryption and fraud protection to secure transactions. Panda Remit is also a legal and secure option.

Xoom vs Azimo: Global Coverage

Xoom supports over 130 countries and multiple currencies. Azimo covers major remittance destinations and currencies. Both support multiple payment methods.

For coverage details, see World Bank remittance coverage report.

Xoom vs Azimo: Which One is Better?

Xoom excels in speed and fully online experience. Azimo offers fast delivery and local payment convenience in Europe. Fees and rates vary by destination.

For users seeking low-cost, fast, and convenient transfers, Panda Remit is a strong alternative.

Conclusion

Comparing Xoom vs Azimo, Xoom suits users prioritizing fast online operation, while Azimo is better for European and global immigrant users. Depending on fees and rates, some users may consider alternatives.

Panda Remit advantages:

-

High exchange rates & low fees

-

Multiple payment options (POLi, PayID, bank transfer, e-transfer)

-

Coverage of 40+ currencies

-

Fast, fully online transfers

Learn more at Investopedia and NerdWallet, or try Panda Remit for fast, low-cost transfer solutions.